| THIS WEEK |

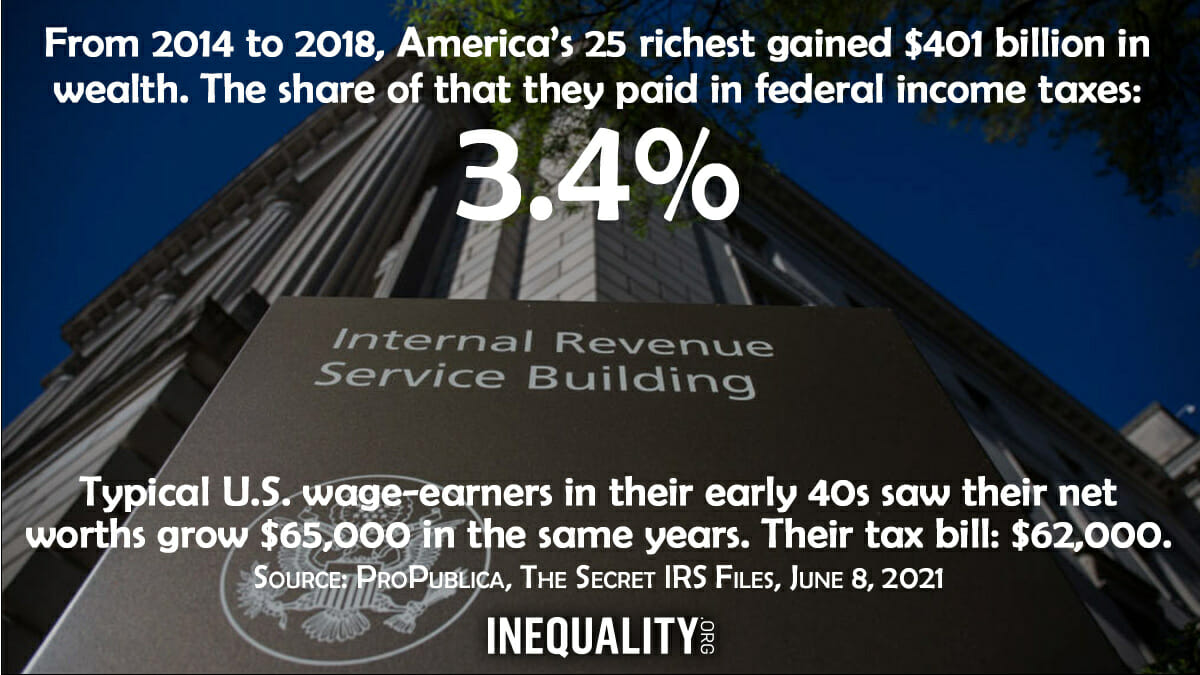

Blink and you may have missed it, but ProPublica has published a trove of billionaire tax returns confirming what we’ve all expected to be true for decades: The nation’s ultra-rich are not paying anything remotely near their fair tax share.

Many of the names in ProPublica’s new bombshell report may be familiar to Inequality.org readers. We’ve exposed a good number of them as pandemic profiteers. Elon Musk, for example, paid no federal income tax in 2018. His wealth has increased 559 percent during the pandemic. Another: Jeff Bezos — a "double-centi-billionaire” with a net worth of nearly $197 billion — legally paid $0 in taxes for two years.

So what can we do? Plenty. We have on the table popular, equitable solutions to this crisis of inequality and wealth hoarding. It’s on all of us to pressure our lawmakers to keep members of the billionaire class from using their clout to rig the economy in their favor.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team

|

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Fighting for Equity in Care — and Infrastructure |

| Home health aide Adarra Benjamin sees her work as every bit as essential to our economy as roads, bridges, and other infrastructure. As she puts it plainly: “We are all going to get older. We’re all going to need a care worker.” This fourth-generation caregiver is speaking out in support of President Biden’s American Jobs Plan, legislation that takes infrastructure beyond roads and bridges. The plan would invest $400 million in home care and reduce the extreme inequalities of a care system that awards mega-million paychecks to nursing home CEOs while families and professional caregivers like Benjamin have to struggle to get by. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A Lapsed Billionaire Socks Jobless ‘Freeloaders’ |

| Jim Justice used to be West Virginia’s only billionaire. Now Forbes has his personal fortune down under $500 million. The man needs help — and he’s getting it from the state of West Virginia. The state’s governor last month announced plans to cut federal unemployment benefits for West Virginia’s jobless, a move that will pressure unemployed West Virginians worried about Covid and child care to take jobs at Jim Justice’s flagship business, the 11,000-acre, five-star Greenbrier hotel complex. The Greenbrier these days pays only $4.66 an hour, plus tips, for pool deckhands. The hotel’s kitchen workers make just $1 more than the state’s $8.75 hourly minimum wage. Jim Justice, for his part, is leading the cheering for West Virginia’s new jobless-benefit cutoff. Demands the mogul: “We need everybody back to work.” The high-profile work Justice himself is now doing? He’s currently serving as West Virginia’s governor. |

|

| |

|

| BOLD SOLUTIONS |

|

| Let’s Loosen Wall Street’s Grip on Our Democracy |

| Wall Street spent a record sum of nearly $3 billion on campaign contributions and lobbying in the 2019-2020 election cycle. The politically potent financial industry counts on getting a good return on this investment — in the form of weak consumer protections and undeserved tax breaks. Wall Street’s massive political spending, argues Elisa McCartin of Americans for Financial Reform, underscores the absolute urgency of passing the pending For the People Act. Besides strengthening voting rights, this legislation would overhaul our campaign finance system. Small donors would get matching funds while deep-pocket financial tycoons would face tighter restrictions on their PAC donations. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| The Fix Our Tax Code Urgently Needs: Sunshine! |

| America’s super rich are seeing red over ProPublica’s bombshell release of data from their tax returns — and so are America’s tax collectors. Treasury Department officials have already referred this “illegal” and “unauthorized disclosure of confidential government information” to the FBI. Merrick Garland, the U.S. attorney general, has pledged to lawmakers that finding the source of the leak to ProPublica “will be at the top of my list.” Does Garland have good cause to make the race to uncover ProPublica’s source his “top” priority? More fundamentally: Do taxpayers have a basic human right to have how much they pay in taxes kept secret? No. Inequality.org co-editor Sam Pizzigati has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

David Cay Johnston, You Can Thank Donald Trump If You’re Feeling Poorer Today. New IRS data show the wealthy grew even richer in the Trump years while the rest of us fell back.

Elsewhere on the Web

Jesse Eisinger, Jeff Ernsthausen, and Paul Kiel, The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax, ProPublica. This could prove to be the most consequential piece of tax reporting so far this century.

Greg Sargent, A shocking exposé of super-rich people’s tax bills should prompt a big rethink, Washington Post. We need to mainstream the idea, long understood in academic and progressive circles, that soaring inequality — in both pre- and post-tax income — reflects deliberate policy choices.

Chuck Collins, The rich got richer while millions lost their livelihoods. It's time for a wealth tax, CNN Business. Unrealized wealth gains — like the increased value of a stock that hasn't been sold or transferred yet — don’t face any tax, even though they account for the bulk of billionaire assets.

Michael Mechanic, It’s Not Just Income Taxes. Billionaires Don’t Pay Inheritance Taxes Either, Mother Jones. As a Trump adviser once put it, only “morons” would do that.

Kelly Candaele, Fixing the Cheats That Create Income Inequality, Capital & Main. A talk with authors Morris Pearl and Erica Payne, capitalist prophets of tax fairness.

Meagan Day, The Rich Breathe Easier Than the Poor, Jacobin. A new study shows that disparities in pulmonary health between the rich and poor have been widening for six decades, setting the stage for vastly unequal, devastating outcomes during the pandemic.

Judd Legum, Koch-and-switch, Popular Information. Billionaire Charles Koch is mouthing pieties about going beyond partisanship while bankrolling new attacks on efforts to build a more equal America.

Binyamin Appelbaum, The Real Tax Scandal Is What’s Legal, New York Times. The United States uses a definition of taxable income that happens to be hugely advantageous for rich people. The new data suggest we need to consider a different definition.

Igor Derysh, GOP megadonor cash undermines NYC Democrats Andrew Yang’s and Eric Adams’ progressive claims, Salon. Illinois billionaire Ken Griffin spent $240 million for his Manhattan penthouse. Pols come cheaper.

Edward Luce, Rich Americans are losing no sleep over Biden’s tax plans, Financial Times. Without a wealth tax on the table, the richest of our rich have little reason to fear for their fortunes.

Anand Giridharadas, Will the Sacklers get away with it? The.Ink. The journalist who’s exposed the Sackler opioid billionaires is asking Congress to “think about the vast numbers of Americans whose lives have been permanently upended and this one billionaire family that is looking to game the system.” |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Be the 1%, for as little as $3 a month! |

|

|

|

| |

|

|