| THIS WEEK |

We’ve suddenly come to a historic — and potentially very brief! — political moment. Progressives now have a real shot at winning a path-breaking tax on the nation’s super-wealthy.

Just over the past week, a billionaire tax proposal has suddenly moved from the edge to the very center of the negotiating table for President Biden’s sweeping Build Back Better agenda.

How did we get here? To a certain extent, billionaires have brought this on themselves. As we’ve been tracking and exposing throughout the pandemic, America’s ultra-wealthy have seen massive growth in their fortunes. And instead of helping people in need, they’ve blown much of their vast riches on frivolities like space races.

But, as our just-published Inequality.org analysis explains , social movements also deserve a great deal of credit. They’ve been ratcheting up the pressure on lawmakers to tax the ultra-wealthy to pay for investments in a more equitable and sustainable economy.

The window for pushing a billionaire tax over the finish line couldn’t be more narrow, as Democrats seek to finalize a deal in the coming days (or even hours!). Please check out the site set up by our allies at Americans for Tax Fairness to learn what you can do to help. Thanks!

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Meet the Tax Attorney Fighting to Tax the Rich |

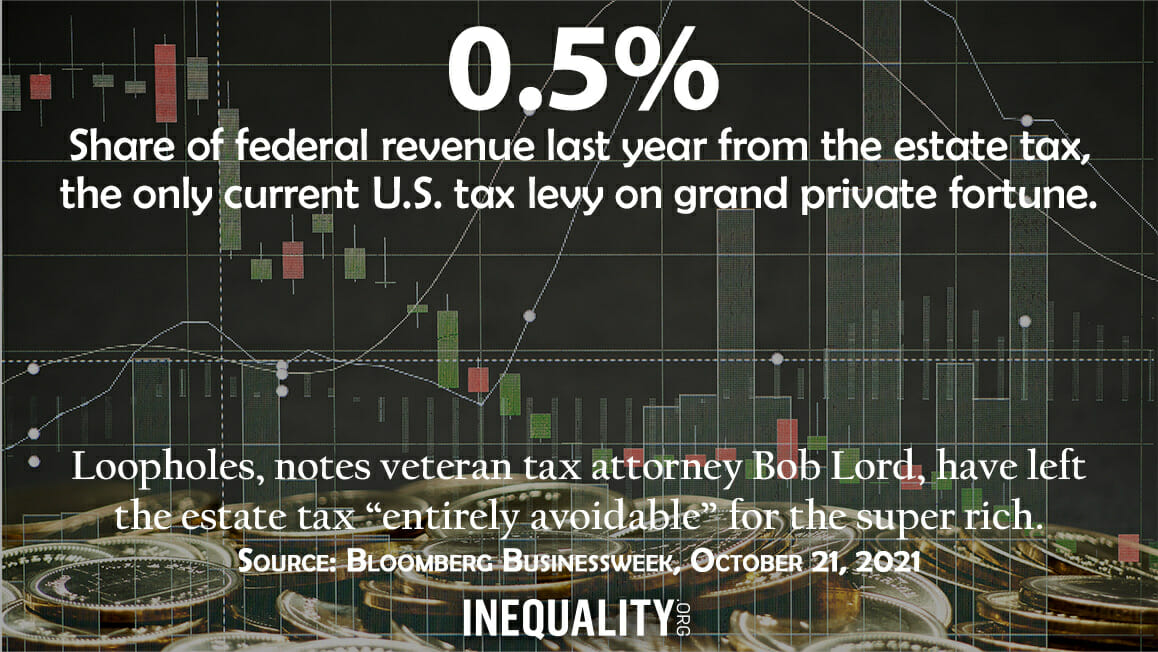

| For years, Bob Lord worked as a tax attorney helping the ultra-rich benefit from the nation’s unequal tax code. Now he’s using his extensive tax code expertise to advocate for closing loopholes and taxing the wealthy. Bob has been an Institute for Policy Studies associate fellow since 2013, based with our Program on Inequality and the Common Good. For Inequality.org, he’s writen extensively on how wealth flows untaxed from one generation to the next. Bob recently worked with Bloomberg reporters to publish a blockbuster report on how Nike founder Phil Knight has utilized tax avoidance strategies to dodge the estate tax and maximize transfers to his heirs and charitable foundations. Inequality.org co-editor Chuck Collins sat down this past week with Bob to walk us through how this can happen under existing tax law — and what needs to change. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| People’s Right to Know? Phooey, Says Pfizer CEO |

| Albert Bourla, CEO of the drug giant Pfizer, has plenty of reasons for strong-arming desperate nations into signing secret contracts if they want to get his company’s Covid-19 vaccine — and none of them have anything to do with public health. Bourla’s Pfizer, a new Public Citizen report charges, is exploiting its market power to “shift risk and maximize profits” at the expense of patients. One example: Pfizer’s secret contract with Brazil restricts that country’s capacity to accept vaccine donations from other sources, an “appalling” move, charges a top Geneva global health center, that runs “counter to the goal of getting vaccines as quickly as possible to those who need them.” Why would Bourla want to put that goal at risk? One possibility: the millions in bonuses he’s been taking home since becoming Pfizer’s CEO in 2019. His pay last year totaled just over $21 million. Last week, Bourla had his flacks dismiss Public Citizen’s bombshell findings as “irresponsible and misleading.” |

|

| |

|

| BOLD SOLUTIONS |

|

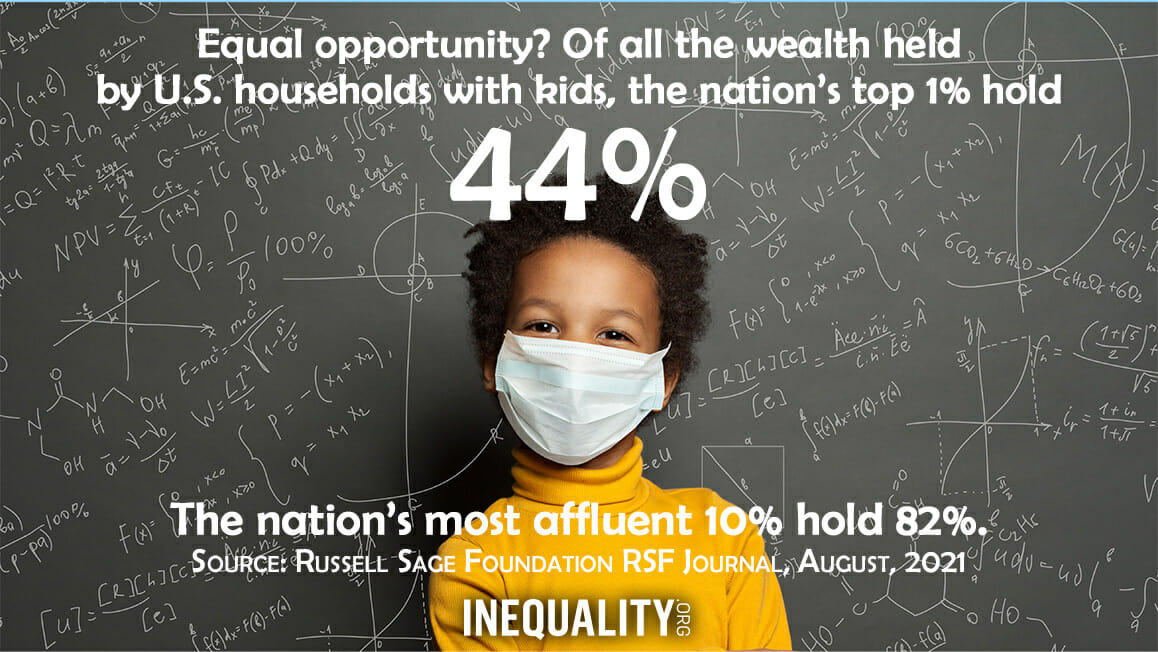

| Taxing the Wealth of the Rich to Build Back Better |

| The Build Back Better agenda now under negotiation in Congress would improve the lives of millions of Americans by creating good jobs, expanding access to affordable child care and home care, and making other vital public investments. Several tax reforms on the table to help pay for the plan would also reduce the wealth inequality that’s undermining our economic health and threatening our democracy. The most powerful option: Senate Finance Chair Ron Wyden’s “Billionaires Income Tax,” a measure that would require the 700 or so U.S. billionaires to pay annual income taxes on their increased wealth, just like workers pay taxes on their paycheck earnings each year. Sarah Anderson and Brian Wakamo have created five charts to explain the need for this proposal and other innovative wealth tax ideas in play on Capitol Hill. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Can Billionaires Save Our Rapidly Fading World? |

| Great wealth can do great damage. Grand personal fortunes, we’ve come to understand, can menace our democracy and distort our economic life. But these fortunes can also wreak a much more hidden havoc: They can mess up the minds of people who hold them. Great fortunes can leave their owners feeling supremely sure they themselves must be great. Great enough to save the world if they put their mind to it. And growing numbers of the rich are doing just that, spending hundreds of millions promoting their own personal utopian visions. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Kalena Thomhave, How South Dakota Became a Tax Haven for the Super-Rich. As the Pandora Papers exposed, for the last 30 years, multimillionaires and billionaires have parked their wealth in the state of South Dakota to avoid taxation and secure dynastic wealth for generations.

Chuck Collins and Sarah Anderson, Let’s Make the Most of This ‘Tax Billionaires’ Moment. The movement to tax extreme wealth to pay for human needs suddenly has a rare political opening.

Elsewhere on the Web

Ben Steverman, Anders Melin, and Devon Pendleton, The Hidden Ways the Ultrarich Pass Wealth to Their Heirs Tax-Free, Bloomberg Businessweek. An inside look at how Nike founder Phil Knight is moving a fortune to his family while avoiding billions in U.S. taxes.

Jacqui Germain, Billionaires Barely Pay Taxes: Here’s How They Get Away With It, Teen Vogue. Insights from Chye-Ching Huang, executive director of the Tax Law Center at NYU School of Law.

Harold Meyerson, Dealing With Sinema, American Prospect. Two enticing tax-the-rich proposals have gained momentum as workarounds to Senator Kyrsten Sinema's opposition to Build Back Better.

Judd Legum and Tesnim Zekeria, Banks engaged in multi-million dollar lobbying effort to protect wealthy tax cheats, Popular Information. The wealthiest 1 percent of American taxpayers are hiding over 20 percent of their earnings from the IRS.

Dean Starkman, Fergus Shiel, Emilia Díaz-Struck, and Hamish Boland-Rudder, Frequently asked questions about the Pandora Papers and ICIJ, International Consortium of Investigative Journalists. A deep dive into the latest landmark work on tax evasion by the global ultra rich.

David Sirota, Julia Rock, and Andrew Perez, The Entitlement Mentality, The Daily Poster. U.S. pols frequently demand draconian work requirements for programs that benefit working-class families but rarely apply such restrictions to tax preferences that enrich themselves, their families, and their donors.

Cory Stieg, Why so many people hate the super-rich — but still love Elon Musk and Bill Gates, according to psychology, CNBC. New research suggests why people tend to admire individual billionaires, but dislike the socioeconomic class of extremely wealthy people. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|