| THIS WEEK |

Will we — the world’s wealthiest nation — continue to allow millions of children to live in poverty while the ultra-rich few grow and protect their fortunes for generations to come? Or will we wield this country’s wealth for good and ensure everyone the tools to reach their full potential?

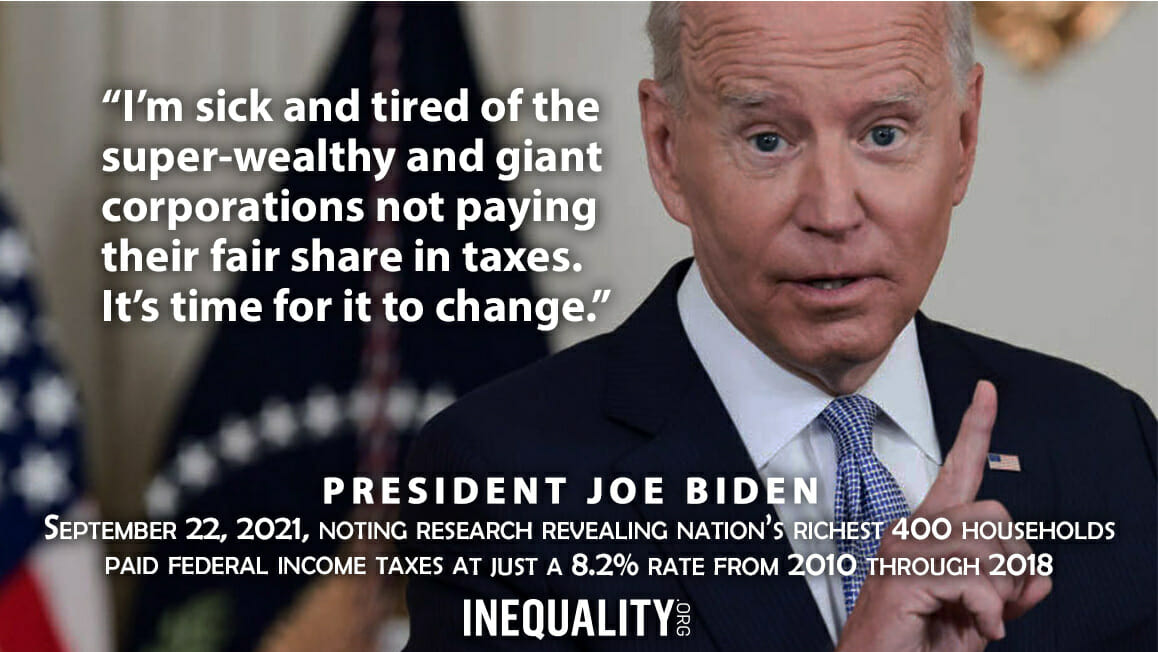

We’re seeing these key questions all at play right now as Congress hammers out a budget deal that could move us forward — on a more equitable track — by raising taxes on the wealthy and the corporations they run to pay for vital investments in human and environmental needs.

Need an example of what’s at stake? One tax reform on the table that we’re highlighting this week would close a loophole that lets private equity execs pay taxes at a lower overall tax rate than many teachers.

Looking for more insights? The New York Times has just featured our research on how the “step-up” tax loophole protects wealth dynasties.

We know we may sound sometimes like a broken record when we talk about the importance of making all our voices heard. But right now we really are facing a transformative moment. Let your lawmakers know!

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| In D.C., Big Pharma vs. Everyday Americans

|

| With corporate lobbyists plotting their next campaign from mere yards away, organizers from across the country gathered last week outside the Pharmaceutical Research and Manufacturers of America headquarters in Washington, D.C to protest Big Phama’s relentless pursuit of profits at the expense of everyday people. To demonstrate that greed, protesters brought a series of visuals, including a 12-foot cardboard PhRMA executive pulling strings on activists portraying three Congressional “puppets” — Reps. Kathleen Rice (D-NY), Kurt Schrader (D-OR), and Scott Peters (D-CA) — all of whom recently threatened to tank a provision in the $3.5 trillion budget resolution that would allow Medicare to negotiate with drug companies for lower prescription prices. Notes Alex Lawson of Social Security Works: “Pharma’s time of openly corrupting the political system is over. We will make sure of that.” Rebekah Entralgo has more. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| Inside Trading Comes Awfully Easy to This Insider |

| Should Federal Reserve regional presidents be buying and selling stocks on Wall Street that stand to gain or lose from decisions the Fed makes? Dallas Fed president Robert Kaplan, a former exec at banking giant Goldman Sachs, certainly thought so last year. In 2020, Kaplan made trades worth over $1 million each in 22 individual companies and investment funds, all at the same time he had access, notes a Wall Street on Parade analysis, “to non-public, market-moving information.” Dennis Kelleher, president of the advocacy group Better Markets, is charging that Kaplan engaged in “pandemic profiteering trading conduct” and needs “to resign or be fired.” Kaplan, for his part, has indicated he’ll now sell off his individual investments by October. But his Dallas Fed staff has so far refused to answer whether Kaplan had in 2020 “shorted” the market by placing a trade that would jump in value if a particular security dropped in price, maybe the ultimate red-flag for conflict-of-interest conduct. |

|

| |

|

| BOLD SOLUTIONS |

|

| Make Private Equity Execs Pay Their Fair Share |

| The now pending multi-trillion-dollar budget reconciliation bill before Congress represents an enormous opportunity to invest in unmet needs and close loopholes that let the wealthy avoid their fair tax share. One of the most extreme examples of tax privilege: the “carried interest” loophole that allows wealthy private equity managers to pay a lower tax rate than many middle-class Americans. Workers like Alisha Hudson, a young mother who lost her retail job to private equity pillaging, find this loophole particularly galling. With help from United for Respect, Hudson has lobbied her Kentucky lawmakers about the need to end this tax loophole and take other actions to rein in private equity abuses. Institute for Policy Studies Inequality Research Analyst Brian Wakamo has more. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Will Fanboys for Grand Fortune Ever Flame Out? |

| More people worldwide these days seem to be worrying about inequality — the deepening concentration of our global wealth — than ever before. But not everyone is fretting. Flacks for grand fortune still abound, both on and off the payrolls of our super rich. These flacks generally busy themselves recycling bromides about the brilliance of our billionaires. Most of us pay these screeds no attention. Still, every once in a while, a shamelessly defiant defense of our indefensible unequal order will grab our attention with claims so audacious we’ll be chuckling one moment and despairing — that anyone could take those claims seriously — the next. Where to find this sort of shamelessness? The editorial pages of the Wall Street Journal have been a go-to source for years. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Sarah Anderson and Brian Wakamo, Taxpayers are Subsidizing Soaring CEO Pay at Pentagon Contractors. If Congress doesn't crack down on military contractor pay, the White House should.

Elsewhere on the Web

Robin Kaiser-Schatzlein, The Tax Loophole That Helps America's Richest Families Stay That Way, New York Times. Wealth easily buys political power. The longer we fail to constrain inherited wealth, the sooner the dream of a democratic society dies.

Carter Dougherty, Senate Democrats Have a Big New Corporate Tax Idea, Washington Monthly. The Tax Excessive CEO Pay Act would impose a surcharge on corporate income tax for any company that pays its CEO 50 times or more its median employee pay.

Joseph Stiglitz, Todd Tucker, and Gabriel Zucman, The Global Minimum Tax Deal Is About More Than Fairness, Foreign Affairs. Squashing the global tax-avoidance industry will be key to coping with climate change.

Shira Ovide, It’s Possible to Be Too Rich, New York Times. Having too much money can make people and companies undisciplined and impulsive.

John Cassidy, How (Not) to Tax Billionaires, New Yorker. A plan from the House Ways and Means Committee targets the merely rich rather than the plutocrats, insuring that our new Gilded Age will continue.

Owen Jones, Eat the rich! Why millennials and generation Z have turned their backs on capitalism, Guardian. The rich – whose wealth surged during the pandemic – remain uneaten. But young people see no rational incentive to back a system that seems to offer only insecurity and crisis.

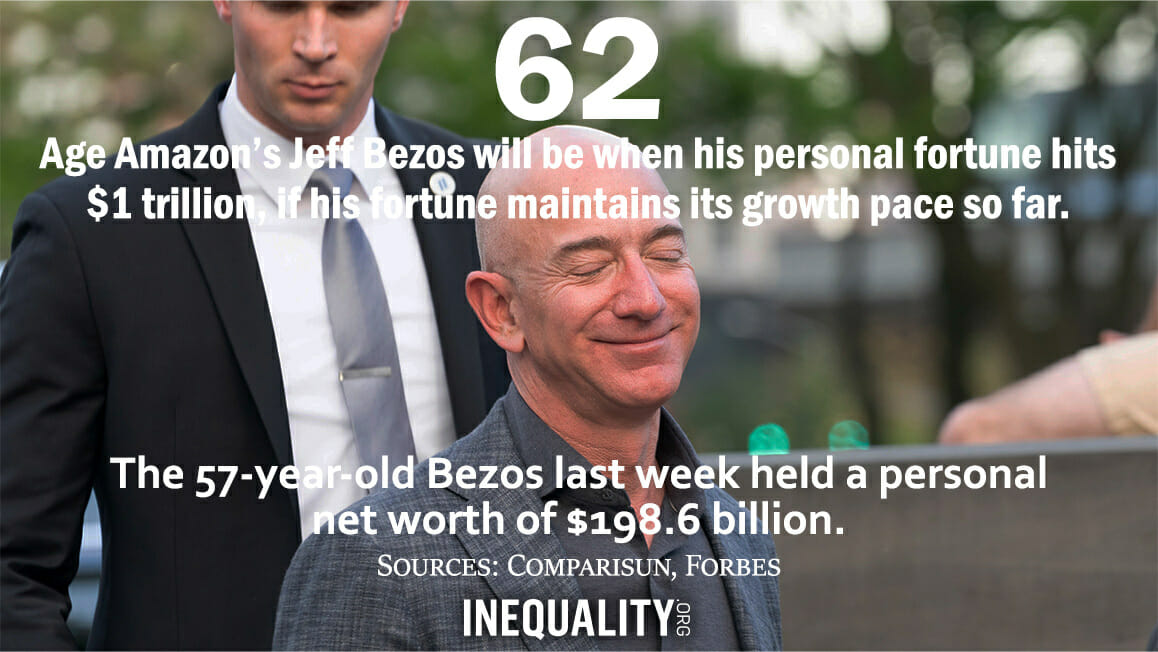

Benji Jones, What happens when billionaires jump on the biodiversity bandwagon, Vox. Jeff Bezos and other billionaires are aiding conservation but doing little to limit the forces that make conservation necessary — and made them rich.

Michael Dauderstädt, Global inequality and the pandemic: exaggerated hopes and fears? Social Europe. A deep dive into the stats.

Martin Wolf, Inequality is behind central bank dilemma, Financial Times. In the medium to long term, secular stagnation appears likely to return, unless income inequality falls.

Gerard Roland, Ten Thousand Years of Inequality: The Archaeology of Wealth Differences, Journal of Economic Literature. Archeologists have figured out how to measure economic inequality in the very distant past. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|