| THIS WEEK |

Let’s start this week with an eye-popping factoid: Corporations shifted nearly $1 trillion in profits earned outside of their home countries to tax havens in 2019, a staggering hike from the $616 billion shifted in 2015.

These numbers come to us from a new study by world-renowned researchers Ludvig Wier and Gabriel Zucman on global corporate “profit shifting” from 2015 to 2019, years that saw major international efforts to prevent corporations from shifting profits to tax havens.

The world’s biggest multinationals, Wier and Zucman found, moved 37 percent of their profits to tax havens in 2019. In the 1970s, the two note, major corporations shifted under 2 percent of their earnings. These new findings clearly demonstrate that the revelations of massive corporate tax dodging that began with the release of the Panama Papers in 2016 haven’t been enough to change corporate behavior.

The new Wier-Zucman data also come at an opportune moment. The White House is releasing its latest budget plan this week. That budget will likely include a call for a 15 percent global corporate minimum tax.

Global corporate tax avoidance is making global corporate execs ever richer and playing a key role in deepening inequality. We need to end this abuse, once and for all, and make sure governments tax corporations where their workers operate and create value.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team |

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Broadband Expansion Should Support Good Jobs |

“More and more of my job has become cleaning up the messes of untrained, low-wage contractors,” notes Texas-based broadband technician Britni Cuington, a Communications Workers of America member.

That reality should concern us all. Fiber lines often sit near gas, sewage, and electrical lines. If installation contractors make mistakes, the consequences can be catastrophic.

“Skilled union workers like me are often called in,” explains Cuington. “We get the brunt of customers’ frustration while we’re left with double the work — often at risk of injury, or even death.”

Meanwhile, Cuington points out, telecom companies are funneling short-term savings from subcontracting into the pockets of their CEOs. The solution? Cuington and her union have ideas on how we can use new federal broadband funding to support good jobs and telecom safety.

|

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

| BOLD SOLUTIONS |

|

| Let’s Stop Throwing Money at Pentagon Contractors |

The United States has by far the world’s largest military budget and — not coincidentally — the world’s highest-paid military contractor CEOs.

What could we do instead with all those budget dollars? The National Priorities Project at the Institute for Policy Studies is once again this year showcasing data on the tradeoffs between military spending and public investments in human needs.

National Priorities Project calculations show that the $100 billion increase in the military budget since 2018 could cover the cost of free tuition for two-thirds of all U.S. public college students, hire a million elementary school teachers, or triple Head Start enrollment.

“We shouldn’t be adding billions upon billions of tax dollars to enrich Pentagon contractors at a time when real people are struggling,” writes National Priorities Project director Lindsay Koshgarian. Read on for more of her analysis and a link to her team’s online tradeoff calculator. |

|

| |

|

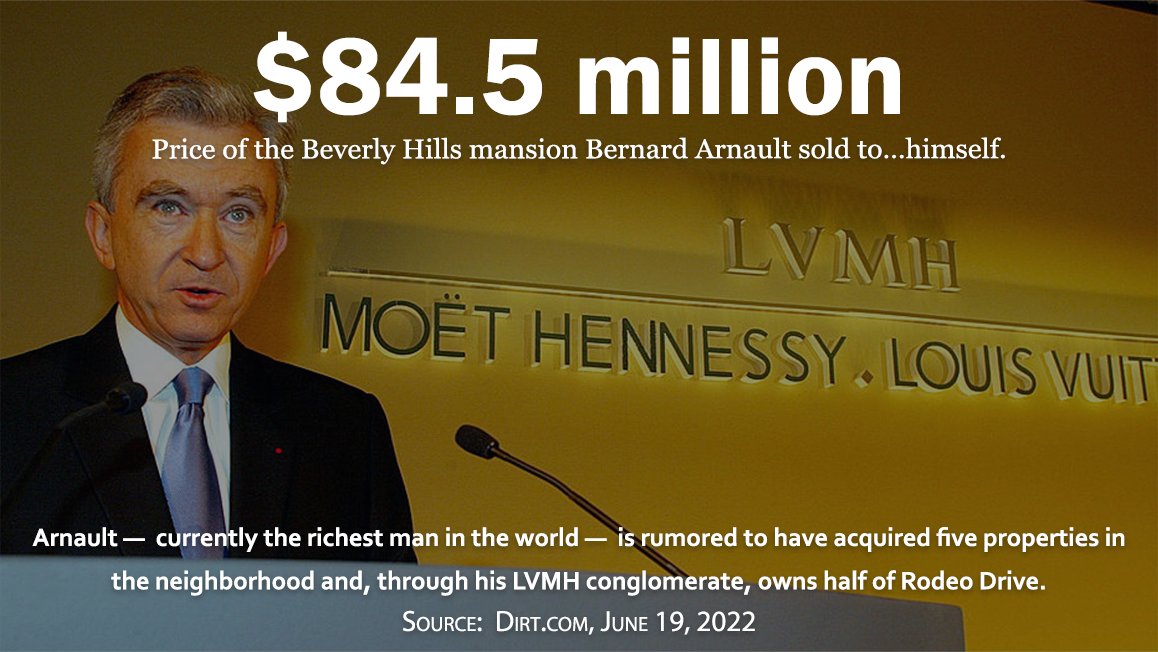

| GREED AT A GLANCE |

|

|

|

|

| |

|

| MUST READS |

|

What's on Inequality.org

Bob Lord, Workers, Machines, and ‘Bonus Depreciation.’ Should our tax system be discouraging automation or leveling the tax playing field between workers and machines?

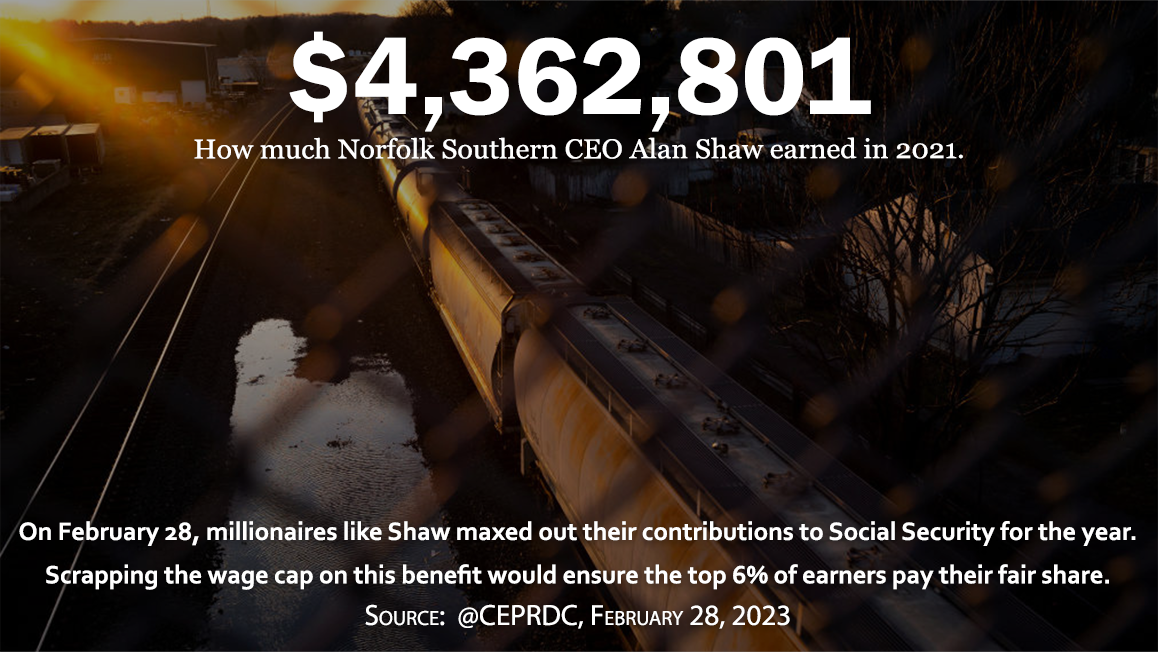

Linda Benesch, Inequality is Weakening Social Security. Here’s How We Fix That. Congress in 1983 set a cap on Social Security contributions. Those lawmakers didn’t anticipate forty years of rising inequality.

Jacob Horwitz, Garment Workers Take on Wage Theft and Wall Street. A new international campaign is targeting fashion brands like Nike that are spending vast sums on stock buybacks instead of compensating workers for lost pandemic wages.

Owen Tudor, Ukraine’s Trade Unions Are Playing a Critical Role in the War Effort – And Will Be Central to a Just Peace. Social justice, including the full respect of fundamental workers’ rights, must be the basis for Ukraine’s future.

Elsewhere on the Web

Alejandro Lazo, Silicon Valley’s Vast Wealth Disparity Deepens as Poverty Increased, Oakland Post.

Just eight households in Silicon Valley hold more wealth than the nearly half-million households in the region’s bottom 50 percent, finds a new analysis from the Silicon Valley Institute for Regional Studies.

Ludvig Wier and Gabriel Zucman, Corporations are laughing at the idea of paying taxes as nearly $1 trillion goes offshore every year, Fortune. Corporations shifted nearly $1 trillion in profits earned outside of their home countries to tax havens in 2019, the latest year with data available, up from $616 billion in 2015.

Branko Marcetic, As Rail Executives Grow Richer, Train Derailments Have Become Commonplace, Jacobin. The number of derailments in Japan over the past 21 years roughly equals one-eighth of the number of derailments the far more unequal United States experiences on average in a single year.

Carl Davis, Ohioans, beware the flat tax. It’s just another tax cut for the rich, Cleveland Plain Dealer. Ohio lawmakers are considering a flat tax that would deliver the state’s wealthiest 1 percent an average tax cut of $11,166. Ohioans in the middle 20 percent would receive a cut of just $24.

Sarah Thomas, My Surreal Years Tutoring the Children of the Super-Rich, British Vogue. A fascinating look at life tutoring the kids of billionaires who had made their money from sweatshops, authoritarian regimes, and tech companies with profits hidden safely offshore.

Kreg Steven Brown, Examining the history of the U.S. racial wealth divide shows stagnating progress on closing these disparities, Washington Center for Equitable Growth. New research highlights historical data that compares black and white wealth at a national scale.

Alejandro de la Garza, Why Billionaires are Obsessed With Blocking Out the Sun, Time. The ultra-rich “good guys” are busy pushing weather-altering schemes they say will save civilization. But their “solar geoengineering” could distract attention from addressing carbon emissions from burning fossil fuels.

Sarita Santoshini, Boom and bust: How Indian billionaire’s rise left the nation vulnerable, Christian Science Monitor. The growing scandals around Indian billionaire Gautam Adani raise questions about India’s political growth model, with the billionaire’s “success” directly linked to the government’s mass privatization drive.

Fran Boait, Big banks are raking in billions, and we all pay the price – time for a new windfall tax, Guardian. Rises in interest rates are driving unemployment, low wages, and poverty while the banks make record profits and hand out huge bonuses.

|

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2023: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|