| THIS WEEK |

With most — not all — members of Congress sleeping soundly in the comfort of their own homes this weekend, the federal eviction moratorium expired Sunday night, putting millions of people at risk of becoming unhoused at the exact moment the country faces a surge in Covid cases.

Talk about inequality personified.

In a show of solidarity with those at risk of losing their homes, dozens of advocates — led by Rep. Cori Bush (D-MO), who years ago lived unhoused herself — slept on the steps of the Capitol all weekend to urge Congress to reconvene and reinstate the moratorium. The protest made for a moving and powerful sight.

This brave act of political courage, bolstered by the power of ordinary Americans, reminds us once again what we need to be doing, all across the United States, to tackle inequality head-on.

Chuck Collins & Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

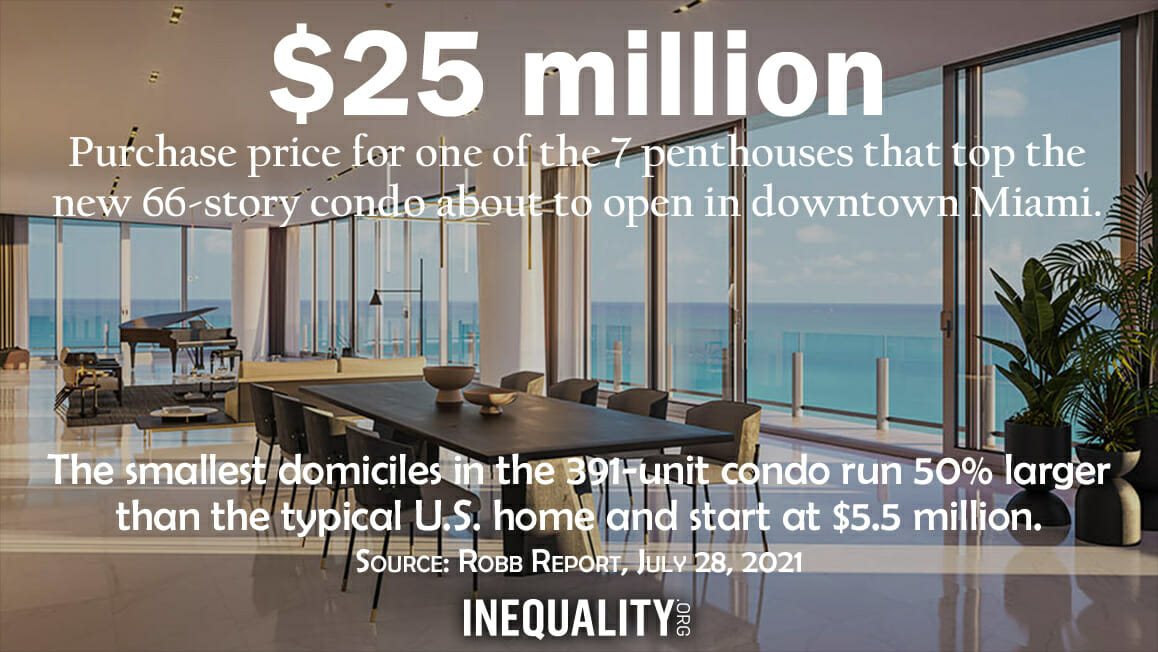

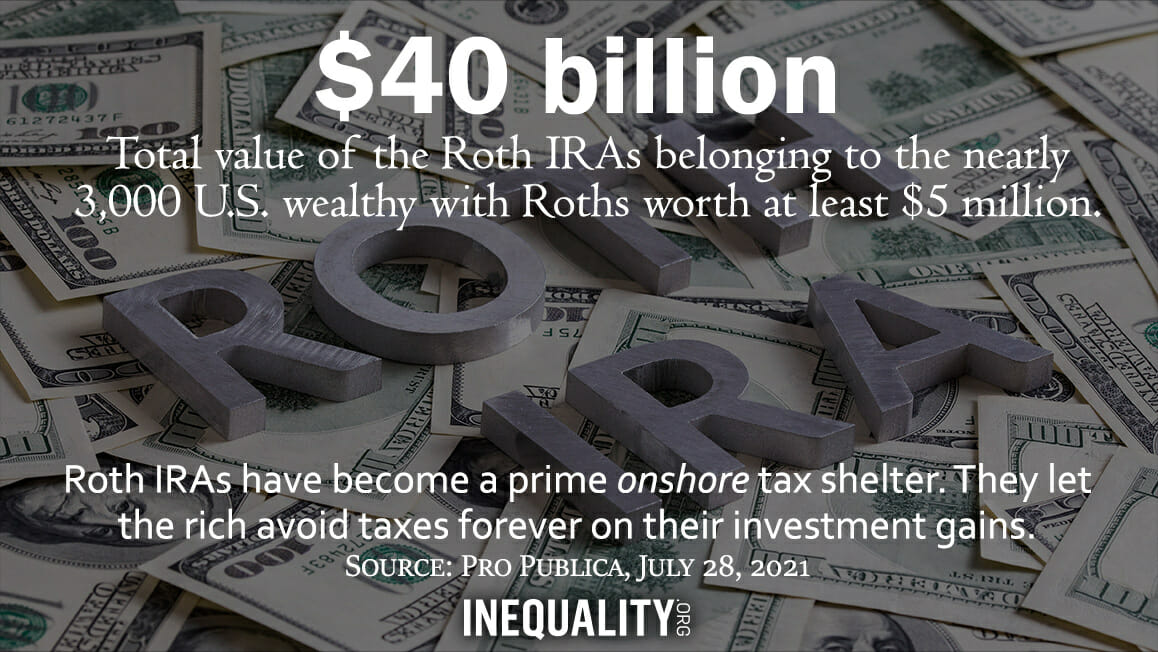

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| An Opportunity to Protect Our Essential Workers |

| Throughout the pandemic, over 55 million essential workers have been risking their health on the frontlines of our economy. But low-quality low-wage jobs, anti-immigrant policies, and other systemic barriers are denying many of these workers basic workplace protections, livable wages, and benefits like paid leave and sick days. Most undocumented workers — 74 percent — are currently laboring in essential industries. Federal lawmakers now have an opportunity, with a $3.5 trillion recovery package before them, to ensure these essential workers the protections they deserve. We have more on the advocates and organizers fighting to include a pathway to citizenship in the recovery package now pending in Congress. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| Lies Can Create a Buzz. They Can’t Power a Truck. |

A business with “bigger” potential than electric cars? Electric trucks! Or so figured “self-described” serial entrepreneur Trevor Milton back in 2015 when he founded Nikola, his own electric-truck company.

Milton quickly created a buzz with his “bold statements” and, midway through 2020, moved to cash in by taking Nikola public via a “SPAC,” a Wall Street artifice that lets execs sidestep SEC rules on what they can legally say when they start selling their company’s shares. Milton’s SPAC couldn’t have worked better — for Milton. Nikola’s share price soared, and his own personal stake hit $8.5 billion. But then, last September, a Wall Street research firm revealed that Milton had been playing fast and loose with his claims about Nikola’s showcase truck. Nikola’s shares promptly tanked, and Milton resigned as top exec the next month.

Last week, a federal grand jury indicted Milton for making false and misleading statements about “nearly all aspects” of his business. Summed up prosecutor Audrey Straus: “Milton told lies to generate popular demand for Nikola stock.” Milton’s lawyers are calling the federal charges an effort “to criminalize lawful business conduct.” If convicted, Milton could get 25 years. He still holds Nikola shares worth about $1 billion.

|

|

| |

|

| BOLD SOLUTIONS |

|

| A CEO Pay Tax to Break the 3-Way Budget Deadlock |

For fans of Japanese manga, “three-way deadlock” refers to characters in the popular Naruto series. That phrase could just as well describe the current state of the debate over raising the U.S. corporate tax rate. To fund public investments in health, education, and other urgent needs, Senate Budget Committee Chair Bernie Sanders wants to push that rate up from the current 21 to 35 percent. President Biden has proposed hiking the current rate to 28 percent. Senator Joe Manchin has set his sweet spot at 25. Other than ninja combat, how could the players here resolve their differences? They could top off a corporate tax rate increase with a CEO pay surtax — an extra levy on firms that pay their top executives absurdly more than their typical workers. Inequality.org co-editor Sarah Anderson explains why this approach would have two appealing selling points for Manchin and other moderate Dems. Read Sarah’s op-ed in The Hill.

|

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| U.S. Billionaires: Borrowing Their Way to Fortune |

| No widely acclaimed artist in the 20th century baited and battled the rich with as much gusto as the great Mexican painter Diego Rivera. But today, nearly nine decades after Rivera’s prime, his artwork has a different sort of relationship with America’s rich: His paintings are helping 21st-century American moguls live lives of tax-free luxury. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Justin Campos, Corporations Should Pay Their Fair Share for Human Needs. Corporations pay lower taxes than ever. A modest corporate tax hike would be transformative.

Sarah Anderson & Justin Campos, Despite Republican Boycott, Dems Launch New Inequality Committee. Over the next two years, the panel will study our economic disparities and develop policy solutions.

Bob Lord, Taxing Lifetime Gains Serves Different Fairness Goal Than Estate Tax. The “basis step-up” lets wealthy people avoid paying income tax on lifetimes of investment gains.

Elsewhere on the Web

Sarah Anderson, To break the corporate tax logjam, tax overinflated CEO pay, The Hill. A CEO pay surtax would be widely popular because overpaid CEOs have become incredibly unpopular.

Chuck Collins and Helen Flannery, New Research Suggests DAF Payout Is Worse Than We Thought, Inside Philanthropy. The wealthy who put money into Donor-Advised Funds get an immediate tax deduction but have no obligation ever to move that money to charity.

James Lardner, Inequality Has Soared During the Pandemic — and So Has CEO Compensation, New Yorker. An ace look at the executive pay terrain and efforts to change it.

Why have some places suffered more covid-19 deaths than others? The Economist. Income inequality a big part of the answer, new data show.

Juliana Kaplan, Elizabeth Warren calls out Jeff Bezos in her latest wealth tax campaign: ‘I'm looking at you,’ Markets Insider. Warren continues to push for legislation that targets America’s highest earners.

Shira Ovide, Big Tech Has Outgrown This Planet, New York Times. The gap keeps widening between super rich tech superstars and the merely super.

Simon Kuper, What Happens When Elites Abandon Their Homeland, Financial Times. Rich people now live in a borderless world.

Joshua Jahani, The space industry should be managed in a way that delivers the most good to the largest number of people, Independent. The profits from the Internet now rest in the hands of a few tech billionaires. We need to avoid that fate for space.

David Bacon, This New Law Would Be Good for Growers, Bad for Farmworkers, The Nation. The bill cements in place the existing deep poverty in farmworker communities, and makes it much more difficult for farmworkers to organize.

|

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|