The Independent Report on DAFs

Demystifying donor-advised funds and their impacts on charitable giving, fair taxation, and our democracy itself.

Getty Images

One of the country's largest donor-advised fund sponsors publishes an annual report that demands a closer look.

“It might seem obvious now, but maybe having a prominent DAF sponsor be the authoritative voice on DAF trends was a mistake.” That’s how a colleague responded after the release of National Philanthropic Trust’s latest annual report on donor-advised funds, or DAFs.

For years, like most in the nonprofit world, I’ve relied on the National Philanthropic Trust (NPT) report as an essential guide to trends in this rapidly growing component of charitable giving. But after reviewing the most recent edition, I believe it’s time for analysts, journalists, and policymakers to reckon with how fundamentally flawed a source it is.

This assessment goes beyond questioning specific data points, like why one or another figure spiked so sharply in a given year or declined in another. (It would help if NPT were to append a list of sponsors included in the reports, but they don’t.)

It’s more about how the reports and the press releases surrounding them consistently present DAF data not only in the most favorable light for the industry as a whole, but for NPT in particular. This includes:

Here are the specifics:

NPT’s report compounds the problems inherent in inadequate reporting requirements by continuing to promote aggregate industry payout figures as gospel – even though report after report after report based on studies of account-level data find that those aggregate figures grossly exaggerate payout rates.

These independent studies consistently find that (a) median payout figures are less than half NPT’s averages, and (b) a shockingly high percentage of accounts make no grants at all in a given year and pay out at rates at or lower than those of private foundations (more on that below).

Unfortunately, NPT’s payout rate calculations find their way into innumerable other articles and reports, while the more accurate independent studies are generally ignored. Not only does NPT promote this, but, along with most of the other sponsors, they compound the misrepresentation by downplaying the skyrocketing growth in DAF assets.

Too often, both the assembly and the presentation of the annual DAF data are blatantly self-serving, disguising aspects of NPT’s own performance that would show their numbers in a much poorer light.

This is especially apparent when radically different sponsors are lumped together in the national sponsor category. Accounts set up by wealthy and ultra-wealthy donors that warehouse hundreds of thousands or millions of dollars bear no resemblance to accounts set up to administer workplace giving and payroll deduction programs or to manage crowdfunding donations.

But including them in the same category allows NPT to tout a deceptively low average account size in its own category ($110,194), when in fact NPT’s account size is one of the largest in the entire sector — more than ten times that average ($1.5 million based on its most recent 990).

This year’s report highlights an equally misleading example. NPT’s main message — which unfortunately is now echoed in the majority of news outlets that simply reprint NPT’s press release — is that while contributions to DAFs dropped markedly in 2023, grants stayed relatively flat, declining by just 1.4 percent, and that “DAFs help stabilize the philanthropic ecosystem.”

But that conclusion is highly misleading. It glosses over both the continuing rise in DAF assets, and, more tellingly, the fact that grants from both community foundation and single-issue sponsors actually increased, while grants from national sponsors declined.

Specifically: contributions to each of the sponsor categories declined (by 20.4 percent for national sponsors, 32.4 percent for community foundations, and 14.9 percent for single-issue sponsors). But grants increased at both community foundation and single-issue DAFs (by 3.1 percent and 26.3 percent [!] respectively) and declined by 7 percent for the national sponsors.

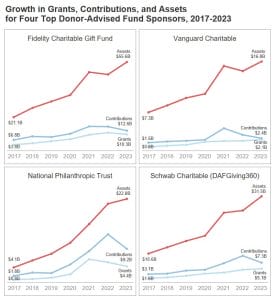

That last stat is especially noteworthy since the assets held by the commercial giants Fidelity, Schwab, and Vanguard, alongside NPT, are in the national category. Those sponsors are sitting on a disproportionate share (69 percent) of all DAF assets — which they like to call “rainy day funds” — and so theoretically should be the best able to maintain grant levels when contributions lag. Instead, they and their donor-advisors have chosen to pull back on grants while watching their assets continue to soar.

These charts, all based on the most recent Form 990 filings, tell the story that NPT chooses to bury:

NPT includes a section on how much better aggregate DAF payout is than private foundations’ mandated (and far too low) 5 percent rate. But this is a meaningless comparison: The largest private foundations are generally governed to preserve endowment assets for perpetuity, and, unlike DAFs, most do not receive ongoing new contributions.

In fact, where sponsors (community foundations in particular) offer endowed DAFs, those accounts’ payout rates are often capped at lower than 5 percent — precisely to preserve the funds’ assets for perpetuity.

A 2021 study of DAFs at community foundations in Michigan found the median payout rate for endowed DAFs was between 4.0-4.6 percent, while the DAF Research Collaborative’s 2024 national study found that the 3-year median was just 2.86 percent (see p. 25 in the technical appendix).

Meanwhile, the DAF sponsors with by far the highest payout rates are those with cash accounts used in workplace giving programs and crowdfunding platforms. And unlike the asset-warehousing DAFs managed by the giant firms above, these accounts grant out the vast majority of their funds in the same year they come in.

To make matters even more complicated, a significant amount of money is transferred between DAF sponsors each year, and research has documented that such transfers represent a sizable percentage of DAF grants. For example, DAF-to-DAF transfers accounted for 10.8 percent of all grants according to a 2022 California Attorney General’s report.

But NPT explicitly chooses to ignore this, further inflating payout rates by including these dollars as outgoing grants, and resulting in double-counting: The initial transfer is counted as a grant, and those funds are counted as grants again when they go out from the second sponsor.

By contrast, Giving USA takes pains to see that they aren’t double-counting grants, as Patrick Rooney explains, helping to ensure that grant numbers are as accurate as possible.

NPT explains that there “are many reasons why a donor may recommend a grant to another DAF, including giving to collaborative DAFs or giving circles or emergency funds that are housed at a different charitable sponsor.”

But this makes no sense: whatever the reasons a donor moves money from one sponsor to another, if NPT counts that as one grant but also counts those funds moving out from the second sponsor as a grant, it’s still double counting.

It’s high time for journalists and policymakers to stop accepting NPT reports as authoritative and accept them for what they are: highly skewed promotional reports from a major industry player touting the industry’s successes and glossing over its shortcomings.

In the meantime, let’s give a shout out to those funders who increased their grantmaking significantly even as contributions and assets declined — like the Oregon grantmakers profiled in a recent piece in Portland Business Journal:

“In a tough investment environment for risk-averse charitable foundations — and with other revenue sources like local corporate giving on the wane — the 33 grant-makers on The List increased their grant volume by 15.4 percent in the last reported fiscal year to $798.9 million.

They did so despite seeing total assets decline by 9.3 percent to $13 billion and revenues fall 4 percent to $1.1 billion.”

Dan Petegorsky is a member of the Charity Reform Initiative at the Institute for Policy Studies.

by Chuck Collins, Helen Flannery, Dan Petegorsky, and Bella DeVaan

Demystifying donor-advised funds and their impacts on charitable giving, fair taxation, and our democracy itself.

by Dan Petegorsky

One of the country's largest donor-advised fund sponsors publishes an annual report that demands a closer look.

by Dan Petegorsky

Donor-advised fund giant Schwab Charitable plays a pivotal role in Leonard Leo’s weaponized funding schemes.

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close