| THIS WEEK |

For decades now, a secret army of tax attorneys, accountants, and wealth managers has been developing into a shadowy “Wealth Defense Industry.” These agents of inequality are making millions hiding trillions for our richest 0.01 percent.

Here at Inequality.org, we’ve recently spotlighted legislative antidotes to all this tax avoidance and evasion, solutions like a wealth tax on the ultra-rich and the recently unveiled STEP Act that would deal a blow to billionaire greed grabs while also slowing democracy-disrupting concentrations of political power.

Now we have a new resource to offer for battling back against concentrated wealth, a just-published book by one of our Inequality.org co-editors, The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions. Interested in learning more? Author Chuck Collins has a clever little video intro to the book online we think you’ll enjoy. Please also consider joining Chuck for an April 12 virtual discussion on the book.

And if you haven’t already, please take a moment to participate in our brief subscriber survey. Let us know what we can do to deliver you a weekly resource that helps us all build a more equal world. Thanks!

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| After Victory, UK Uber Driver Shifts to New Battle |

| U.S. Uber drivers and other gig workers are still struggling these days to secure basic labor rights. But their counterparts in other countries are starting to score some impressive victories, with the UK Supreme Court’s recent scathing judgment against Uber the most stunning of all. In an exclusive interview for Inequality.org, international labor expert Bama Athreya spoke with James Farrar, a former Uber driver and a lead plaintiff in the case. Farrar and his colleagues are celebrating a David v. Goliath triumph that will deliver wage protections, vacation pay, and other basic benefits for UK gig workers. They’re also gearing up for new struggles to gain employees of app-based digital platforms rights over their own data. Athreya’s interview has more on this critical 21st-century labor battlefront. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A Sure-Fire Big Pharma Formula for CEO Success |

| Johnson & Johnson CEO Alex Gorsky has been no stranger to courtrooms the last two years. His Big Pharma giant has been battling lawsuits on everything from opioid profiteering to links between the company’s baby powder and asbestos. All the litigation has so far cost J&J some $9 billion. How much has the litigation cost Gorsky personally? Nada. J&J exempts litigation costs from CEO pay calculations. That exemption, calculates corporate governance analyst Michael Pryce-Jones, has stuffed an extra $4.4 million in Gorsky’s already stuffed pockets. Gorsky pulled down $29.6 million in 2020. He’s now refusing to comment on that windfall and J&J’s litigation. Activist investors, meanwhile, want the company to review its pay practices. Any success J&J may have had on a Covid-19 vaccine, says Illinois state treasurer Michael Frerichs, should not insulate J&J execs from “costs and failures that happened under their watch.” |

|

| |

|

| BOLD SOLUTIONS |

|

| Fund Home Care, Not For-Profit Nursing Homes |

| By 2050, the number of people in the United States needing long-term care will double to over 27 million. Many families would prefer that their loved ones receive the quality long-term care they need at home but find themselves forced to rely on dangerous, for-profit nursing homes owned by private equity firms. Long-term care infrastructure needs permanent investment just as much as the nation’s physical infrastructure. President Biden’s recently unveiled infrastructure plan would earmark $400 billion to expand access to quality, affordable home-based care for aging and disabled Americans, while also ensuring care workers are paid their worth. Inequality.org managing editor Rebekah Entralgo has more. |

|

| |

|

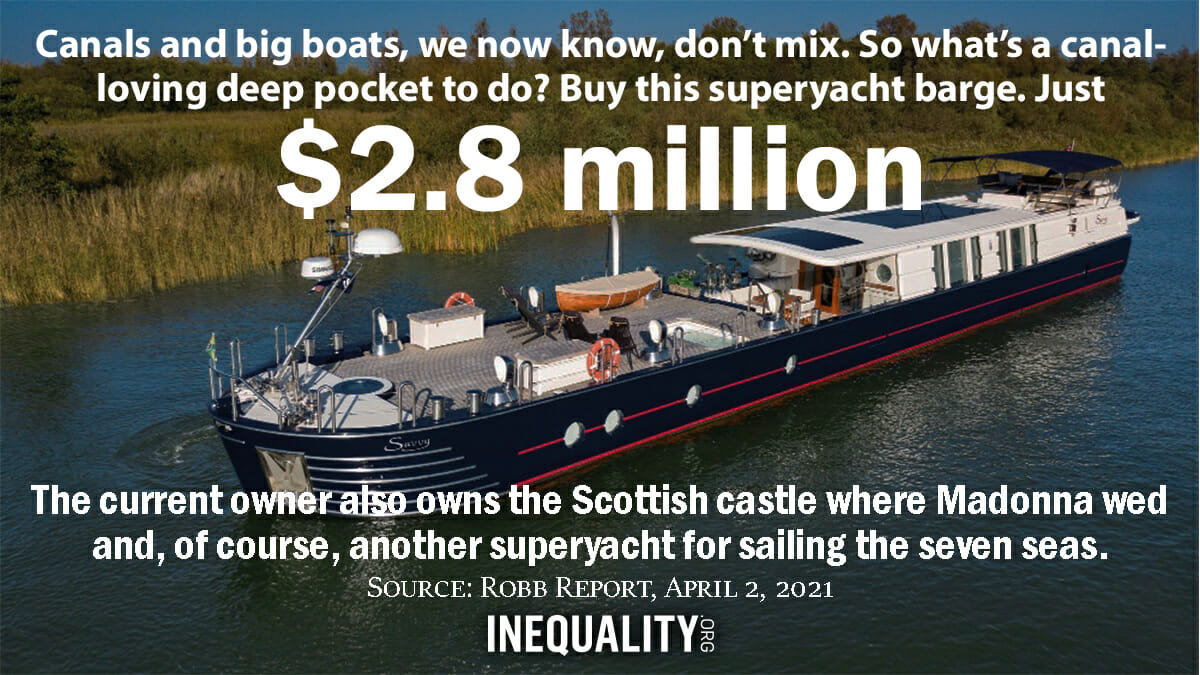

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| A Manchester United for a More Equal Metropolis |

| Have the last twelve months, a year packed with pandemic stress and racial reckoning, fundamentally changed everything? Or are we already reverting back to life as deeply unequal normal? All the early indicators are pointing to reversion — and worse. Our richest haven’t just survived the last year. They’ve absolutely thrived. Over the course of the pandemic’s first year, the wealth of the world’s 2,365 billionaires has soared by an astounding $4 trillion. This explosion of wealth has come at the same time as the world’s economy was shrinking and leaving millions in misery. The pessimists among us, in short, have ample reason to fear for our future. The rest of us? We now have Manchester, a British urban center that has just delivered an amazing gameplan for building equality from the local level up. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Carl Davis, Meg Wiehe, and Misha Hill, Sales Taxes Widen the Racial Wealth Divide. States and Cities Have Far Better Options. Local wealth taxes and income taxes on corporations and the rich would advance racial equity.

Chuck Collins and Omar Ocampo, Global Billionaire Wealth Surges $4 Trillion Over Pandemic. The cost of vaccinating the world: $141.2 billion. Billionaire wealth has jumped by trillions since the pandemic hit. Let’s tax it.

Bob Lord, STEP Act: The Critical First Blow to Millionaire Income Tax Avoidance. New legislation would put an end to an income tax windfall for millionaires and their descendants.

Elsewhere on the Web

Chuck Collins, Raising this tax would make the ultra-rich pay their fair share, CNN. How we can address the underlying inequality that’s let the wealth of the wealthy skyrocket as the rest of the country suffers.

Martin Levine, Federal Bill to Limit CEO Pay Marks One Step toward Fairness and Equity, Nonprofit Quarterly. The legislation aims to disincentivize management practices that prioritize short-term stock value — and CEO earnings — over long-term investments and worker pay.

Rupert Neate, ‘Raise my taxes – now!’: the millionaires who want to give it all away, Guardian. With Covid widening the inequality gap, a global league of super rich is urging governments to take their money.

Anand Giridharadas, The trillion-dollar woman, The.Ink. Do we need to tax the rich because we need dollars to pay for social programs? Or do we need to tax the rich because their wealth and power threaten democracy? Economist Stephanie Kelton’s compelling perspective.

Chris Dillow, Complicated Motives, Stumbling and Mumbling. Does ever more money motivate execs to perform wonders? A reflection on the evidence about money as a motivator.

Dean Baker, New York Times Does Public Relations Work for the Pharmaceutical Industry, Center for Economic and Policy Research. Big Pharma has manufactured vaccines and billionaires over the past year. Our taxes subsidized the vaccines and the vaccines have helped us. The billionaires haven't.

Brock Colyar, Meet the Teen Who Hates 432 Park More Than Anyone, Curbed. The only thing socially redeeming about billionaire luxury towers: We get to enjoy the responses to plutocratic greed from the likes of this Canadian teen.

Theodore Schleifer, Why we can’t stop talking about billionaires, Recode. With billionaires giving away more money in a single year than any previous person and still ending the year richer than the year before, we can't help but raise questions about the system that produces these billionaires.

Paul Buchheit, The Boundless Advantages of the Welfare State — for the Rich, Common Dreams. Wealthy Americans benefit from a wide array of tax breaks and government subsidies hidden behind a constant blather attacking entitlements for the poor.

Mike Savage and Nora Waitkus, Property, wealth, and social change: Piketty as a social science engineer, British Journal of Sociology. How economist Thomas Piketty's inequality analysis has sidestepped siloed disciplinary debates on everything from the meaning of modernity to the rise of capitalism.

Jonathan Chait, For Republicans, the Time Is Never Quite Right to Tax the Rich, New York. The American right rejects higher taxes under any conditions, especially when those taxes fall disproportionately on the rich. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|