The Independent Report on DAFs

Demystifying donor-advised funds and their impacts on charitable giving, fair taxation, and our democracy itself.

Sarah Gertler

Philanthropy is becoming just another tool to benefit the wealthy and their money managers — leaving real charities behind in the process. Here’s how we fix it.

Philanthropy in America — the transfer of wealth out of private hands, ostensibly to non-profit organizations working for public benefit — is being captured by Wall Street’s wealth defense industry.

The country’s biggest philanthropists become wealthier every day from the appreciating value of their stockholdings and unrealized assets. Most of today’s mega-rich Americans live off the “buy, borrow, die” philosophy, skimming cash off their pools of wealth and using lines of credit to avoid incurring taxable income. And their philanthropic practices mirror their tactics to accrue, preserve, and defend their wealth.

Financial services advisors understand that by including philanthropy management in their portfolio of services, they can make money and generate tax benefits for clients.

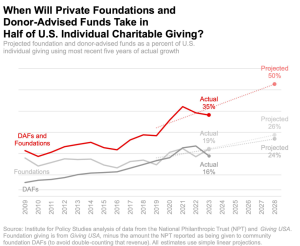

Wealthy donors use donor-advised funds (DAFs) and private foundations to get tax deductions immediately but maintain control over the disbursement of the money. Federal law mandates that private foundations must disburse just 5 percent of their assets each year, while donor-advised funds have no such requirement at all.

With the help of professionals, donors are also pioneering the use of financialized instruments such as LLCs, impact investing, and recoverable grants. In Bank of America’s most recent Study of High Net Worth Philanthropy, the number of wealthy households participating in impact investing had doubled over the past three years, and 40 percent were using that impact investing in place of some or all of their charitable giving. And venture capitalists and fintech companies are eyeing opportunities to generate fees off “frictionless” charitable transactions.

These choices have made our working charities fragile, over-dependent on fewer donors, and vulnerable to profit-seeking from emerging technology and investment trends. This is dangerous for our society and for nonprofits, who increasingly must accommodate the priorities and behaviors of wealthy donors.

In other words, our system effectively classifies pools of capital under management as charities — which both increases inequality and shortchanges groups on the ground doing actual charity work.

When Congress formed the laws that govern our charities over 50 years ago, they didn’t intend for things to look this way.

This report, the fourth installment in our Gilded Giving series since 2016, examines these trends in detail and recommends several policy fixes to make sure philanthropy serves the public interest, not the bottom lines of wealthy donors and investors. Key chapters explore how the financial sector drives the expansion of DAFs and how financial sector instruments blur the line between charity and investment.

The full version includes much more background and detail, including charts, citations, and methodology.

Congress last codified the rules that shape how money flows through our charitable sector in 1969. Wealth inequality was at one of its lowest points in modern American history, in part due to progressive top marginal tax rates. Late-sixties legislators did not anticipate the massive growth of concentrated wealth or the expansion of the financial industry into the charitable sector.

Now, with creeping profit incentives and deepening struggles for working charities, it’s time for legislators to act. We recommend a number of common sense reforms:

You can read about these ideas in much more depth in the full version of our report. And if you’d like to get involved, you can sign up to join our latest campaigns, the Donor Revolt for Charity Reform and Stop Hoarding Charity Dollars.

Chuck Collins, Bella DeVaan, and Helen Flannery lead the Charity Reform Initiative at the Institute for Policy Studies.

by Chuck Collins, Helen Flannery, Dan Petegorsky, and Bella DeVaan

Demystifying donor-advised funds and their impacts on charitable giving, fair taxation, and our democracy itself.

by Bella DeVaan and Chris Mills Rodrigo

A new documentary, Union, lifts the veil on the successful organizing campaign at Amazon’s JFK8 warehouse.

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close