| THIS WEEK |

You don’t have to be an economist to understand that wealth hoarding has become one of the biggest factors contributing to inequality.

In a healthy, democratic society, wealth disperses over decades as people have children, pay their taxes, and give to charity. But in a society with a weak tax bite on the richest among us, wealth accelerates over generations, leaving wealth and power ever more consolidated.

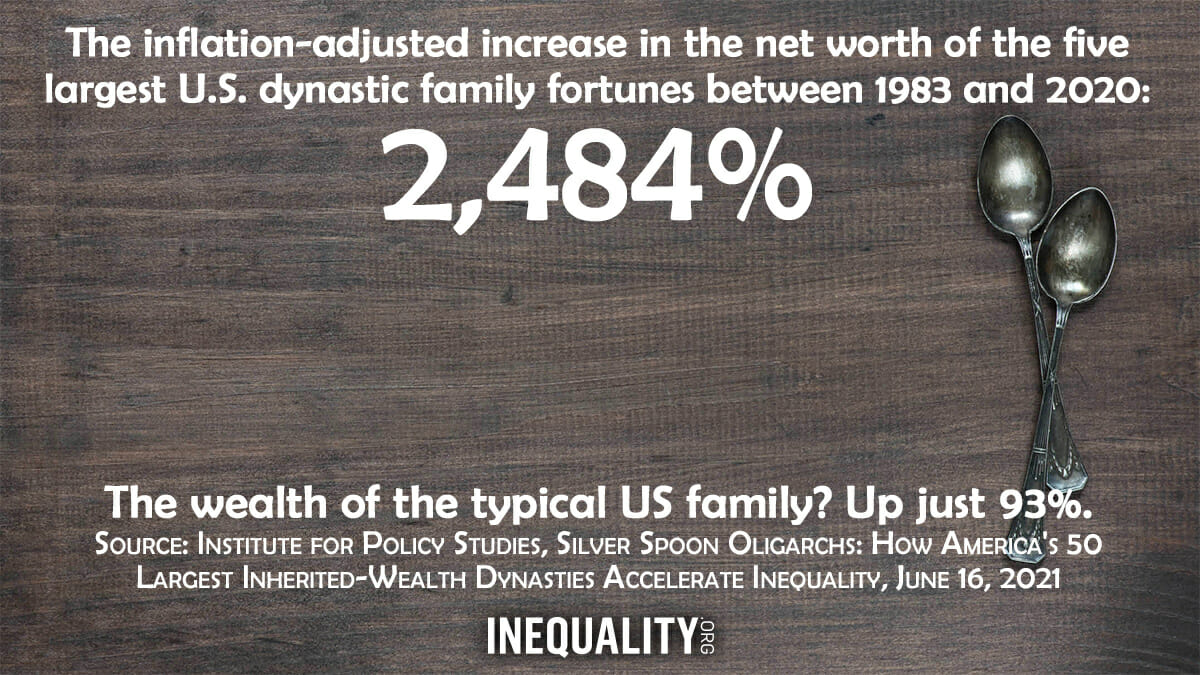

A new report from our Inequality team confirms this reality. Fifty dynastic U.S. billionaire families today hold as much wealth as the entire bottom half of our nation’s families. These silver spoon oligarchs, over the last 40 years, have seen their wealth grow at ten times the ordinary family rate.

We clearly need to get these wealth dynasties in check and build a more equitable society for us all. In this week’s issue, more on how we can start to even out the imbalance that so envelops us.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| In Connecticut, ‘Equity Requires Revenue’ |

| Connecticut epitomizes extreme inequality in the United States. The state’s 14 billionaires became $12.6 billion dollars richer during the pandemic while hundreds of thousands of working people in the state suffered. A new coalition called Recovery for All now sees Connecticut as long overdue for an equitable transformation. The Coalition is fighting to tax the wealthy and corporations to provide relief to poor and working-class residents and fund vital programs and services for working-class and communities of color, and now the state legislature has passed a tax-the-rich package that will generate nearly $1.5 billion in new revenue. Puya Gerami, the coalition’s campaign director, shares more on how Recovery for All made progressive tax reform an essential fight in Connecticut. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A Paragon of Responsibility Now a Billionaire Too |

| Where on Earth today is wealth concentrating the fastest? One possibility: the executive suites at drugmaker Moderna. Stephen Hoge, the company’s president, has just become the fifth Moderna mover and shaker — since the pandemic began — to amass a personal fortune over $1 billion. Moderna has so far declined comment on Hoge’s milestone. But the company couldn’t decline comment last July when a congressional subcommittee quizzed Moderna and other Big Pharma execs on their vaccine pricing plans. AstraZeneca and Johnson & Johnson execs pledged to price their Covid vaccines on a not-for-profit basis. Hoge, testifying for Moderna, refused to follow suit, even after Rep. Jan Schakowsky from Illinois pointed out that Moderna had been receiving federal R&D funding. A Moderna spokesperson later noted that the firm would price its vaccine “responsibly.” What price would Moderna rate as responsible? Any price, apparently, that manufactures at least five Moderna billionaires. |

|

| |

|

| BOLD SOLUTIONS |

|

| A Gameplan for Ending Inherited Dynastic Wealth |

| The 50 wealthiest American families have a combined total of $1.2 trillion in wealth. That money pays for everything from the frivolous — the private jets, the vacation homes, the yachts — to the dangerous — the lobbyists, the think tanks, even the politicians themselves. A new IPS report on today’s Silver Spoon Oligarchs shows how we can stop this explosion of wealth and power at the very top. Popular ideas like a wealth tax can be a start, but we can go further. With a more progressive estate tax, an inheritance tax on heirs, greater oversight by the IRS, and a ban on the dynasty trusts that keep billionaire family wealth churning from one generation to the next, we could break up inherited dynastic wealth and put that money back into the society that made it. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Can We Conquer Grand Generational Fortunes? |

| All things eventually end, even grand family fortunes. In the abstract, we all know this to be true. But the facts on the ground can be disconcerting. And those facts have never been clearer, not after this week’s release of stunning new research on America’s enduring family wealth dynasties. In America, the fabled land of opportunity, our wealthiest have taken full advantage of the “opportunities” their fortunes create. They’ve deployed the power their riches impart to rig our politics and manufacture the closest thing to a perpetual-motion machine for ensuring dynastic fortune the world has ever seen. But these rich have more than their billions going for them. They have an aura of invincibility. Their fortunes seem too huge to ever dent. To puncture that aura, we need history on our side — and, fortunately, we have it! Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Chuck Collins and Kalena Thomhave, Dynasty Trusts: A Tool for Billionaire Tax Avoidance. A new policy brief outlines how the wealthy stow and grow their fortunes for future descendants.

Elsewhere on the Web

Ezra Klein, What the Rich Don’t Want to Admit About the Poor, New York Times. Those in the economy with the power to do the dictating profit from the desperation of low-wage workers.

Oren Schweitzer, ‘The Billionaires Are Nervous. And They Should Be Nervous’: An interview with Alexa Avilés, Jacobin. Community organizer Avilés, a candidate for New York City Council, discusses the recent billionaire-funded scaremongering attacks against her.

Amanda Holpuch, Wealth secret of the super rich revealed: be born into a rich family, Guardian. A new report shows nothing beats family money when it comes to getting – and staying – really, really rich.

Christine Emba, Is it time to limit personal wealth? Washington Post. Instead of debating tweaks at the edges of our tax system, we should be stretching ourselves to imagine a world where billionaires have become impossible.

Anand Giridharadas, Warren Buffett and the Myth of the ‘Good Billionaire,’ New York Times. With America slouching toward plutocracy, we should be worrying not about the virtue level of billionaires, but the social arrangements that make it possible for anyone to gain and keep so much wealth, even as millions of others lack for so much more.

Rohit Malpani, If vaccine apartheid exists, vaccine billionaires shouldn’t, Stat. The failure to share vaccine recipes undermined global immunization efforts and handsomely profited Big Pharma execs and investors.

Nicholas Shaxson, Making sure the ‘big people’ pay their taxes would be a boost to democracy, Guardian. On both sides of the Atlantic!

Branko Marcetic, The Political Establishment Doesn’t Want You to Know the Economy Is Rigged, Jacobin. ProPublica’s bombshell story about the financial malfeasance of the richest Americans has stirred bipartisan outrage in Washington — against, unfortunately, the whistleblower who exposed the story.

Daniel Thomas Mollenkamp, Legal Milestones That Fight Income Inequality, Investopedia. The United States has at times tried to achieve a more equitable distribution of wealth.

Maureen Dowd, Fat Cats on a Hot Tin Roof, New York Times. Paging Madame Defarge: Where do you get your knitting needles? |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|