Getty Images

Philanthropy

What Could Our Working Charities Do With $339 Billion? Let’s Find Out.

Simple changes to outdated laws would generate groundbreaking funding for working charities — along with hundreds of millions in tax revenue.

Our philanthropic sector has seen better days. Ultra-wealthy donors have gained ever greater tax benefits and influence from their giving while our working charities have been hard hit by a decline in dependable funding.

Currently, an estimated $1.7 trillion sits in private foundations and donor-advised funds (DAFs). DAFs alone have skyrocketed in wealth by 411 percent in the last ten years, stockpiling an estimated $230 billion in assets in 2023. Our nation’s largest foundations give at a rate that hovers around 5 percent — while their gains in the market have averaged 9 percent over the last five years.

To put it simply, these funds are growing faster than the rate at which they give. As giving to these intermediaries increases, giving to working charities falls behind: Total U.S. giving has declined in real dollars for the past two years.

This state of affairs doesn’t reflect the original legislative intent of our laws that govern philanthropy in America. Initially, in the Tax Reform Act of 1969, private foundations were mandated to give away 6 percent of their wealth or the annual net growth from their investments: Whichever was higher.

Negotiations were rife with friction, but both philanthropists and their Congressional critics concurred that payout flexibility was essential to keep foundations democratically accountable.

Foundations’ tax benefits wouldn’t provide license for funds to just grow forever and ever, and they were to be consistently responsive to shifting economic reality. A decade of revisions to payout requirements reflected those principles and eventually created our flat 5 percent mandate. But that 5 percent is overdue for re-evaluation, and our elected representatives have fallen asleep at the wheel.

Private foundations and donor-advised funds disbursed an estimated $155.66 billion last year. With simple rule changes, we could unleash over $110 billion in additional funding for working charities each year.

As legislators get ready to overhaul the tax code in 2025, we’re hopeful that this can be a watershed moment for charity reform akin to 1969. It’s high time to refresh the rules governing philanthropy to move money off the sidelines.

Public opinion, nonprofit leaders, and even a critical mass of fed-up donors have coalesced behind good-faith, common sense charity reform proposals that would dramatically recalibrate the fairness and efficiency of America’s vital third sector. Our polling suggests that well over 70 percent of the American public — across the political spectrum — supports reform.

What we want to do:

- Increase the minimum payout rate requirement for foundations to 10 percent for foundations with assets of $50 million or more, and increase it to 7 percent for all other foundations

- Exclude private foundation overhead expenses above 1 percent of assets from counting towards payout

- Exclude grants from private foundations to DAFs from counting towards payout

- Require DAFs to pay out funds within 5 years of receipt (and provide individual account-level transparency)

- Exclude grants from DAFs to other DAFs from counting toward payout

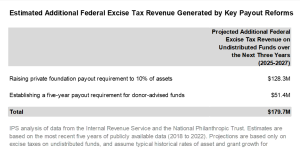

- Generate excise tax revenue from intermediaries that don’t meet the new requirements

In a new policy brief, we attempt to quantify the transformative effects of these reforms, hoping that our estimates inspire Congress to act upon this opportunity. Politicians who claim to care about the health of our democracy should take notice: Passing these broadly popular reforms would unlock $339 billion in charitable contributions that have already been tax exempted over the next three years.

If Americans manage to exert the political will to reform the sector, boosted payouts would be paired with crucial transparency measures. Shining a light on DAF gifts in particular — billions of which have been directed as dark money contributions — would ensure that these donations truly benefit the common good (in exchange for their tax breaks). And through this illumination, we reckon donors to the most plutocratic or hateful causes might well have second thoughts.

It’s worth imagining a future in which billions more flow towards life-saving medical cures, food security, housing access, and environmental protection through organizations that are already woven into our social fabric — well-oiled machines like Feeding America, United Way, Direct Relief, Habitat for Humanity, and the Boys and Girls Clubs — or organizations that could and should be with strengthened access to funding.

Our country could use these charitable donations to level the playing field for under-resourced families and safeguard our planet’s future. The best part? Taxpayers wouldn’t have to contribute another dime to make it happen.

Take a look at our research in depth here or summarized in the charts below:

Helen Flannery and Bella DeVaan are members of the Institute for Policy Studies’ Charity Reform Initiative.