Xeth Feinberg

Wealth Concentration

Foundation-to-DAF Conversions: Is It a Thing?

Foundation-to-DAF conversions make up only about 5 percent of all dissolving foundations, but they represent a much larger portion of the dollars.

Donor-advised funds, or DAFs, offer greater tax benefits, lower costs, and more anonymity than private foundations — while still giving donors a huge amount of power over grantmaking. So we wondered: Are a lot of foundation donors converting their foundations to DAFs?

Our new analysis, Foundation-to-DAF Conversions: Is It a Thing? shows that foundation-to-DAF conversions make up only about 5 percent of all dissolving foundations, but they represent a much larger portion — about 19 percent — of the dollars. This is because the foundations that are converted to DAFs tend to be about eleven times larger than the typical dissolving foundation.

Overall, in fact, grants to DAFs make up about a quarter of the grants paid out by all dissolving foundations each year.

DAFs are a growth industry

Donor-advised funds have been the fastest-growing giving vehicle in the charitable sector for more than a decade. Their incoming contributions have skyrocketed to the point where now seven of the top ten public charities in the U.S. are DAF sponsors.

A large part of their appeal is that DAFs provide their donors with larger tax reductions and lower costs than private foundations, while still allowing donors to continue to make granting and sometimes even investment decisions about the money they donate.

It is also impossible for the public to trace a DAF grant back to an individual donor, making DAF granting essentially anonymous — something that would be much more difficult to achieve with a private foundation.

And, unlike private foundations, DAFs have no minimal annual payout requirement, so donors can take as long as they like to decide on their grants. They could even take forever.

Donor-advised fund sponsors — community foundations and national sponsors alike — haven’t hesitated to market these advantages to prospective donors, and to emphasize how easy it is to convert a private foundation to a DAF.

What we found

In a new analysis of private foundation tax returns, we found that, on average:

- 5 percent of the foundations that dissolve each year do so by converting to DAFs.

- The foundations that dissolve by converting to DAFs are eleven times larger than the typical dissolving foundation.

- Grants to DAFs from converting foundations make up a disproportionately high percentage — an annual average of 19 percent — of the grants paid out by all dissolving foundations.

- Overall, grants to DAFs make up one quarter of the grants paid out by all dissolving foundations.

How we identified the foundations converting to DAFs

Unfortunately, private foundations aren’t required to identify their grantees by any kind of ID number. And there are no mandatory reporting requirements about the donors to individual donor-advised funds. Both of these things make it difficult to find out how many foundations convert to DAFs each year. But we took a stab at it.

We describe our analysis process fully in our paper. But the short story is that we identified all of the foundations that dissolved in a given year as those that checked the Final Return checkbox in the header of their tax returns. Then we used a language search to identify as many grants from those dissolving foundations as we could that went to the country’s largest national and community foundation DAF sponsors. If a dissolving foundation paid 90 percent or more of its final-year grants to any of these sponsors, we counted it as a foundation that was converting to a DAF.

What we found, continued

Over the five years from 2017 to 2021, the most recent year available at the time we did our analysis, we found that:

- Roughly 1.5 percent of foundations dissolve every year. In 2021, for example, 1,939 foundations checked the Final Return checkbox on their tax returns out of a total foundation population of 113,699.

- Of the foundations that dissolve, 5 percent do it by converting to DAFs. In 2021, of the 1,939 foundations with the Final Return box checked, 4.7 percent gave 90 to 100 percent of their final-year grants to DAF sponsors.

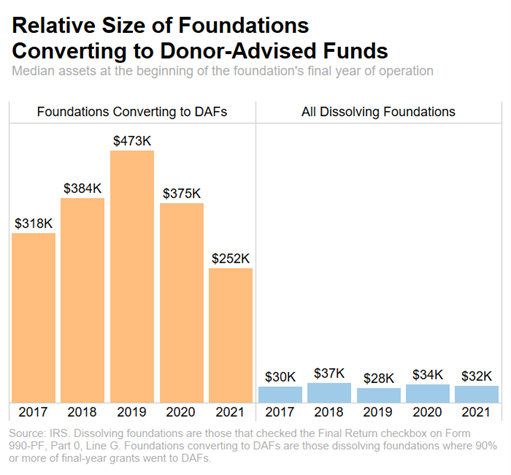

- The foundations that convert to DAFs are an average of eleven times larger than the typical dissolving foundation. In 2021, the median assets of all foundations with the Final Return box checked was $32,199 at the beginning of the year, compared to $251,670 for the foundations that dissolved by converting to DAFs.

- Grants to DAFs from converting foundations make up a disproportionately high percentage — an annual average of 19 percent — of the grants paid out by all dissolving foundations. In 2021, the foundations that had the Final Return box checked gave out a total of $1.4 billion in grants. Foundations converting to DAFs paid out $256 million in grants that year, $252 million of which went to DAF sponsors.

- Overall, grants to DAFs make up an average of 24 percent of the grants paid out by all dissolving foundations. In 2021, dissolving foundations paid out $1.4 billion in grants, and $361 million — 25.7 percent — of those grants went to donor-advised funds.

You can find much more detail behind these numbers in our paper, Foundation-to-DAF Conversions: Is It a Thing?

Why this matters

Whether wealthy donors are converting their foundations to DAFs may seem like an obscure topic. But it is important for several reasons.

Private foundations have a minimum payout requirement, while DAFs have none. Every year, private foundations are supposed to pay out grants that amount to at least 5 percent of their assets, so there is at least a minimal guarantee that some of the funds stored within them will move out to working charities. DAFs, on the other hand, have no payout requirement at all. By moving money fr

om a private foundation to a DAF, the money goes from an intermediary with at least a minimal payout requirement to an intermediary with none at all.

The public pays a larger subsidy on donations to DAFs. This is because the deductibility caps on donations to donor-advised funds are higher than those on donations to private foundations. And every cent of these deductions is subsidized by taxpayers.

So by moving money from a foundation to a DAF, the money goes from an intermediary with lower public subsidies to an intermediary where the subsidies are potentially much higher. The donor doesn’t get any additional tax reduction for the initial switch, but any additional donations they make to their DAF will get the higher subsidy.

Private foundations are much more transparent. Private foundations have to disclose detailed information about their financial behavior, including their grants, their payout rate, and their major donors.

DAFs have much looser reporting requirements — they only have to report on grants and payout on the aggregate sponsor level, and the sponsors themselves may not always know who is behind an individual fund.

By moving money from a private foundation to a DAF, the money goes from an intermediary with at least minimal reporting requirements to an intermediary with next to none.

We have long urged major donors to give boldly and directly to working charities, rather than giving through intermediaries like private foundations and donor-advised funds. And opting for a DAF over a private foundation means that the money is subject to no payout requirement, less accountability, and higher public subsidies.

We need to keep an eye on foundation-to-DAF conversions in the future to see if our public tax dollars are being used responsibly. And we need to push for meaningful charity reform to ensure that they are.