| THIS WEEK |

Our team has been in the middle of a media frenzy this past week, doing interviews with dozens of outlets ranging from the New York Times and Fortune to CNN and ABC News. Why all the media interest? The release of our latest annual Executive Excess report on corporate CEO pay.

Our 28th Executive Excess edition has clearly struck a nerve. With profits way up in 2021, corporations had an opportunity last year to make a big leap towards greater pay equity. They could have given their workers a fair reward for their heroic efforts during the pandemic. Instead, Corporate America continued to fixate on pumping up CEO pay.

One of our most shocking findings: Two-thirds of U.S. low-wage firms that cut worker pay last year spent tens of billions inflating CEO pay via stock buybacks. At Lowe’s, the millions blown on this stock manipulation maneuver would have been enough to give every one of their 325,000 workers a $40,000 raise! Instead, median pay at Lowe’s last year fell 7.6 percent to $22,697 while the CEO pocketed $18 million.

The good news in all this: President Biden has the power to crack down on runaway CEO pay, without waiting for Congress to act. Read more about what he — and you — can do below. Thanks!

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Florida Family Fights for Stronger Home Care Policy |

Alison Holmes, a mother and member of the Florida Voices for Health coalition, has been her son’s primary caretaker. JJ has cerebral palsy. He can’t speak or use his arms and legs and has to type with his nose to communicate. An advocate himself, JJ knows how better policy could help — and how politicians have abdicated their responsibility to act.

JJ’s mom Alison, trapped in Florida’s Medicaid coverage gap, has waited 15 years and counting for in-home health care assistance. Now, with her own chronic pain flaring, she’s “worried sick” about her future ability to provide for JJ — and for the countless other families in their position.

With home care costs far out of reach for average families, private equity vultures cashing in on our aging population, and fewer people entering the low-wage care workforce, our current care economy works for no one except the wealthy and well-connected. Sums up Alison:

“Most of us will need some kind of long-term care to stay independent in our own homes.”

We need lawmakers to invest in home care now. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| This Chief Prefers His Own Benefits 'Quantifiable' |

| The worst place in the United States to work? Can’t be Dollar General, the discount retail chain — at least not for CEO Todd Vasoa. He’s making, at last count, $16.5 million a year. But for workers, on the other hand, Dollar General ranks as a top competitor for national worst-place-to-work dishonors. Those workers face, charges U.S. senator Patty Murray, “shameful labor practices” that include “low wages, insufficient benefits, and unsafe working conditions.” Workers average $9.68 an hour, the lowest rate in its retail class, and the typical Dollar General staffer made only $16,688 in 2020, some 986 times less than what CEO Vasoa took home. How does Vasao defend those numbers? He has his PR people explaining that Dollar General’s CEO-worker pay ratio doesn’t include the “non-quantifiable benefits” employees and their families receive. Those “benefits,” More Perfect Union has found, “appear to be limited to free classes for workers and their families at two for-profit universities.” |

|

| |

|

| BOLD SOLUTIONS |

|

| Biden Has the Power to Crack Down on CEO Excess |

In a recent poll, 87 percent of Americans called the growing gap between CEO and worker pay a problem for the nation. And yet we’re all enabling these obscene divides through the billions of dollars in taxpayer-funded contracts that flow every year to companies with extreme pay gaps.

Of the 300 low-wage companies examined in our new Institute for Policy Studies Executive Excess report, 40 percent have received federal contracts worth a combined $37 billion over recent years. The average CEO-worker pay ratio at these contractors hit 571-to-1 in 2021.

President Biden could crack down on such extreme disparities by introducing new standards making it hard for companies with huge CEO-worker pay gaps to land lucrative federal contracts. Taking this step would have a huge impact, since federal contractors employ an estimated 25 percent of U.S. private sector workers.

President Biden has already ordered contractors to pay at least $15 per hour. Now he needs to incentivize contractors to narrow their pay divides. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| The ‘Secret’ That Gets Today’s CEOs Really Rich |

| Management theorists today generally give Peter Drucker, a refugee from Nazism in the 1930s, the credit for laying down “the foundations of management as a scientific discipline” right after World War II. Drucker went on to become the nation’s top authority on enterprise effectiveness. That effectiveness, he believed, had to rest on fairness. Firms that compensate top execs at rates that far outpace worker pay create cultures where organizational excellence never has a chance. Drucker lived long enough — he died in 2005 at age 95 — to see Corporate America make a mockery of his teachings. How much of a mockery? The just-released latest annual edition of Executive Excess from the Institute for Policy Studies has a vivid answer. Inequality.org’s Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

What's on Inequality.org

Chuck Collins and Omar Ocampo, Bay State Billionaires Reap Wealth Gains of 46 Percent During Pandemic. This report examines the growing wealth of billionaires and other ultra-high net worth individuals in Massachusetts, where voters this November will have the chance to levy a 4 percent surtax on those making more than $1 million a year.

DaMareo Cooper, The Federal Reserve Has Had a Diversity Crisis Long Enough. Federal Reserve leaders should be representative of the country’s population. If they don’t understand us, they can’t represent us.

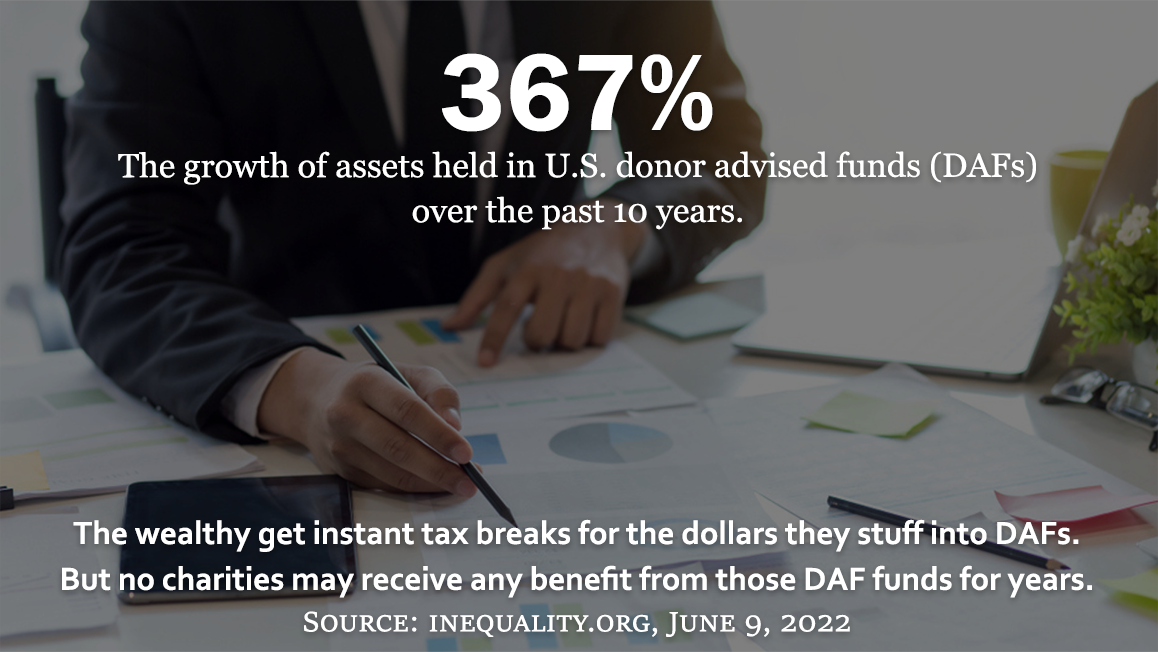

Chuck Collins and Helen Flannery, Visualize This: Donor-Advised Funds As Largest Recipients of Charitable Gifts. Watch this stunning time lapse illustration of the rise of DAFs as the largest recipients of charitable gifts.

Sarah Anderson, Low-Wage Employers Spent Billions Inflating CEO Pay Through Stock Buybacks. President Biden has the power to crack down on executive excess by imposing new CEO pay and buyback restrictions on federal contractors.

Elsewhere on the Web

Juliana Kaplan and Madison Hoff, The lowest-paid workers saw their CEOs make 670 times their salaries last year — all while inflation cancelled out their raises, Business Insider. At 49 of the 300 companies a new Institute for Policy Studies report examines, the CEO-to-worker pay ratio is running over 1,000-to-1.

Arwa Mahdawi, What are Bill Gates and Elon Musk feuding about this time? Who is better at saving the world, Guardian. Sitting on mountains of cash doesn’t appear enough to keep these billionaires happy. They want to be worshipped for their benevolence, too.

Peter Weber, Is a single man largely responsible for America's wealth gap? The Week. How Jack Welch helped create the America of Donald Trump, Jeff Bezos, and Elon Musk.

Pat Kreitlow, Wisconsin Billionaires Who Got a Monster Tax Break From Ron Johnson Are Now Spending Millions to Get Him Re-Elected, Up North News. A classic tale that vividly illustrates how our contemporary plutocracy operates politically.

Abe Asher, San Francisco Elites Scapegoated Chesa Boudin for the City’s Problems. It Worked, Jacobin. A billionaire-funded recall pinned San Francisco’s problems on progressive district attorney Chesa Boudin. That recall succeeded, but the city’s problems aren’t going anywhere as long as inequality remains.

Nik Popli, Why Investors Are Pushing Back on Massive CEO Pay Hikes, Time. Shareholder support for executive bonuses stands at its lowest level “since these so-called say-on-pay votes became mandatory in 2011.”

Pam Martens and Russ Martens, The Money Trail to the January 6 Attack on the Capitol Is Ignored in Last Night’s Public Hearing, Wall Street on Parade. To understand who would have benefited most from installing Donald Trump for a second term, follow the money trail that leads to the billionaire behind one of the world’s largest private corporations.

Tim Cowlishaw, Professional golfers are setting the new standard for greed in a sports world gone mad, Dallas Morning News. Time to remake 1987’s Wall Street because the whole “greed is good, greed is right” speech feels so much in touch with today’s times. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2022: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|