| THIS WEEK |

Do you follow Senator Bernie Sanders on social media? If so, you may have just seen our colleague Sarah Anderson featured in one of his latest videos on taxing the rich.

Sarah explores in this video the controversy around tax data recently leaked to ProPublica. A number of U.S. billionaires, the data show, have paid zero federal income taxes over recent years, a revelation that has the nation’s elite in a tizzy — but not because of what the data reveal about our rigged tax system.

Instead, as Sarah reminds us, pols like Senate Minority Leader Mitch McConnell are fulminating against those who leaked the data because they fear that this new evidence about our tax code’s core unfairness is only going to increase pressure on them to raise taxes on the wealthy. And Mitch has reason to

worry: Taxing the rich remains supremely popular.

Congress, meanwhile, is continuing to debate how best to fund the nation’s pandemic recovery. The answer is staring us all in the face: Tax the ultra-rich. They’ve benefited the most during this crisis. They can fund the recovery we need to be strong enough to confront the crises ahead.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

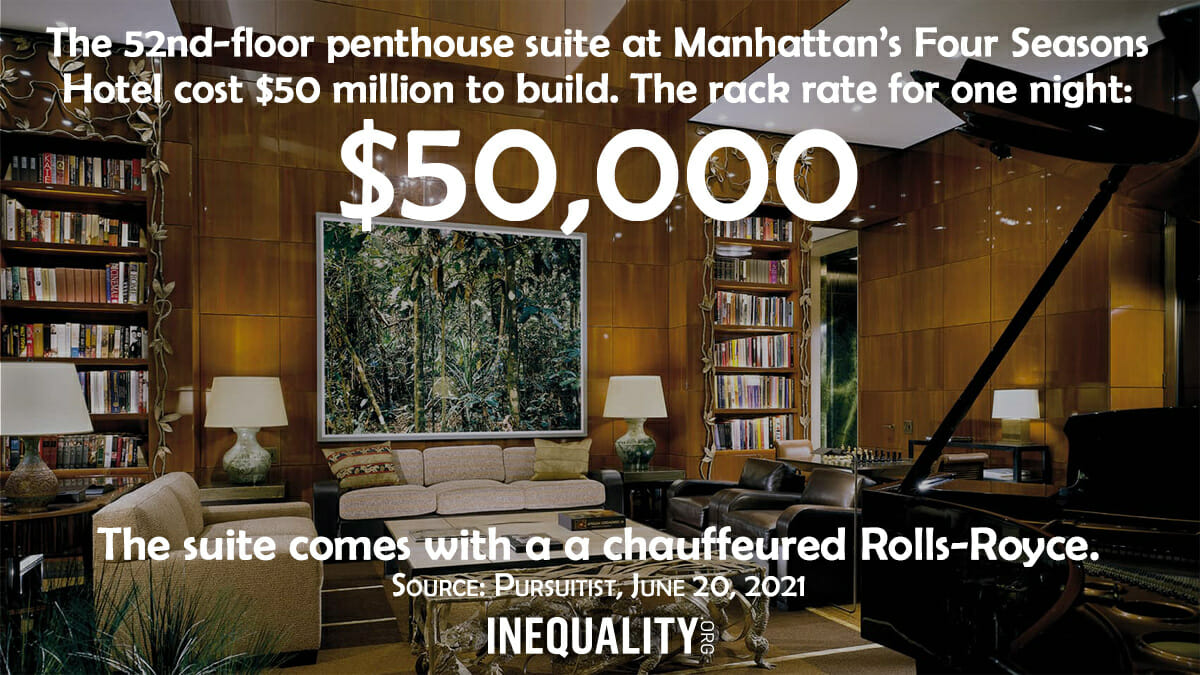

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| From Appalachia to DC: Low-Wage Workers Rise |

| Last week, with Congress and the White House deep in tense negotiations over the latest infrastructure proposal, hundreds of low-wage workers, faith leaders, and advocates from Kentucky and West Virginia joined the Poor People’s Campaign for a “Moral March on Manchin and McConnell” in the nation’s capital. Pamela Garrison, a retired retail cashier from West Virginia, addressed the crowd, sharing her frustrations on a system that places compromise above the needs of working people. Asked the activist: “We are the people. Why is it that the only time compromise is mentioned is when it’s something to help the people? I never heard of compromise when the rich were getting their tax breaks.” |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| Years Left to Share the Planet with Peter Thiel: 67 |

| Billionaire Peter Thiel doesn’t have much sympathy for the one in four working-age Americans who have nothing set aside for retirement. All their own fault, he believes, for their failure at “living modestly and saving well.” Thiel himself, now 53, plans on living to age 120. And how well has he personally been saving? Maybe better than anyone in human history, thanks to his manipulation of the “Roth IRA,” a 24-year-old retirement savings vehicle designed for average working stiffs. Thiel has used his Roth IRA, the public-interest group ProPublica revealed last week, to spin a retirement account worth less than $2,000 in 1999 into a colossus now worth over $5 billion. And if he waits until April 2027 — the halfway point of his 60th year — Thiel “will never have to pay a penny of tax on those billions.” At the heart of Thiel’s tax “magic”: a sweetheart deal that let him buy 1.7-million shares of PayPal stock at a tenth of a penny each. Thiel has so far refused to comment on the ProPublica bombshell. He’s apparently been too busy decrying “confiscatory taxes” on the incomes of America’s rich. |

|

| |

|

| BOLD SOLUTIONS |

|

| A $6-Trillion Floor for the Federal Budget Deal |

| With the bipartisan infrastructure deal up in the air, progressive groups are calling on lawmakers to go bold on a broader budget proposal that would increase taxes on the wealthy and big corporations to support much-needed public investments. Millions of U.S. families struggle just to make ends meet “while the ultra-wealthy continue to reap billions without paying their fair share,” points out a statement organized by the Progressive Caucus Action Fund, Economic Policy Institute, Poor People’s Campaign, and Institute for Policy Studies. Senate Budget Committee Chair Bernie Sanders says he’s aiming for a $6-trillion budget reconciliation deal that could bypass a Republican filibuster. Given the scope and scale of current needs, note the progressive groups, this figure “should be the floor, not the ceiling.” Their statement will be open for organizational endorsements until noon tomorrow. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| An Inequality Even the Supremes Can’t Swallow |

| The head football coach at Clemson University now makes $8.3 million a year. Four decades ago, in 1981, his coaching predecessor won a national championship making just $50,000. Nationwide, over 50 college head coaches are annually taking home over $3 million. That amounts to over $3 million more than the students they coach are taking home. The justification for this top-heavy state of affairs? Lawyers for the NCAA, the governing body for college athletics, argue that sharing with students the billions in revenues college sports annually generate would somehow soil the noble ideal of collegiate amateur athletics. The NCAA president who safeguards this noble amateur ideal, Supreme Court Justice Neil Gorsuch observed last week, currently makes nearly $4 million a year himself. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Sarah Anderson and Justin Campos, Tying Equity Strings on the Semiconductor Subsidies. CEOs of the top 19 U.S. chip-making corporations make $14 million on average. Should taxpayers have to subsidize those fat paychecks?

Bob Lord, Peter Thiel’s $5 Billion Roth IRA: Only the Size is News. Lawmakers have known about this giant loophole for years. Now we need to do something about it.

Sarah Anderson, The Real Reason Mitch McConnell Is Mad About Whistleblowers Leaking Billionaire Tax Info. The latest tax-dodging scandal could boost momentum for wealth tax proposals on the table in the budget negotiations.

Elsewhere on the Web

Luke Savage, You Can Have Billionaires or You Can Have Democracy: An interview with Chuck Collins, Jacobin. Our wealth dynasties have one objective: making sure the government shields their inherited wealth.

Polly Cleveland, Fighting the Wealth Hoarders with Transparency and Taxes, Dollars and Sense. Absentee billionaires have fastened onto New York City like alien parasites. One antidote to fierce wealth concentration: define property tax far more broadly.

Robin Kaiser-Schatzlein, The Millionaires Who Want to Abolish Extreme Wealth, New Republic. A million small fixes to inequality will not help us if we do not have a vision of the society we seek.

Abigail Disney, I Was Taught From a Young Age to Protect My Dynastic Wealth, Atlantic. The ideology underlies how the ultra wealthy go through life: The government can’t be trusted with money.

David Sirota, Why Are Billionaires Presumed Innocent? Daily Poster. Our officialdom sees crime as something only poor people do.

Robert Reich, The American economy is perilously fragile. Concentration of wealth is to blame, Guardian. Trouble ahead: The U.S. economy rests on the spending of Americans who don’t have much to spend.

Jeff Yang, Being Superrich Doesn’t Make You a Superhero, New York Times. What does it mean when the poverty you’re hoping to eradicate directly result from a system that created your wealth?

Dean Baker, What’s the Difference Between a Waitress and a Private Equity Partner? (Their Tax Rate), Center for Economic and Policy Research. The tax double-standard that privileges the already rich.

Chauncey DeVega, American apartheid and the wealth gap: How white supremacy drives inequality, Salon. America's grotesque economic inequality hurts everyone. But can we at least quit pretending this inequality rates as race-neutral?

Shira Ovide, The Inequality of the GoFundMe Economy, New York Times. In a country with high wealth inequality, digital fundraising tools worsen the real-world gulf between winners and losers.

Chris Erickson, Plutocrats don’t pay taxes: Why this is inefficient and unfair, Las Cruces Bulletin. The rich benefit disproportionately from government programs. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

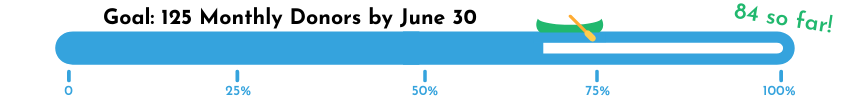

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for June 2021: that 125 of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|