| THIS WEEK |

Quite a week we’ve had. First came the uproar over Donald Trump’s taxes, then the tumult of the Trump-Biden debate, followed by the biggest bombshell of all: the president’s positive Covid test. His infection, pundits quickly opined, shows the pandemic plays no favorites. The coronavirus has become, this conventional wisdom holds, “the great equalizer.”

Nonsense. The pandemic hasn’t “equalized” anything. The pandemic has left us more unequal, as we detail in a set of 13 charts now getting wide play nationally. U.S. billionaire wealth soared $821 billion in the six months after Covid-19 burst out big-time. And at the other end of the spectrum? New Washington Post data paint a grisly picture: Since March, “the less workers earned at their job, the more likely they were to lose it.”

Amid all this past week’s blockbusters, hardly anyone paid much attention to the release of a report that, in normal times, makes major news: the latest edition of the Federal Reserve’s triennial Survey of Consumer Finances. One analyst’s take on the new Fed numbers: Millionaires and billionaires last year held 79 percent of U.S. wealth, up from 60 percent in 1989. By 2050, at this pace, our richest will hold nearly 99 percent of our nation’s wealth. If we let that happen, we won’t have much of a nation.

Chuck Collins, for the Institute for Policy Studies Inequality.org team |

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| An Army of Doctors for Everyone, Not Just Trump! |

| Trump’s VIP medical treatment may be the ultimate illustration of the extreme inequities that run throughout our health care system. For the president, Chris Christie, and other elite players who flout Covid-19 precautions, the government spares no expense. Meanwhile, low-wage essential workers who take risks day in and day out, by the nature of the jobs they do, have to struggle to get even basic testing and treatment. Poor people who’ve had enough of this apartheid system have formed a new Nonviolent Medicaid Army. This past week, in eight states, activists in this new army marched to demand the universal right to health care. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A CEO Awfully ‘Conscious’ of His Own Well-Being |

| What does America need? The answer Whole Foods founder and CEO John Mackey gave last month hawking his new book, Conscious Leadership: “We need justice, and we also need freedom.” What don’t we need? A $15 minimum wage. Mackey, a self-described proponent of “conscious capitalism,” opposes a national wage floor as well as government involvement in providing health care or any other service “that a business can make money doing.” Three years ago, Mackey also opposed the Jana Partners hedge fund when the “greedy bastards” — Mackey’s phrasing — bought a stake in Whole Foods and insisted on changes designed to make the grocery chain “more profitable.” But then Mackey proceeded to profiteer. He sold Whole Foods to Amazon for $13.4 billion, a move that brought Jana a tidy $300 million windfall. What exactly does Mackey’s “conscious leadership” entail? Apparently not listening to workers at Whole Foods suppliers facing wage theft and unsafe workplaces. This past January, Whole Foods denied workers in North Carolina’s sweet potato fields “the dignity of a formal meeting.” |

|

| |

|

| BOLD SOLUTIONS |

|

| San Franciscans to Vote on CEO Pay Tax |

| On November 3, San Francisco voters will have a chance to crack down on one of the key drivers of inequality: the extreme pay gaps between CEOs and their workers. Proposition L would increase tax rates on local business revenue, ranging from an additional 0.1 percent on corporations that pay their CEO more than 100 times their typical San Francisco worker pay to 0.6 percent for companies with pay ratios of 600 to 1 or more. The measure would be a twofer. It would encourage companies to narrow their pay gaps while generating an estimated $60 million to $140 million per year for social programs. Inequality.org co-editor and CEO pay expert Sarah Anderson spoke at length about the ballot measure for the San Francisco Public Press “Civic” podcast. |

|

| |

|

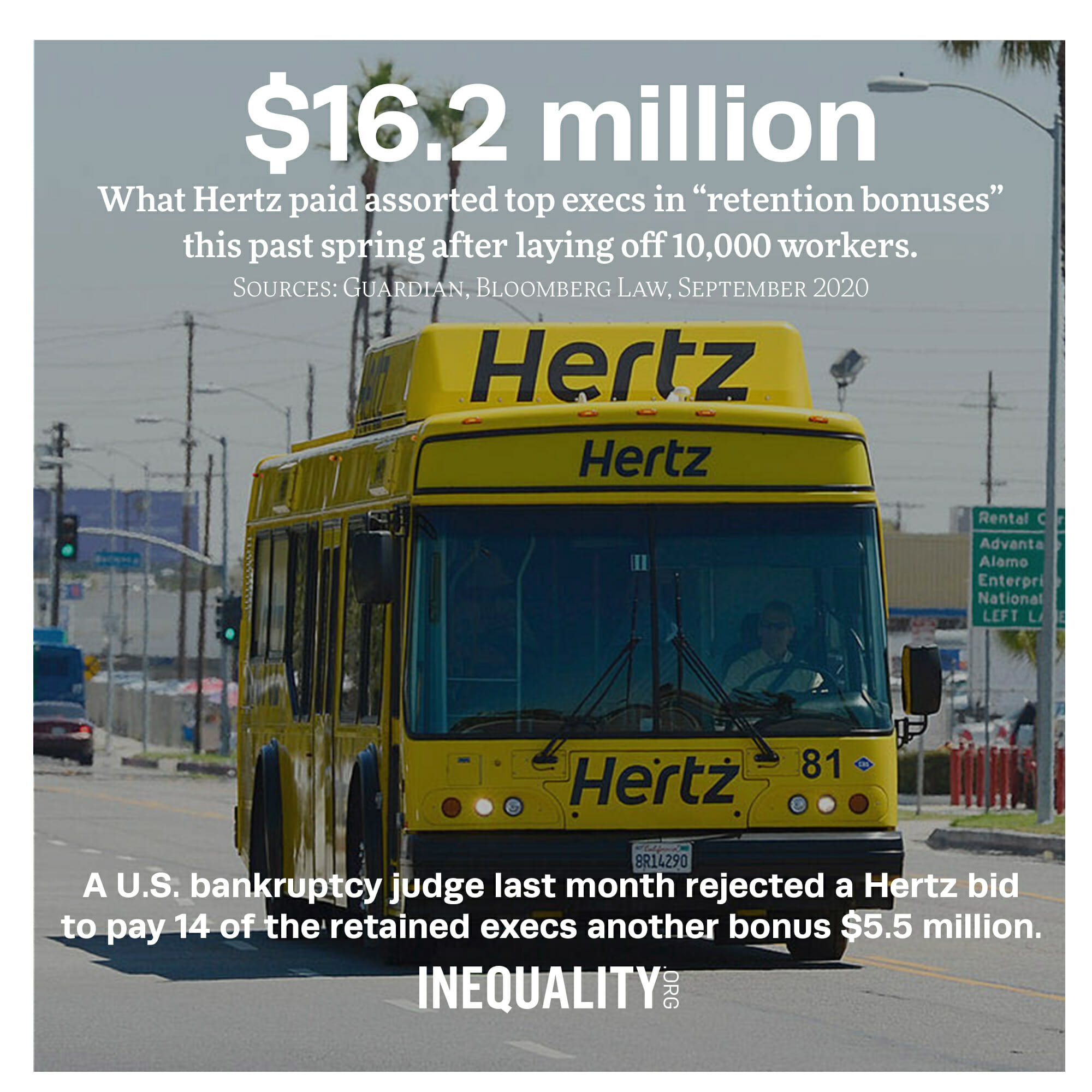

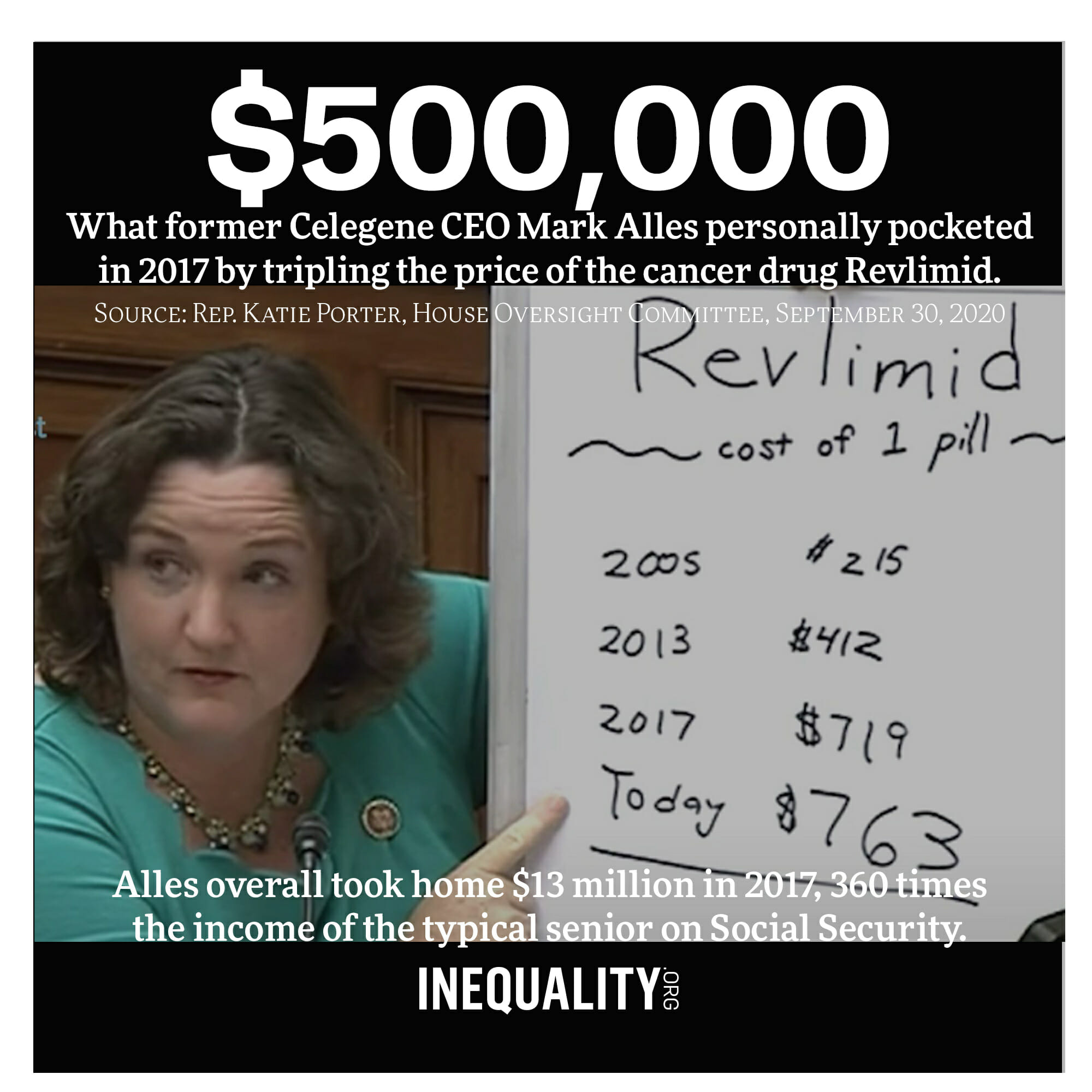

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Ivanka Trump as a Consultant for a Pizza Parlor? |

| The warmest and fuzziest phrase in the political folklore of American capitalism? “Family-owned business”! These few words evoke everything people like and admire about the U.S. economy. The always welcoming luncheonette. The barbershop where you can still get a haircut for less than $20. The corner candystore. But “family-owned businesses” have a dark side, too, as we can see all too clearly in the Trump Organization, an empire of enterprises owned by one Donald Trump. We now know — thanks to last week’s landmark New York Times exposé on Trump’s taxes — far more about this sordid empire than ever before. But the exposé’s complicated details tell the simplest of stories: how great wealth lets wealthy families get away with greed grabs that would shove families of mere modest means into the deepest of hot water. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Omar Ocampo, Vacant Housing. A new report addresses housing shortages and vacancies in Los Angeles.

Phyllis Bennis, Defense Industry CEOs Are Getting Even Richer off Funds That Were Supposed to Go for PPE. The Trump administration took $1 billion in stimulus money that was supposed to go towards making masks and other protective equipment for the pandemic — and gave most of that cash to weapons manufacturers.

Chuck Collins, The Worst Part of Trump Paying Zero Taxes? It’s Probably Entirely Legal. The tax code has one set of rules for the super rich and another for everyone else. A cottage industry exists to help our rich avoid their fair tax share.

Derek Robey, The New Physics of Inequality: Compounding Advantage for the Rich and Accelerating Disadvantage for the Bottom 60 Percent. Researchers are examining how inequality is becoming more durable and intractable.

Sarah Anderson, For Laid-off Workers, Trump's Lies About Trade and Jobs Are Hard to Swallow. We need a fresh approach to trade that lifts up workers everywhere — not the CEOs who pit workers and communities against each other for their own personal gain.

Andrew Park, Fed Bailout Allows Private Equity Pirates to Loot $10 Billion From Companies They Own. Wall Street executives are taking advantage of the pandemic to enrich themselves while plundering companies in their portfolios and putting worker jobs at greater risk.

Elsewhere on the Web

Edgar Villanueva and Chuck Collins, It’s time for wealthy donors to embrace reparations, not more charity, MarketWatch. A powerful next step any philanthropic institution can take would be to transfer 10 percent of its assets to a trust fund led by indigenous and Black Americans.

Morris Pearl, Our tax system, not Trump, is the scandal. It's designed to help rich people avoid taxes, USA Today. The top rate for long-term capital gains is just 20 percent, meaning a billionaire making millions of dollars a year from his investments will end up with a lower top tax rate than someone working for a salary of just $41,000.

Lynn Parramore, How Corruption is Becoming America’s Operating System, Institute for New Economic Thinking. In the original Gilded Age and in ours today, the wealthy have seized the main levers of power and bent them to their own objectives.

Martyn Rawlinson, One trillion reasons for a windfall tax, Morning Star. A call for a windfall tax that would transfer one-third of UK top 1 percent wealth into a self-sustaining community wealth fund.

Amy Hanauer, It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up, JustTaxes. Trump-like tax avoidance leaves the public sector underfunded.

Lola Butcher, America the Unhealthy: Inequality kills, Knowable. Smoking, poor diet, lack of exercise? Yes, but that’s not all. A researcher tells us what really hurts U.S. life expectancy.

Nick Rizzo, A tale of two billionaires, Brooklyn Paper. Two billionaires are spending tons of dollars to avenge personal vendettas -- and distort New York state politics.

Miles Kampf-Lassin, Abraham Lincoln Taxed the Rich. This Election Day, Illinois Can, Too, Jacobin. On Election Day, the state can follow the example of Abraham Lincoln and finally establish a progressive state income tax.

Seth Hanlon, Andres Vinelli, and Christian Weller, Repealing the ACA Would Put Millions at Risk While Giving Big Tax Cuts to the Very Wealthy, Center for American Progress. If the Affordable Care Act were to be repealed, as Donald Trump so desperately desires, the richest 100 U.S. billionaires would pocket a total 2020 tax cut of $12.6 billion.

Kim Phillips-Fein, Is Amy Coney Barrett Joining a Supreme Court Built for the Wealthy? New York Times. The court’s future decisions could give corporations even more power and workers less, by blocking potential legislation that might mitigate the impact of unfettered capitalism and staggering inequality. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

|