The Donor Revolt for Charity Reform

Prominent philanthropists, national funders, and policy organizations are launching a campaign to call for common sense charity reforms.

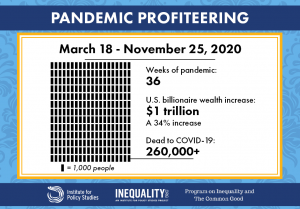

Tuesday, November 24, as the Dow crossed the 30,000 mark, the wealth of 650 U.S. billionaires approached a total of $4 trillion, with more than $1 trillion ($1.008 trillion) in growth since March 2020.

Of this group, 29 billionaires have seen their wealth double since March 2020. There are 36 additional billionaires in the U.S. since March 2020. There are 47 new individuals on the list, with 11 going off the list due to death or financial decline.

Some of the big gains include:

Find our most recent analysis of billionaire wealth here.

The almost $4 trillion owned by U.S. billionaires is about 3.5 percent of all privately held wealth in the U.S., estimated at $112 trillion. Billionaire wealth is twice the amount of wealth held by the bottom 50 percent of households combined, roughly 160 million people.

According to the Federal Reserve, 2020 Second Quarter Distribution of Financial Accounts, the distribution of $112 trillion in total private wealth is this: The top 1% has $34.23 trillion; The top 90-99 percentile have 43.09’ The 50-90 percentile have $32.65 trillion; and, the bottom 50% have $2.08 trillion.

This is not normal or predetermined by any means. According to IPS analysis, U.S. billionaires saw their fortunes decline in the years after the 2008 Great Recession along with everyone else. It wasn’t until almost 4 years later, in September 2012, that the total wealth of the Forbes 400 exceeded its 2008 pre-Great Recession levels (see below).

Forbes 400 Total Wealth

by Bella DeVaan

/by Oliva Alperstein

/by Chuck Collins

/by Inequality.org

/by Helen Flannery

/by Dan Petegorsky

Prominent philanthropists, national funders, and policy organizations are launching a campaign to call for common sense charity reforms.

by Chuck Collins

/by Omar Ocampo

Four years after the start of the Covid-19 pandemic, the United States has 737 billionaires with a combined wealth of more than $5.5 trillion.

by Chuck Collins

Check back for our regular updates on U.S. unemployment and billionaire wealth during the pandemic emergency.

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close