Musk’s Trillion-Dollar Pay Package Isn’t the Only Bad Thing on the Tesla Shareholder Ballot

Investors will vote on several issues at the heart of a broader national effort by oligarchs and corporate insiders to consolidate power over our economy.

Sarah Gertler, Institute for Policy Studies

Commonsense guardrails are needed to protect taxpayers dollars from wasteful stock buybacks and excessive CEO pay.

The 2022 CHIPS and Science Act represents a huge opportunity to both bolster domestic semiconductor production and encourage more equitable and sustainable corporate practices.

This new report by the Institute for Policy Studies and Americans for Financial Reform Education Fund zeroes in on the law’s $39 billion in subsidies for semiconductor manufacturing, and specifically on the Biden administration’s decision to grant preferential treatment in the awarding of these subsidies to firms that agree to forgo all stock buybacks for five years. This policy sends a critical message about the importance of ensuring that public investment dollars are used for their stated purpose in ways that benefit working families and build a stronger economy, rather than to further enrich executives and wealthy shareholders.

The administration has a clear commitment to discouraging this wasteful practice and ensuring that public dollars are spent equitably for productive ends. To give real teeth to this commitment, Department of Commerce officials should include explicit buyback restrictions in the CHIPS subsidy contracts they are currently negotiating with a number of semiconductor manufacturers.

The semiconductor industry has been a major exploiter of stock buybacks, a financial maneuver that artificially inflates the value of company shares (and the value of executive stock-based pay) while siphoning resources from worker wages, R&D, and other productive investments.

Stock buyback defenders often try to justify the practice as a legitimate tool for boosting shares that the market has undervalued. They also sometimes claim that buybacks merely return “left over” money to shareholders after meeting planned payroll, investment, and other commitments and thus have little to no effect on capital allocation or wages. New SOC Investment Group analysis of seven leading semiconductor companies debunks these arguments.

The analysis indicates that buyback activity during the 2019-2023 period was concentrated not among companies with undervalued shares but among the most highly valued companies, and at times when those valuations were elevated. The SOC researchers also found that when market signals indicated that a company should invest more, semiconductor companies did not boost investment activity, but instead bought back shares.

To further understand recent buyback trends, the analysis in this report examines buybacks by the 11 companies that had signed preliminary memoranda of terms with the Department of Commerce for CHIPS subsidies as of June 30, 2024. (see tables below) The subsidies for these 11 firms are worth nearly $30 billion combined.

When stock buybacks artificially boost the value of a company’s shares, this in turn pumps up the value of executives’ stock-based compensation and makes it easier for them to hit bonus targets tied to share values.

Research also indicates that executives often time the sale of their personal stock holdings to cash in on the stock price surge that typically follows a buyback announcement. An SEC investigation of several hundred such announcements in 2017 and 2018 found that these announcements boosted share prices by an abnormally high average of 2.5 percent in the following month, and CEOs and other top executives sold five times as much stock in the eight days after an announcement as they did in the days before the announcement.

Research by Professor Lenore Palladino of the University of Massachusetts-Amherst reinforces these findings. Her analysis of transactions over a 12-year period found that significant stock sales by corporate executives are nearly twice as common in quarters when meaningful stock buybacks take place as they are in other quarters.

Opportunities for reaping huge stock buyback windfalls have expanded as equity-based pay (stock awards, stock options, performance stock units, restricted stock, etc…) has become an increasingly large share of executive compensation packages. The Economic Policy Institute found that realized equity compensation made up more than 81 percent of total average realized CEO pay at big corporations in 2022.

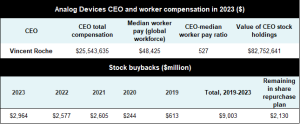

U.S. chipmaker Analog Devices is reportedly seeking federal CHIPS subsidies and has already received financial support from the Oregon government to expand a factory in that state. Like many others in the industry, Analog has a history of massive spending on stock buybacks and executive pay. CEO Vincent Roche made $25.5 million in 2023 – 527 times as much as pay for the firm’s median worker. During the 2019-2023 period, the chipmaker spent $9.5 billion on stock buybacks and has more than $2 billion remaining in their board-authorized repurchase program.

More than 70 Analog Devices employees recently delivered a petition to top executives demanding better pay and working conditions. They pointed out that while workers were suffering unpaid shutdowns and delays of scheduled raises, the company had continued to reward executives and shareholders with billions in stock buyback spending. Among their key demands: a $27 minimum hourly wage, no unpaid shutdowns or forced vacations, and improved training for handling dangerous chemicals.

The bipartisan CHIPS and Science Act, signed into law on August 9, 2022, forbids semiconductor subsidy recipients from spending CHIPS funds on stock buybacks or shareholder dividends. Since money is fungible, some Democratic lawmakers have urged the agency responsible for administering the program, the Department of Commerce, to go further to prevent CHIPS funds from enabling stock buybacks.

In a public webinar, Congressional Progressive Caucus Chair Pramila Jayapal recounted “deep and frequent negotiations” with Commerce Secretary Gina Raimondo, which started in July 2022, as the CHIPS Act was heading towards passage. These negotiations focused on ensuring that the new funds would go towards “an industrial strategy of revitalizing domestic manufacturing, creating good-paying American jobs, strengthening American supply chains, and accelerating the industries of the future rather than that money going directly into the pockets of CEOs and Wall Street traders,” Jayapal explained.

Senator Elizabeth Warren has also initiated a series of letters to Secretary Raimondo urging stronger action on stock buybacks. “Without strict controls, we are concerned that CHIPS funding may result in a subsidy for additional buybacks, enriching executives and stockholders at taxpayers’ expense while undermining the goals of the legislation,” read one joint letter from Warren, Jayapal, and several other Democrats in October 2022.

Protecting taxpayers and “realizing the economic and national security objectives of the CHIPS Act will require the Department [of Commerce] to use its authority to ensure that CHIPS funds are not used to subsidize stock buybacks and shareholder distributions, whether directly or indirectly,” read another joint letter from four senators and four House members.

In February 2023, Commerce released CHIPS subsidy criteria requiring all applicants to detail their intentions with respect to stock buybacks over five years and promising preferential treatment in the awarding of grants to firms that commit to refrain from all stock buybacks.

“This is about enhancing research and development in America,” Raimondo explained in an interview. “The money should be used to expand in America, to out-innovate the rest of the world. Invest in R&D and your workforce, not in buybacks.”

While encouraged by the Commerce Department’s precedent-setting policy on buybacks, Jayapal cautioned that “it’s going to be on us all collectively to make sure that this is the direction we continue to follow and that things don’t start to fall through the cracks. That’s all about implementation…We need to engage to make sure that public money is used for public good.”

Stock buybacks were largely considered unlawful stock market manipulation until 1982, when the Securities and Exchange Commission (SEC) created a massive safe harbor from liability. In recent years, particularly since the 2017 corporate tax cuts, buyback spending has exploded. S&P 500 firms alone spent $806 billion on buybacks in the first year after that tax reform, a massive jump from the $519 billion they spent repurchasing stock in 2017. While buybacks dipped in 2023 due to recession concerns, Goldman Sachs analysts expect a sharp uptick this year and a historic outlay of more than $1 trillion in 2025.

In the midst of this boom, buybacks have come under much greater scrutiny than ever before. Analysts have documented the association between buybacks and reduced capital investment and innovation, wage stagnation, and worker layoffs. In response, policymakers have pursued various mechanisms for discouraging this financial maneuver:

The CHIPS for America program is a key pillar of President Biden’s economic agenda, along with the historic and complementary programs the administration is implementing through the Inflation Reduction Act and the Bipartisan Infrastructure Investment and Jobs Act to strengthen public infrastructure and accelerate the transition to a clean energy economy.

As the administration has stated, the goals of this economic plan are to “invest in America, stimulate private sector investment, create good-paying jobs, make more in the United States, and revitalize communities left behind.”

The likelihood of achieving these goals will be far greater if corporations receiving public investment dollars shift away from the all-too-common focus on short-term payouts for top executives and wealthy shareholders and instead focus on building strong workforces and creating long-term value.

The administration has taken many important steps to use the power of the public purse to push corporations in this positive direction. For instance, President Biden lifted the wage floor for certain federal contract workers to $15 per hour. And he has ordered construction firms involved in large public infrastructure projects to negotiate collective agreements with their workers.

With regard to the CHIPS program, the administration took the important step of requiring corporations receiving more than $150 million in subsidies to submit plans to provide affordable, high-quality child care services for their manufacturing and construction workers. If effectively implemented, this will help reduce barriers to semiconductor jobs for people who are underrepresented in the sector, including women. Century Foundation experts have been monitoring companies in line to receive CHIPS grants and are seeing some hopeful signs that firms are engaging with communities to develop good plans for their employees without contributing to rising costs for other households.

Strong stock buyback restrictions on corporations receiving federal subsidies and contracts would reinforce the administration’s economic agenda, since every dollar spent on buybacks is a dollar not spent on employee child care subsidies, worker wages and training, or innovation for long-term competitiveness.

The administration’s decision to provide preferential treatment to CHIPS grantees that agree to forgo buybacks was a positive step. However, as Senator Warren, Representative Jayapal, and other members of Congress pointed out in a recent letter to Commerce Secretary Raimondo, the agency’s guidance for grant applicants continues to “leave the door open for semiconductor companies to take millions or even billions in CHIPS grants, move some money around, and then engage in more stock buybacks.”

To maximize the benefits of this program, the Department of Commerce should take advantage of its statutory authority to fully ban CHIPS grant recipients from engaging in stock buybacks as a condition of their awards. Agreements should also include strong accountability measures if grant recipients engage in stock buybacks in violation of the ban.

As semiconductor corporations have been competing for this funding in recent months, they appear to have been holding back on buyback activity – likely hoping to avoid drawing greater scrutiny of this wasteful practice. But if contracts do not include strong teeth to reinforce the administration’s position, the buyback floodgates could open once again.

Sarah Anderson directs the Global Economy Project and co-edits Inequality at the Institute for Policy Studies. Natalia Renta is a Senior Policy Counsel in charge of corporate governance and power at the Americans for Financial Reform Education Fund.

by Natalia Renta

Investors will vote on several issues at the heart of a broader national effort by oligarchs and corporate insiders to consolidate power over our economy.

by Natalia Renta

Comptroller Lander aims to hold Musk and his board accountable while Republican financial officers are blaming protestors.

by Natalia Renta

As Elon Musk works to gut federal enforcement agencies, he's just won a state legislative victory to weaken shareholders' power to hold corporate lawbreakers accountable.

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close

Inequality.org

→ In Your Inbox

Get the indispensable guide to the latest on our unequal world, in your inbox every Wednesday.

You can unsubscribe any time. We do not sell or share your information with others.

Click to close