| THIS WEEK |

We have a new update on billionaire wealth, some shocking new numbers on billionaire pandemic-time fortunes. You may want to sit down for this.

The United States has reached a grim milestone: Our billionaires have now grown $2 trillion richer since the global Covid pandemic first hit. U.S. billionaires have watched their wealth soar over 70 percent, notes a just-released new analysis from our Inequality.org team and Americans for Tax Fairness, at the same time Covid was taking over 700,000 American lives and costing millions of other Americans their livelihoods.

This growth in billionaire wealth could, all by itself, pay for 60 percent of President Biden’s Build Back Better agenda. But most of these new billionaire trillions, under our existing tax system, will go totally untaxed and disappear entirely off the tax radar once our billionaires pass it on to their billionaire babies. But that could change. What could make that change? We’re excited about a proposal gaining traction on Capitol Hill that would require billionaires to pay annual taxes on their increased wealth, just like workers pay taxes on their paycheck income each year. Our ultra-rich have run wild during the pandemic. It’s only right that they pay their fair share of the recovery.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| When Private Equity Came Knocking in New York |

| For Francine Townsend, a mobile home resident for some 20 years, mobile home parks exist in part to provide disadvantaged, lower income, and retired people the chance to have their own space. But where Townsend saw potential for thriving, supportive communities, Wall Street saw only a big-time profit opportunity. In 2012, RHP Properties — a corporation entwined with Brookfield Asset Management, a Toronto-based private equity firm — took ownership of Townsend’s mobile home community in New York. Higher rents, unanswered maintenance requests, and evictions soon ensued. Francine Townsend has more on her story, and how legislation like the Stop Wall Street Looting Act could finally hold greedy private equity executives accountable. |

|

| |

|

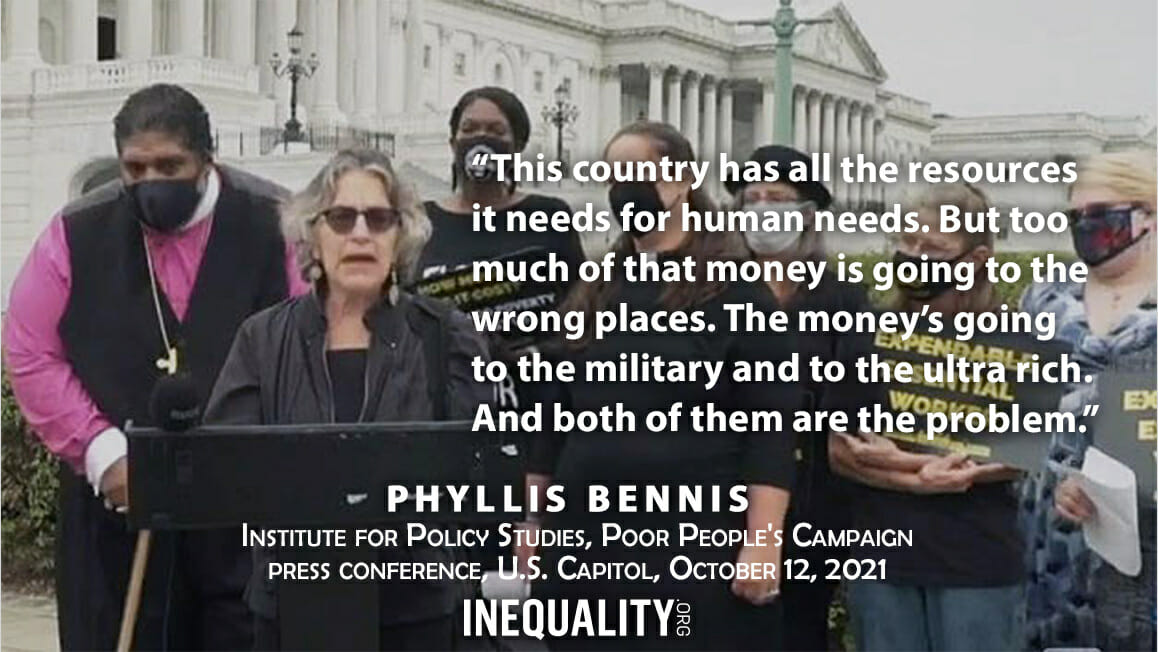

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A CEO’s Certainty: Cream Always Rises to the Top |

| Only losers ask for raises. True achievers like Indra Nooyi, the former CEO and board chair of PepsiCo, would never stoop so low. So the retired Nooyi, now an Amazon board member, has just assured the New York Times Magazine. In an interview hyping her new memoir, Nooyi boasts she had “never, ever, ever asked for a raise” and, in fact, finds the notion that anyone would ask for one absolutely “cringeworthy.” Adds the 65-year-old: “I cannot imagine working for somebody and saying my pay is not enough.” Nooyi stepped down as PepsiCo CEO in 2018 after pocketing $31 million in her final year, 650 times the pay of her company’s most typical worker. Nooyi’s dozen years at PepsiCo’s summit have left her with a net worth of $290 million. Marvels the Guardian’s Arwa Mahdawi: “Isn’t it funny how the only people who think money isn’t important are the ones who have gobs of it?” |

|

| |

|

| BOLD SOLUTIONS |

|

| A Minimum Tax to Curb Offshore Tax Dodging |

| For decades, large multinationals have driven a global corporate tax race to the bottom that’s left wealthy CEOs and shareholders ever richer while straining social spending on education, health care, and infrastructure. The Biden administration has just forged a pact with nearly 140 other nations to put an end to this reckless race. A key feature of the deal: a 15 percent “global minimum tax” on corporate profits, a rate nearly double the average tax U.S.-based multinationals paid the IRS in 2018. This new minimum tax would likely generate $148 billion in new U.S. revenue over a decade, enough to cover the costs of vital investments in the pending Biden Build Back Better proposals. That revenue could fund, for instance, universal free community college and over twice the cost of building affordable housing for 300,000 families. Sarah Anderson and Brian Wakamo have more on the global minimum and other innovative tax ideas on the budget negotiating table. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| A Smiling Sayonara from Private Equity’s Pioneers |

| The long-time kingpins at the private equity giant KKR, the cousins Henry Kravis and George Roberts, are finally retiring. The end of an unhappy era for America's workers and the hard-hit communities they call home? Unfortunately, no. The animal spirits that these two billionaires have done so much to unleash are still running rampant. How can we tame them? Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Chuck Collins, Updates: Billionaire Wealth, U.S. Job Losses and Pandemic Profiteers. Billionaire wealth has surged by 70 percent, or $2.1 trillion, during the pandemic. Total current billionaire wealth: $5 trillion!

Elsewhere on the Web

Katharina Pistor, The Pandora Papers and the threat to democracy, Social Europe. National legal systems have become items on an international menu of options. Wealthy asset holders simply choose the laws by which they wish to be governed.

Rachel Connolly, What Succession gets right about the rich, Guardian. Some TV shows allow us to feel some moral superiority over the rich. But as Succession’s Logan Roy shows, they couldn’t care less.

David Wessel, How ‘Opportunity Zones’ Became a Tax Loophole for the Rich, New York Times. Wealthy Americans are getting tax breaks for financing luxury student housing in university towns because college kids show up as poor in census tallies.

Julieta Caldas, Philanthropy Is a Scam, Jacobin. The super rich often claim their philanthropy aims to “change the world.” But their widely hyped benevolence really serves to keep the world exactly as is.

Robert Reich, The Real Reason the Economy Might Collapse. Our core economic problem: The wealthy spend only a small percentage of their income and wealth, not enough to fulfill the consumer demand that keeps the economy churning.

Jason Grotto, Caleb Melby, Mira Rojanasakul, and Paul Murray, How a $2 million luxury condo in Brooklyn ends up with a $157 tax bill, Bloomberg BusinessWeek. Opaque methods, hypothetical numbers, and ‘bonkers’ adjustments shift the property-tax burden toward middle- and working-class New Yorkers.

Juliana Kaplan and Andy Kiersz, The top 1% officially have more money than the whole middle class, Business Insider. The middle 60 percent of American households by income now cumulatively hold less in assets than the top 1.

Concentrated Corporate Power Is Raising Prices Harming Main Street, and Empowering Pandemic, Groundwork Collaborative and the American Economic Liberties Project. Shareholders and CEOs are getting richer on the backs of parents, workers, and consumers struggling to make it through the pandemic. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|