| THIS WEEK |

Want to hear something outlandish? The overall wealth of global billionaires has increased by an unimaginable $4 trillion over the last year of the Covid-19 pandemic. So finds our just-completed latest analysis of billionaire fortunes, conducted with our partners at Patriotic Millionaires.

Grand stashes of private wealth will always be problematic. At a time of pandemic, these stashes become unconscionable, as the “ultra-millionaire tax” Sen. Elizabeth Warren has proposed for the United States makes crystal clear. This levy, had it been in effect globally last year, would have raised $345 billion in wealth taxes, more than twice the estimated cost of delivering Covid-19 vaccines to every person on the planet.

We don’t, of course, have an institutional body that could now levy such a global wealth tax, but we can dream, can’t we?

A good bit of the blame for our current billionaire nightmare rests on the worldwide wealth defense industry, and one of us has just published a book about these sordid wealth defenders. Interested in learning more? Join Chuck tonight, April 12, for a virtual discussion on The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions.

Chuck Collins and Rebekah Entralgo,

for the Institute for Policy Studies Inequality.org team |

|

| |

|

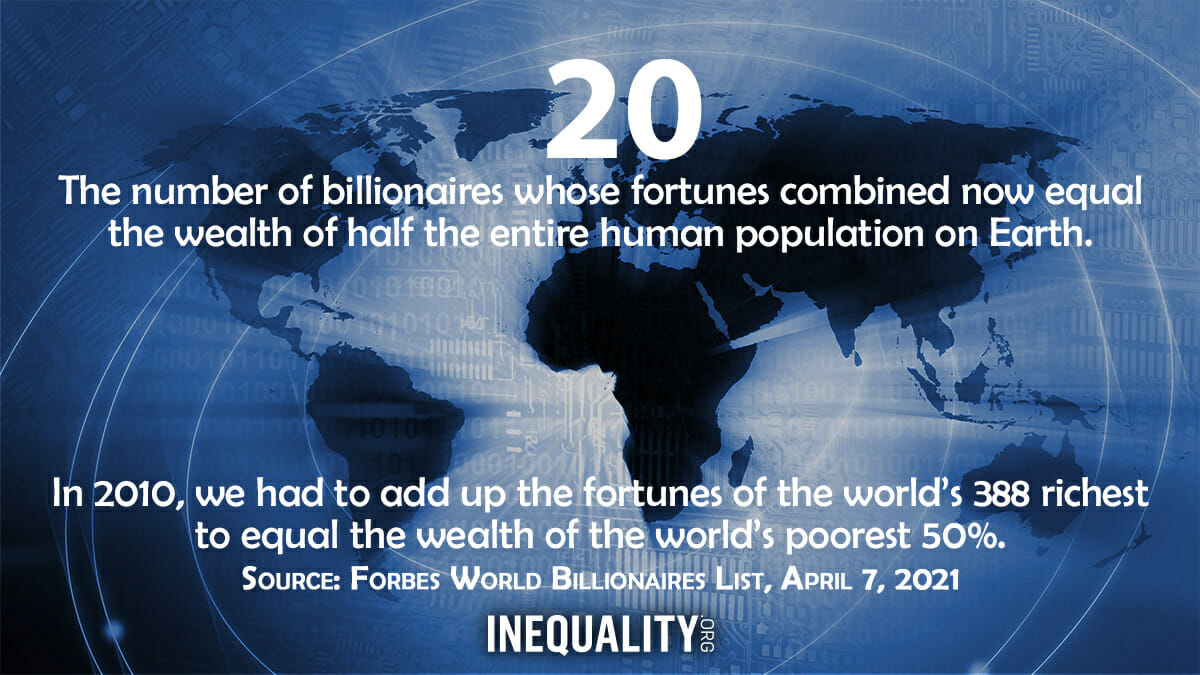

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Union Loses Amazon Vote, Boosts Labor Support

|

| The vote for a union at Amazon’s huge year-old warehouse in Alabama has fallen short. But workers there are at the vanguard of a surging movement. Even in the face of intimidation by one of the largest companies in the world, workers in Alabama bravely spoke out against unfair labor practices and made their cause a national media story, inspiring other workers across the country to explore forming their own unions. Unionizing has always been an uphill battle. It shouldn’t be. Inequality.org managing editor Rebekah Entralgo has more on how the pending PRO Act would make the process much more democratic and transparent. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| A New Tax Tomorrow Has Upset ‘Daddy Warbucks’ |

| Did Little Orphan Annie, back in the Great Depression, ever want to tax the rich? Maybe we can ask the current deep pocket who hails from the same family as the inspiration for Annie’s comic-strip rich benefactor, “Daddy Warbucks.” This family descendant — Warburg Realty CEO Frederick Peters — blasted away earlier this month at New York lawmakers about to hike the state tax rate on income over $25 million to 10.9 percent. That move will bring the top combined state-local tax rate on New York City’s ultra rich to 14.8 percent, the nation’s highest such rate. Complained Peters: “The rich shouldn’t feel like the enemy. They should feel like partners.” Retorted state senator Michael Gianaris: “If they’re feeling like the bad guy, it’s because they’re making themselves the bad guy by arguing that they shouldn’t contribute more to help us recover when they have done extremely well.” New York’s new tax on the rich will up school aid and fund a small business pandemic recovery program. |

|

| |

|

| BOLD SOLUTIONS |

|

| Crack Down on the Wall Street Bonus Culture |

| Inequality.org co-editor Sarah Anderson recently cranked out a viral stat: If the minimum wage had increased at the same rate as Wall Street bonuses since 1985, our minimum would now stand at $44. That stat went viral on social media, Anderson explains, “because it speaks volumes about who has power in Washington — and who does not.” For more than a decade, Congress has failed to raise the minimum wage. And in the face of powerful financial industry lobbyists, regulators have failed to implement an 11-year-old law to restrict Wall Street bonuses. Anderson is calling on President Biden’s new crop of regulators to take swift action to activate and rigorously enforce this long-dormant bonus restriction. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| What’s Driving the Tax Games Corporations Play? |

| How do we make sure America’s corporations pay their fair tax share? We cut away, team Biden is now proposing, at the thicket of tax loopholes that Corporate America is so shamelessly exploiting. U.S. corporations — the world’s most profitable — are currently paying just 7.8 percent of their profits in federal income taxes, down from nearly 50 percent a half-century ago. The Biden administration’s focus on corporate tax-dodging, in other words, could hardly be more welcome. But the emerging corporate tax debate is so far overlooking one core reality we can’t afford to ignore: To make sure corporations pay their fair tax share, we need to make sure individuals are paying theirs. And rich individuals are not paying that fair share, not anywhere close. Inequality.org co-editor Sam Pizzigati has more on how falling tax rates on our rich invite rising levels of corporate tax avoidance. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Bob Lord, Feast Your Eyes on the Trillion-Dollar SUV. The concentration of America’s wealth has hit still another terrifying new milestone.

Socorro Diaz, Protect Care Workers — You'll Need Us Someday. Day care workers are only asking for the same rights and protections other workers enjoy.

Elsewhere on the Web

Chuck Collins, The High Cost of Hidden Wealth, Boston Globe Magazine. An excerpt from the new book, The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions.

Jim Lardner and Sarah Anderson, CEO Pay: It’s All Our Business, Feet to the Fire. Co-editor of Inequality.org Sarah Anderson speaks about her research on CEO pay excess in an interview on Lardner’s Feet to the Fire podcast.

Gretchen Morgenson, CEOs of public U.S. firms earn 320 times as much as workers. Even some CEOS say the gap is too big, NBC News. An employee of the month at an HCA Healthcare hospital won a $6 coupon after surviving Covid. The HCA CEO last year won $30 million.

Patricia Cohen, Beyond Pandemic’s Upheaval, a Racial Wealth Gap Endures, New York Times. Billions in aid has been dispensed, and the social safety net has been reinforced. Will more ambitious steps to address longtime inequities now be on the table?

John Timmer, Egalitarians are more aware of inequality, Ars Tecnica. Why can’t some people see the inequalities right in front of their faces? Scientists are conducting experiments that explore how people filter information in ways that help reinforce existing beliefs.

Dave Zirin, NCAA championship always have the same losers: its unpaid athletes, MSNBC. The NCAA depends on the free labor of mostly Black student athletes. Its profits go to the majority white executives who run it.

Chris Giles, IMF proposes ‘solidarity’ tax on pandemic winners and wealthy, Financial Times. Excess profits taxes and higher tax rates on high incomes, says the International Monetary Fund, would strengthen social cohesion.

David Leonhardt, Corporate Taxes Are Wealth Taxes, New York Times. And their decline has led to a steep drop in tax rates on the affluent.

Michael Meeropol, A Corporate Income Tax Increase Is A Very Good Idea, WAMC. The corporate income tax protects the individual income tax from becoming “voluntary” for the rich.

Oren Cass, The Corporate Erosion of Capitalism: A Firm-Level Analysis of Declining Business Investment, 1971-2017, American Compass. Over the past half-century, Corporate America has been increasingly disgorging cash to shareholders at the expense of investments in future productivity. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

| BE THE 1% (NO, NOT THAT 1%) |

|

Our goal for 2021: that 1% of our Inequality.org subscribers become monthly sustainers and help grow our newsletter and research efforts. Become part of our Inequality.org 1%, for as little as $3 a month! |

|

|

|

| |

|

|