| THIS WEEK |

If we had seen this report on billionaires behaving badly in some source other than the Washington Post, we would have likely found it difficult to swallow: A Tennessee billionaire businessman, Willis Johnson, is paying to station South Dakota National Guard troops at the U.S.-Mexico border.

Can we now expect a future full of billionaire mercenaries? Potentially. We are, after all, living in a political system where the ultra-rich need not content themselves with democratic processes like voting. Our system lets the rich deploy their enormous wealth to influence and even make policy. Our system encourages and rewards reckless behavior.

How much money will Willis Johnson be donating from his personal foundation to make policy at the border? Johnson — a prominent National Rifle Association backer who pumped $550,000 into the Trump campaign — has told reporters simply: “I want to protect America and that’s it.”

We want to protect America, too, and we think we have a much better approach than Johnson. Let’s require the ultra-rich to pay up, at tax time, so we can create a more equitable society that works for all of us!

Enjoy your Fourth of July holiday! We’ll be taking a little holiday break this week. Watch for us in your email inbox Monday after next.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Dignity Should Never Depend On Sheer Luck |

| At a moment when billionaire fortunes are soaring, hearing the voices of people on the other end of the economic ladder could hardly be more important. Adriana Cadena’s father first arrived in the United States to work in the Bracero program. Adriana and the rest of her family crossed the border to join him. Undocumented and poor — and also fearful and exhausted — the Cadenas worked harder than they could imagine to just scrape by. Then luck struck: The family gained legal resident status through an amnesty program, a move that gave them breathing room and illuminated Adriana’s path towards a career fighting for immigrant families like hers. But luck can be no substitute for a living wage, education, and humane immigration policy. Adriana Cadena, a human rights advocate at the Reform Immigration for Texas Alliance, shares why. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| This Could Be Covid’s Most Contaminated Windfall |

| This past April, the CEO of the troubled vaccine manufacturer Emergent BioSolutions announced he was taking “full responsibility” for the corporate sloppiness that had contaminated and shelved millions of Johnson & Johnson and AstraZeneca Covid vaccine doses. But Emergent CEO Robert Kramer seems to have misspoken. Kramer isn’t actually taking “full responsibility” for anything. He’s taking “full advantage.” At the pandemic’s height, Kramer saw his annual pay jump 51 percent, and his company, thanks to a $628-million no-bid 2020 contract with the federal government, is now heading for a record 2021. Kramer remains fully unapologetic for Emergent’s stellar earnings and lousy performance. Declares Kramer: “We ran at this opportunity and the pandemic in a way that few if any other organizations did.” Helping that opportunity along: a former Emergent consultant who, as a Trump administration official, approved the company’s now-notorious federal Covid vaccine contract. |

|

| |

|

| BOLD SOLUTIONS |

|

| Global Equity Strings on Semiconductor Subsidies |

| The U.S. Senate has just approved $52 billion in subsidies for the semiconductor industry, as part of a broader bipartisan bill wrapped in xenophobic anti-China rhetoric. If the House takes up similar legislation, lawmakers should tie strings to these subsidies to advance economic justice — in the United States and in China and other developing nations where U.S. semiconductor companies do much of their manufacturing. Semiconductor CEOs have a track record of enriching themselves and their wealthy investors while slashing U.S. jobs and shifting production overseas. One example: The vast majority of On Semiconductor’s 34,500 employees work outside the United States. The company’s median worker, located in China, earned just $15,044 last year. Its CEO made 684 times as much. Institute for Policy Studies researchers Sarah Anderson and Justin Campos have calculated that CEOs at 19 leading U.S. semiconductor companies averaged $13.7 million in pay last year. Taxpayer dollars should incentivize corporations to narrow these gaps — here and globally. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| What’s Going On When Wealth Tilts to the Top? |

| The high priests of America’s trickle-down economic policy mindset may still be preaching their gospel — the notion that enriching the rich will end up enriching us all — but fewer and fewer people are taking them seriously. The “facts on the ground” have simply become too compelling to ignore: Under the sway of trickle-down ideologues, the United States has become the developed world’s most deeply unequal nation. Most of us with egalitarian sensibilities tend to concentrate on the moral ugliness of America’s concentrated wealth. But much more is lurking that we need to see — and stop. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Manuel Pérez-Rocha, Excessive Corporate Power is a Root Cause of Migration. Under U.S. trade agreements, corporations are suing developing country governments for sums that far outstrip the value of humanitarian aid.

Elsewhere on the Web

Will Bunch, The real crisis for American democracy is our cowardly inability to tax the rich, Philadelphia Inquirer. A leak of IRS records shows the super-rich like Jeff Bezos and Warren Buffett pay hardly any taxes. Put a fork in America if we don't do something.

Justin Elliott, Patricia Callahan, and James Bandler, The Ultrawealthy Have Hijacked Roth IRAs. The Senate Finance Chair Is Eyeing a Crackdown, ProPublica. Peter Thiel, a PayPal co-founder and Facebook investor, has a Roth IRA worth $5 billion. If he waits just before he turns 60, he can withdraw money from the account tax-free.

Robert Reich, Why Your Chipotle Burrito Costs More, RobertReich.org. Chipotle’s execs remain among the best paid in America. Its CEO raked in $38 million last year, 2,898 times Chipotle’s typical paycheck.

Grace Blakeley, While Average People Suffered, 5 Million People Became Millionaires Under COVID-19, Jacobin. The world is swimming in central bank cash that’s all flowing up rather than trickling down.

Ian Leahy and Yaryna Serkez, Since When Have Trees Existed Only for Rich Americans? New York Times. In the most extreme cases, wealthy U.S. communities have 65 percent more tree canopy than communities where nine out of 10 people live below the poverty line.

Richest Latin Americans should pay ‘much more’ tax, says IMF, Financial Times. Recent social unrest in Latin America, says the IMF’s western hemisphere director, highlights the need for a much more equal distribution of income.

Joe McCarthy, Billionaires Jeff Bezos, Richard Branson, and Elon Musk Could Save 41 Million People at Risk of Starvation, Global Citizen. Our real-life dystopian science fiction: As climate change cooks oceans and forests, a pandemic endangers billions and world hunger surges, a handful of mega wealthy are pumping billions into their own personal space travel companies. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

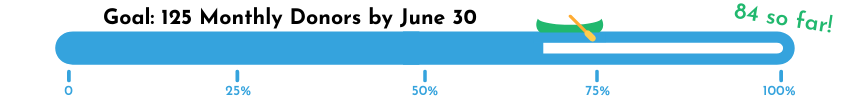

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|