| THIS WEEK |

Did you watch last night’s Super Bowl? Did you thrill to the on-the-field heroics? Did you wonder how much the winning Tampa Bay players took home? Their victory bonus: checks for $150,000. But none of the biggest winners from Super Bowl LV actually wear shoulder pads. The biggest winners own the teams, as we detailed last week in our latest report, Pandemic Super Bowl 2021: Billionaires Win, We Lose.

Just one example: The Hunt family that owns the Kansas City Chiefs has seen its fortune jump $482 million since the pandemic shut down normal life. The Hunts, let’s not forget, don’t just owe a chunk of their fortune to their players. They owe their fans, too. Their franchise has pocketed $250 million in taxpayer subsidies for stadium renovations alone.

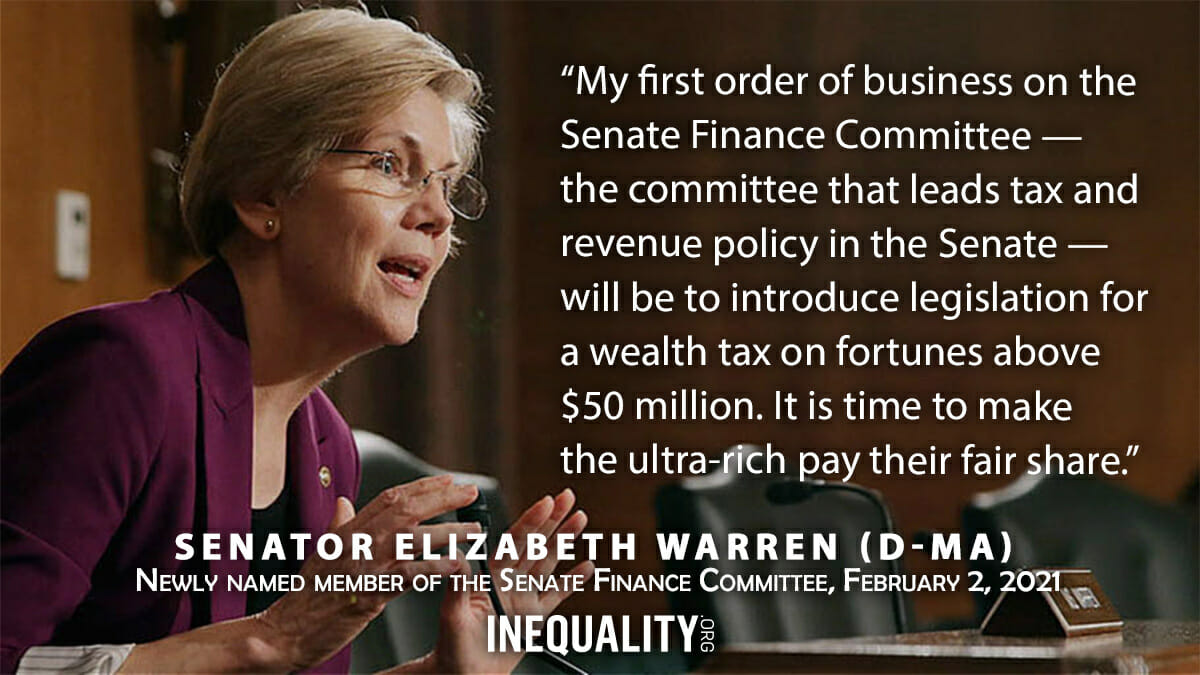

What can we do to create a nation where billionaires don’t do all the big winning? We can, for starters, tax grand private fortunes. Last week we testified in support of legislation now before lawmakers in Washington State that would do just that. More in this week’s issue on that legislation and the real source of Washington State’s biggest billionaire fortune.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team |

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Tipped Wages and Justice for Black Workers |

| President Biden’s Covid relief proposal would lift the wage floor for all U.S. workers and give a particularly long overdue raise to millions of restaurant servers and others who rely on tips. For three decades, the federal minimum wage for tipped workers has been stuck at $2.13. For Tanya Wallace-Gobern, executive director of the National Black Worker Center Project, this subminimum wage remains a shameful relic of slavery. Racial justice demands an end to subminimums. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| Forgive Student Debt? This CEO Would Rather Not |

| Financiers have been making big bucks off student loans ever since the 1980s, even after the Obama 2010 federal student loan makeover. That reform left private firms like Navient with contracts to service student loans, and the Consumer Financial Protection Bureau later found that Navient was steering troubled borrowers into plans that “racked up interest charges.” Federal officials, Navient CEO Jack Remondi has contended, are making a “completely false” claim. One narrative no one disputes: Remondi has personally been raking in ample rewards, with annual pay averaging just under $7 million the past four years. His future prospects? The drive for student debt cancellation has Navient a bit unsettled. A “broad-based loan forgiveness program,” Remondi acknowledged last month, would “obviously” have an “impact” on his company’s earnings. His latest headache: The U.S. Department of Education has now ordered Navient to refund $22.3 million in overcharges. |

|

| |

|

| BOLD SOLUTIONS |

|

| A Move to Tax Extreme Wealth at the State Level |

| Legislators in Washington State are taking bold steps towards instituting a state-level wealth tax. They’ve proposed a 1 percent levy on wealth over $1 billion, a tax that would apply to fewer than 100 households in the state and raise an estimated $2.25 billion in 2023 — and $2.5 billion more in 2024. Washington State, noted House Finance Committee chair Noel Frame at a hearing on the wealth tax proposal last week, needs a new “tool in the toolbox for comprehensive structural tax reform.” Washington’s current tax code ranks as one of the country’s most regressive. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| The Unintentional Honesty of Amazon’s Jeff Bezos |

| Kudos to Jeff Bezos for recognizing — in the noble words that last week announced his departure as Amazon’s CEO — the enormous contributions that the company’s employees have made over the past 27 years. But hisses and boos for his abject failure, over those same 27 years, to recognize those contributions in actual deed. Amazon’s employees should have been sharing in the company’s success all along. The rewards, instead, have flowed overwhelmingly to Bezos himself. His current net worth: nearly $200 billion. In his farewell email to staff, Bezos claims that Amazon deserves praise for upping its minimum pay to $15 an hour. What the letter doesn’t point out: At $15 an hour, an Amazon worker would have to labor over 32,000 years to earn even a single billion. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Daiva Repečkaitė, What's a Bigger Issue: Financial Speculation Over Video Games — or Over Water?. Stock market trading in water futures has become the latest battleground in the struggle over the right to water.

Chuck Collins and Omar Ocampo, Pandemic Super Bowl 2021: Billionaires Win, We Lose. Even in a pandemic, 64 billionaires have seen incredible gains from the major league sports teams they own.

Elsewhere on the Web

Alex Press, The Alabama Town That Could Defeat Jeff Bezos, New Republic. An unionization effort is offering hope for the fightback against Amazon greed.

Dylan Grundman O’Neill, States Are Finally Going Bold with Progressive Tax Efforts, JustTaxes. A look at encouraging tax-the-rich initiatives now underway in nine states.

Mariana Mazzucato, From moonshots to earthshots, Social Europe. The pandemic has created a huge opportunity for a mission-driven governance that prevents the few from benefiting at the expense of the many.

David Sirota and Andrew Perez, The Washington Post Deserves 324 Billion Pinocchios for Its Attacks on Bernie Sanders, Jacobin. The Vermont senator had the temerity of noting that the 2017 tax cut overwhelmingly benefits the wealthy, an inconvenient fact that the Post’s chief “fact checker” tried to explain away.

Alexis Goldstein, Biden’s Covid Relief Plan Could Help End the GameStop Frenzy, New York Times. Speculation only thrives when inequality runs high.

Amber Petrovich, Why we cannot and will not stop with GameStop, Washington Post. The case for using the collective power of retail investors for social good.

Dean Baker, The GameStop Game and Financial Transactions Taxes, Center for Economic and Policy Research. If we tax gambling on horses, why shouldn't we tax gambling on stocks?

Gene Marks, Entrepreneurs are great, but it’s mom and dad who gave them their start, Guardian. Our self-made billionaires turn out to be anything but.

Richard Wolff, US Economy Excels at One Thing: Producing Massive Inequality, NewsClick. Bitterness, resentment, and anger flow from our persistently widening gap between haves and have-nots.

Joe Gill, After Trump, coronavirus could deliver the final blow to neoliberalism, Middle East Eye. The greater the shock to the system, the easier it becomes to reduce privilege at the top. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|