| THIS WEEK |

On this day, Tax Day, households across the United States are scrambling to file — or extend — their taxes. Members of our billionaire class, on the other hand, are doing a great deal more smiling than scrambling.

Over one recent five-year period, a bombshell ProPublica investigation last week revealed, the 25 richest Americans paid a true tax rate of roughly 3.4 percent. That’s right, you most likely paid a bigger share of your income in taxes than America’s wealthiest.

Most Americans want to change that. According to a just-released survey from Data for Progress, two-thirds of likely voters, including 53 percent of Republicans, think billionaires should be paying more in taxes. What’s preventing those higher taxes? Our society still lacks the political will to take on our super-rich.

But crises, as oligarchy expert Jeffrey Winters details in today’s issue, can provide “real opportunities to restructure institutions and give setbacks to oligarchs and elites.” Let’s see our current moment of crisis, with global inequality at an all-time high, as just such an opportunity — to mobilize against a system that rewards wealth over work.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

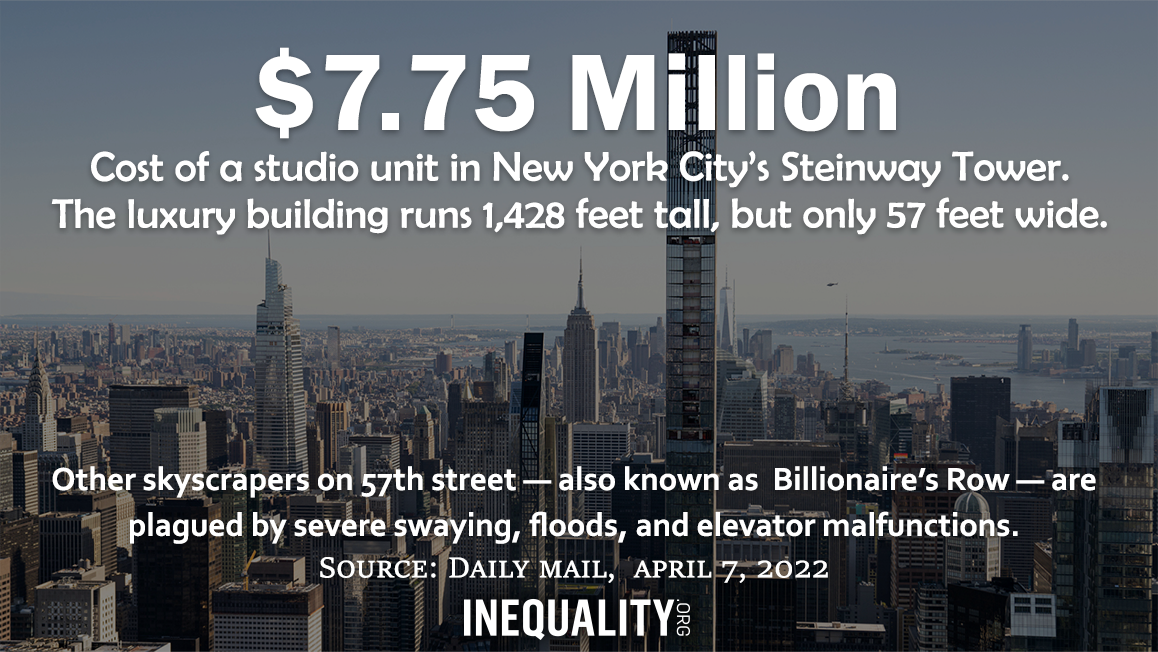

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Fighting a Union-Busting Contract for Gas-Guzzlers |

After nearly 30 years in the labor movement, Cindy Estrada knows how the standard corporate playbook works: “As soon as wages and benefits get decent, they want to move that work somewhere else.” The United Autoworkers vice president saw exactly that happen after Oshkosh Defense secured a huge contract to build postal vehicles. The ink was “still drying,” Estrada told a recent rally, “when they announced they were moving the work to South Carolina.”

UAW members working at Oshkosh in Wisconsin had expected that they would be building the postal trucks since the company had won the contract on the basis of their record of quality work. Instead, the company is building a new facility in a notoriously anti-union southern state.

Estrada and other UAW leaders joined with environmental groups outside U.S. Postal Service headquarters in Washington, D.C. earlier this month to deliver 150,000 petitions demanding union-built, emissions-free new postal vehicles. Notes Estrada: “We have nothing against South Carolina workers. We believe every worker should have democracy in their workplace.” Inequality.org co-editor Brian Wakamo has more. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| This Anti-Woke Billionaire Sure Likes Beachfronts |

| Who’s been “gleefully” retweeting the manic blather of Peter Thiel, the billionaire who earlier this month labeled socially conscious investing a “hate factory” and Warren Buffett the “sociopathic grandpa from Omaha”? None other than Thiel’s fellow billionaire, Marc Andreessen, the Netscape co-founder who now has his own venture capital fund. Andreessen has been on a twitter tear, in one recent two-week period shooting out some 350 missives taking aim, reports Bloomberg, at “the usual bogeymen of the far right,” everything from “wokeism” to sympathy for Ukrainians. Somehow, amid the diatribes, Andreessen has found time for what appears to be his life’s other current passion: buying Malibu beachfront property. Since late last year, he’s picked up three different estates on California’s goldest of coasts, shelling out over $255 million in the process. |

|

| |

|

| BOLD SOLUTIONS |

|

| How to Crack Down on the Oligarchy |

| Why do Americans feel comfortable employing the term “oligarch” to describe Russian billionaires while many recoil at the thought of labeling U.S. billionaires the same? Jeffrey Winters – professor at Northwestern University and author of the 2011 book Oligarchy – believes we should make no distinction between the two because, ultimately, oligarchy amounts to the politics of wealth defense. In a Q&A with our researcher Omar Ocampo, Winters points to solutions — as well as to historic examples of democracy failing to rein in oligarchs. The bottom line? Transparency in both wealth and income, in addition to a simpler tax code, would devastate the oligarchic class. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

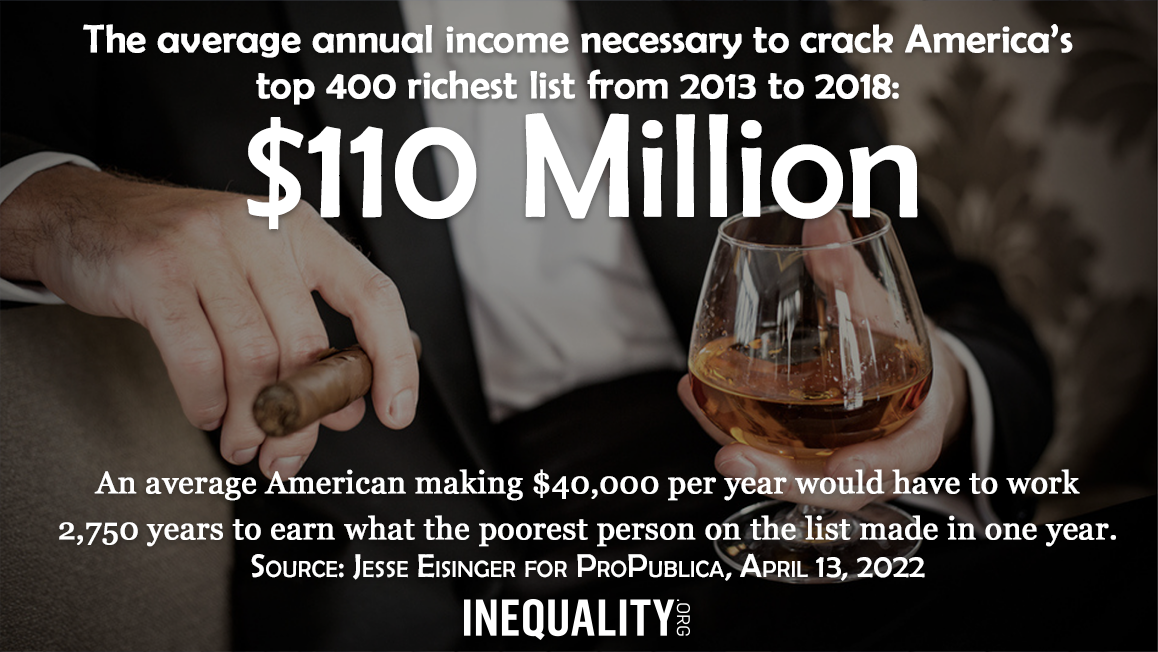

| Still Another Good Reason for Taxing Our Richest |

| From 2013 through 2018, new ProPublica data show, America’s tech billionaires pocketed 10 of the nation’s 15 highest incomes, and about a fifth of the nation’s highest 400 incomes belonged to hedge fund managers. None of the top 400 averaged less than $110 million a year. But the most eyebrow-raising insight in the new ProPublica research? America’s wealthiest may be even wealthier than we all think. Inequality.org’s Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

What's on Inequality.org

Robin Alexander, International Solidarity in Action: Lessons From a Path-Breaking US-Mexico Union Alliance. A veteran labor activist reflects on decades of experience building mutual respect and support across borders.

Manuel Pérez-Rocha, Ousted Pakistani Leader Was Challenging Investment Treaties That Give Corporations Excessive Power. Mexico and many other countries are facing anti-democratic corporate lawsuits like the case that pushed Pakistan’s Khan to withdraw from international investment agreements.

Elsewhere on the Web

Fair Taxes on America’s Billionaires and Giant Corporations Would Provide $252 Billion in Revenue Per Year to Help Slash Poverty and Reduce Hunger in the US, Oxfam. Tax Day serves as a stark reminder of the gross inequity in our nation’s tax system that enables the ultra-wealthy to purchase private islands while the US child poverty rate climbs.

Maya Srikrishnan, How federal tax law hurts Black Americans, Center for Public Integrity. An interview with Dorothy Brown, the Emory University law prof who explores the tax code’s racial disparities in her recent book, The Whiteness of Wealth.

Paul Kiel, Ash Ngu, Jesse Eisinger, and Jeff Ernsthausen, America’s Highest Earners And Their Taxes Revealed, ProPublica. An up-close, detailed look at how little in taxes America’s 400 richest are paying.

Chuck Marr, Tax Filing Season Highlights Need to Reform Tax System, Rebuild IRS, Center for Budget and Policy Priorities. An excellent tax-deadline rundown that explains how tax cuts tilted to the rich and the corporations they run have left the U.S. with less in total tax revenue, relatively speaking, than nearly every other developed country.

Matt Stoller, Elon Musk and Selling Tickets to the End of the World, BIG. We shouldn’t be arguing about Elon Musk. Let’s end the federal statute that immunized web giants from speech that users say on their platforms.

Kurtis Alexander, California Proposes Wealth Tax for Clean Air Efforts, San Francisco Chronicle. Dubbed the Clean Cars and Clean Air Act, the measure would tax California's wealthiest residents — those making more than $2 million a year — and channel the proceeds to helping the state curb wildfires and smoke.

France’s Macron, Le Pen call Stellantis CEO’s pay package ‘shocking,’ Reuters. French President Macron, racing for re-election, says we “should put a cap” outrageous CEO pay. He warns that otherwise “society [is] going to blow up.”

Victor Pickard, We Can’t Let Billionaires Control Major Communications Platforms, Nation. Musk has described himself as a “free speech absolutist,” but this commitment doesn’t apply to those in his employ. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2022: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|