| THIS WEEK |

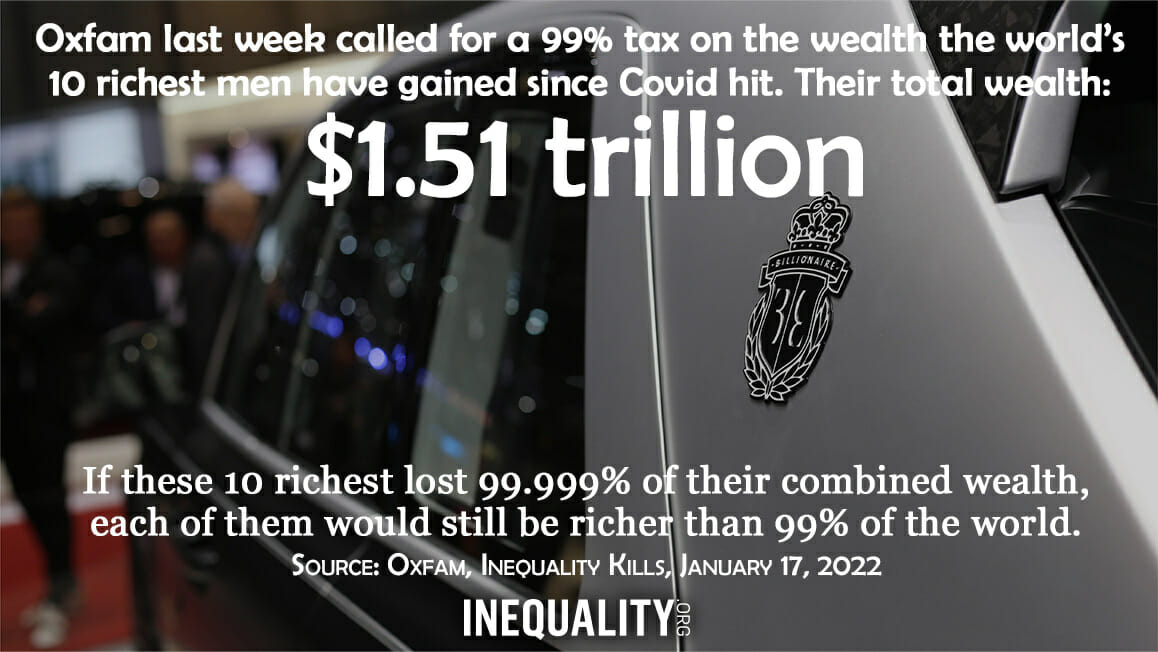

We write a lot about billionaires and their wealth here at Inequality.org. But what about the rest of our global ultra-high net worth class? Over 183,000 people worldwide now hold fortunes worth over $50 million. Their combined wealth: $36.4 trillion.

Those trillions lie at the heart of our latest bombshell report, a study conducted with our partners at Oxfam, Patriotic Millionaires, and the Fight Inequality Alliance. Even a relatively modest tax on the world’s richest, our new research finds, would raise $2.52 trillion a year. That revenue would be enough to lift 2.3 billion people out of poverty, make enough vaccines for the whole world, and deliver universal health care and social protection for all the citizens of low- and lower middle-income countries.

All this may seem like pure utopian thinking. We don’t, after all, currently have a central global tax authority that could enforce a worldwide tax on wealth. But nations have reached global tax accords before, and they have steps they can take to curb wealth hoarding and tax dodging. Our job? We need to beat the drum for those steps and start building a global economy that works for us all, not just the wealthiest among us.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| The Workers Who Aren’t Giving Up on the BBB |

| You may not have heard, so far in the new year, much about any new developments on President Biden’s Build Back Better agenda. But the advocacy for that agenda continues. Last Wednesday, over 35,000 care workers joined a telephone town hall to keep up the pressure. Care workers, a workforce disproportionately non-white and female, make an average hourly wage of just $17, as we detail on our Inequality.org fact page on inequality and the care economy. The investments in care that Build Back Better would provide, notes one care worker, would “create the most racially diverse middle class this country has ever seen.” Inequality.org managing editor Rebekah Entralgo has more. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| This CEO Wants ‘Sustainability’ — for His Paycheck |

| Corporations listen when Larry Fink talks. The reason: Fink runs the world’s largest financial asset manager. His BlackRock empire is currently handling over $10 trillion in assets for investors ranging from giant pension funds to households eager to park a few spare dollars in mutual funds. Fink likes to style himself an enlightened business leader who understands the climate crisis. But Fink — who pocketed $29.9 million in 2020 as BlackRock’s CEO — is facing stiff protests from climate change groups. They’re pointing out that BlackRock has become “the world’s largest investor in fossil fuels.” Last week, in his annual letter to corporate CEOs, Fink punched back, arguing that Blackrock “does not pursue divestment from oil and gas companies as a policy” because “divesting from entire sectors” won’t “get the world to net zero.” The reaction from the Sierra Club Fossil-Free Finance Campaign’s Ben Cushing: “not much to see here other than more hot air from a would-be climate leader.” |

|

| |

|

| BOLD SOLUTIONS |

|

| Taxing Extreme Global Wealth to Save Democracy |

| How much money could an annual wealth tax raise at the global level and in the United States? Our new Inequality.org report, Taxing Extreme Wealth, researched with the Fight Inequality Alliance, Oxfam International, and Patriotic Millionaires, provides new data on the ultra-wealthy, including wealth totals for households worth over $5 million and $50 million at the global level. We estimate that an annual wealth tax on these rich could raise $2.32 trillion each year, enough to vaccinate the world and invest significantly in robust public health systems. The added bonus: This tax would also save democracy from extreme concentrations of wealth and power. Inequality co-editor Chuck Collins has more. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Suppressing Votes, Cutting Rich People’s Taxes |

| State lawmakers are threatening democracy these days with much more than schemes for voter suppression. In one state after another, legislators are enacting tax cuts that pump more dollars into rich people’s pockets — and fix in place more plutocratic power over the political process. This rash of tax cutting has received precious little national attention, and — given our turbulent times — that shouldn’t surprise us. The ongoing tax cuts, after all, seem to involve mere dollars, not our national future as a democracy. But tax cuts for the rich and attacks on the integrity of our democracy go hand in hand. The same state legislatures that are pushing voter suppression are pushing “tax relief” for their state’s most affluent. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Ranen Miao and Philip Keisler, Why Student Body Presidents Are Calling on Biden to Eliminate Student Loan Debt. Over 110 student body presidents have penned a letter urging the Biden administration to take action on student loan forgiveness to address inequality.

Elsewhere on the Web

Luke Savage, A Worldwide Tax on Extreme Wealth Could Lift Billions Out of Poverty: An interview with Omar Ocampo and Chuck Collins, Jacobin. Global tax agreements, we need to remember, already have precedent in existing treaties.

Lynn Parramore, Fable of the Squirrels: New Research on Wealth Inequality Among Animals Sparks Debate on Human Economies, Institute for New Economic Thinking. Researchers have yet to identify a Squirrel Gilded Age with gold-encrusted pinecones and fluffy-tailed robber barons.

Furvah Shah, Millionaires urge governments to ‘tax us now’ as they admit current system is unfair, Independent. More than 102 of global super-rich admit “few if any of us can honestly say that we pay our fair share.”

Jennifer Morgan, Why is Greenpeace talking about taxing the super rich? Greenpeace. A small number of super rich individuals — and the corporations they make their profit from — are endangering the ability of our planet to sustain life in all its forms.

Maggie Mancini, Some of Penn's Wharton students think the average American earns more than $100,000, professor says, PhillyVoice. Another sign of the cluelessness of our elites and those about to enter their ranks. The actual average U.S. annual income in 2020 hit only $56,310.

Claire Armitstead, Root of the problem: the brutal creation of a billionaire’s pleasure garden, Guardian. A look at a “profoundly moving” new cinematic meditation on the power of the mega rich.

Aída Chávez, Members of Congress Shouldn’t Be Getting Rich from Trading Stocks, Nation. Last year, over a hundred members of Congress bought and sold nearly $290 million in stocks and beat the market. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2022: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|