Philanthropy

Private Foundations Gave $3.2 Billion in Grants to National Donor-Advised Funds in 2022

Private foundations are currently allowed to make grants to donor-advised funds and to count those grants toward their charitable distribution requirement of 5 percent of their assets each year.

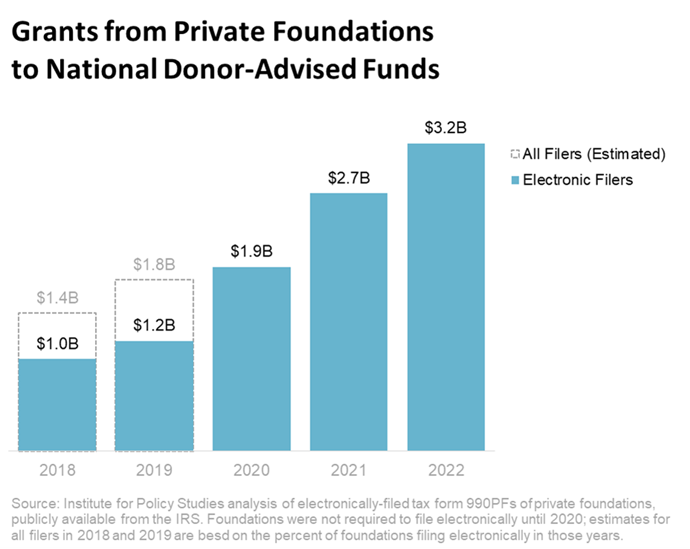

Last year, we analyzed the tax returns of U.S. private foundations and found that, in total, they had given more than two and a half billion dollars in grants to national donor-advised funds in 2021. That was the most recent data we could get at the time.

Thanks to the IRS’ release of more nonprofit tax filings this year, we are now able to update our findings through 2022. We found $3.2 billion in grants going from private foundations to donor-advised funds at national sponsors in 2022 alone.

Private foundations are currently allowed to make grants to donor-advised funds, or DAFs, and to count those grants toward their charitable distribution requirement of 5 percent of their assets each year.

As we have detailed in the past, DAFs are giving vehicles with little transparency and no payout requirement at all, so this should be concerning to any taxpayer who wants to ensure that the charitable revenue they subsidize moves out to working charities in a timely manner.

This is especially important in the case of commercial DAFs like Fidelity Charitable Gift Fund and Schwab Charitable where the sponsors have a significant financial interest in donations staying put, generating management fees for their affiliated financial institutions.

New numbers

The DAF granting we found prior to 2020 is almost certainly an undercount, since we only examined giving from private foundations to national DAFs — not DAFs held at community foundations or other nonprofit organizations. And we were only able to analyze the foundations that filed their taxes online — not the ones that filed on paper.

Thanks to a new reporting requirement, however, all foundation tax returns have been required to be filed electronically starting in 2020. This means that the grants we found represent about 65 percent of all foundation filings up through 2019, and closer to 95 percent of the foundation filings from 2020 onwards. And the $3.2 billion going from foundations to national DAFs in 2022 is, by itself, a huge amount of charitable revenue cycling between bank accounts.

Why this matters

This sort of transfer shouldn’t count as charity. Donors get tax deductions for putting money into private foundations so that money can go to real charities. And the 5 percent payout requirement is meant to ensure that that happens.

When foundations use grants to donor-advised funds to meet payout, it subverts the public purpose behind that requirement.

The dollars flowing from private foundations to donor-advised funds make for a considerable amount of money delayed in reaching active charities. Foundation DAF giving, as well as DAF giving in general, has been on a steep upward trajectory. As it grows, it has been steadily eating into the revenue that has historically resourced working nonprofits.

And there is another reason to be concerned about foundation giving to DAFs: the loss of accountability.

Foundations have to publicly disclose both their major donors and their grantees, so there is a clear paper trail from donors to recipients. DAFs, on the other hand, don’t have to make their donors public and only have to disclose their grantees at the aggregate sponsor level, so it is impossible for regulators, the public, and sometimes even recipient charities to track grants back to specific donors.

By giving grants through DAFs, therefore, private foundations can get around their transparency requirements — and there is evidence that they are using them to do just that.

Together foundations and donor-advised funds now take in 41 percent of all individual giving every year. The scale, growth, and nature of this kind of giving make it more important than ever to have improved DAF governance, as well as greater transparency into DAF giving.

For more information, and for what we can do to fix this, see our previous reporting.