Today is a great day to deeply consider how and what we collectively choose to fund with our tax dollars.

|

THIS WEEK

|

|

Some of our American readers may have filed their taxes weeks ago. Others may still be scrambling to beat the April 15 tax filing deadline. But regardless of your tax status, today is a great day to deeply consider how and what we collectively choose to fund with our tax dollars.

What are we collectively prioritizing right now? One choice worth contemplating: Nuclear weapons are currently getting about as many federal tax dollars as K-12 education, our colleagues at the National Priorities Project have found. One of those things surely ranks as more important than the other.

We have plenty more on taxes in this week’s issue, including a sneak peek at our new Institute for Policy Studies report that lays out how higher taxes on the wealthy could help bridge our gaping racial wealth divides.

Chuck Collins, for the Institute for Policy Studies Inequality.org team |

|

|

|

|

INEQUALITY BY THE NUMBERS

|

|

|

|

|

|

|

|

FACES ON THE FRONTLINES

|

|

Round Two in the Fight to Tax Our Millionaires

|

| The Supreme Court in Massachusetts blindsided activists last year when the judges struck down a ballot initiative to increase taxes on the state’s millionaires. But those activists are already gearing up for round two. The second push for their “Fair Share Amendment” — also known statewide as the “millionaire tax” — began with a legislative hearing last Thursday. Jen Wofford has a dispatch from the statehouse, where 200 people showed up to demand the 1 percent start paying their fair tax share. |

|

|

|

|

WORDS OF WISDOM

|

|

|

|

|

|

|

PETULANT PLUTOCRAT

OF THE WEEK

|

|

| On Capitol Hill: A Clueless Big-Bank Top Executive |

| As CEO of banking giant JPMorgan Chase, Jamie Dimon has ultimate budget responsibility for a mega-billion-dollar enterprise. But last week, testifying before Congress, Dimon declined to take any responsibility for — or show much interest in — the budget challenges JPMorgan workers face. Rep. Katie Porter of California asked Dimon what advice he’d give an entry-level JPMorgan employee with a child who lives in a one-bedroom in her district that rents for a monthly $1,600. After food, child care, and other basic expenses, the $2,425 the worker takes home monthly from JPMorgan leaves her $567 in the red. Dimon at first quipped that the entry-level worker just “may have my job one day.” Maybe, replied Porter, but right now she’s doesn’t have “your $31 million” to spend. Porter went on to press for a helpful budgeting suggestion. Replied Dimon: “I don’t know. I’d have to think about that.” |

|

|

|

|

GREED AT A GLANCE

|

|

|

|

|

|

|

|

TOO MUCH

|

|

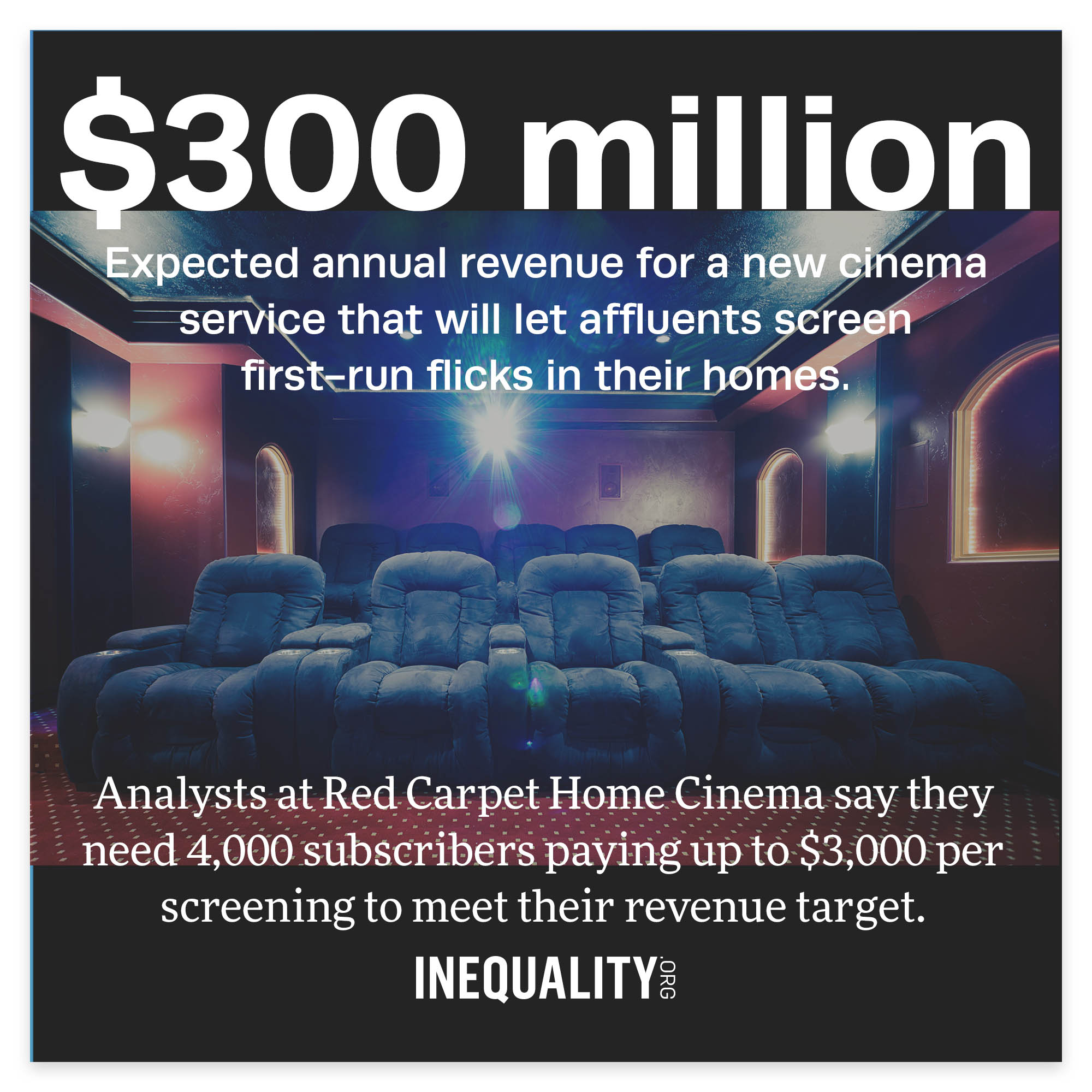

| Plutocracies as Problem-Solvers (for the Privileged) |

| People of modest means seem to face endless political gridlock when they want malfunctioning systems — like the drug industry — reformed. People of privilege face no such frustration. Their problems never go ignored. And their problems, thanks to the power wealth engenders, tend to become the problems their society addresses. Oxfam America has just explored a perfect case in point: Big Pharma’s astonishingly big windfall from the 2017 Republican corporate tax cut. Inequality.org co-editor Sam Pizzigati, author of The Case for a Maximum Wage, has more. |

|

|

|

|

|

|

MUST READS

|

This week on Inequality.org

Liam Kennedy, For Ayn Rand Acolyte, Taxes Are a Form of Violence. As economic divides fan the flames of Brexit and Trumpism, a free market fundamentalist insists that inequality merely reflects our natural order.

Frank Clemente, So Who Really Got a Tax Cut This Year? If Tax Day has you thinking about our unfair tax system, you have company!

Sarah Anderson, House Dems Slam Big Bank CEOs Over Pay Disparity. A decade after a reckless bonus culture crashed the economy, Wall Street titans still rake in massive paychecks while their employees struggle to make ends meet.

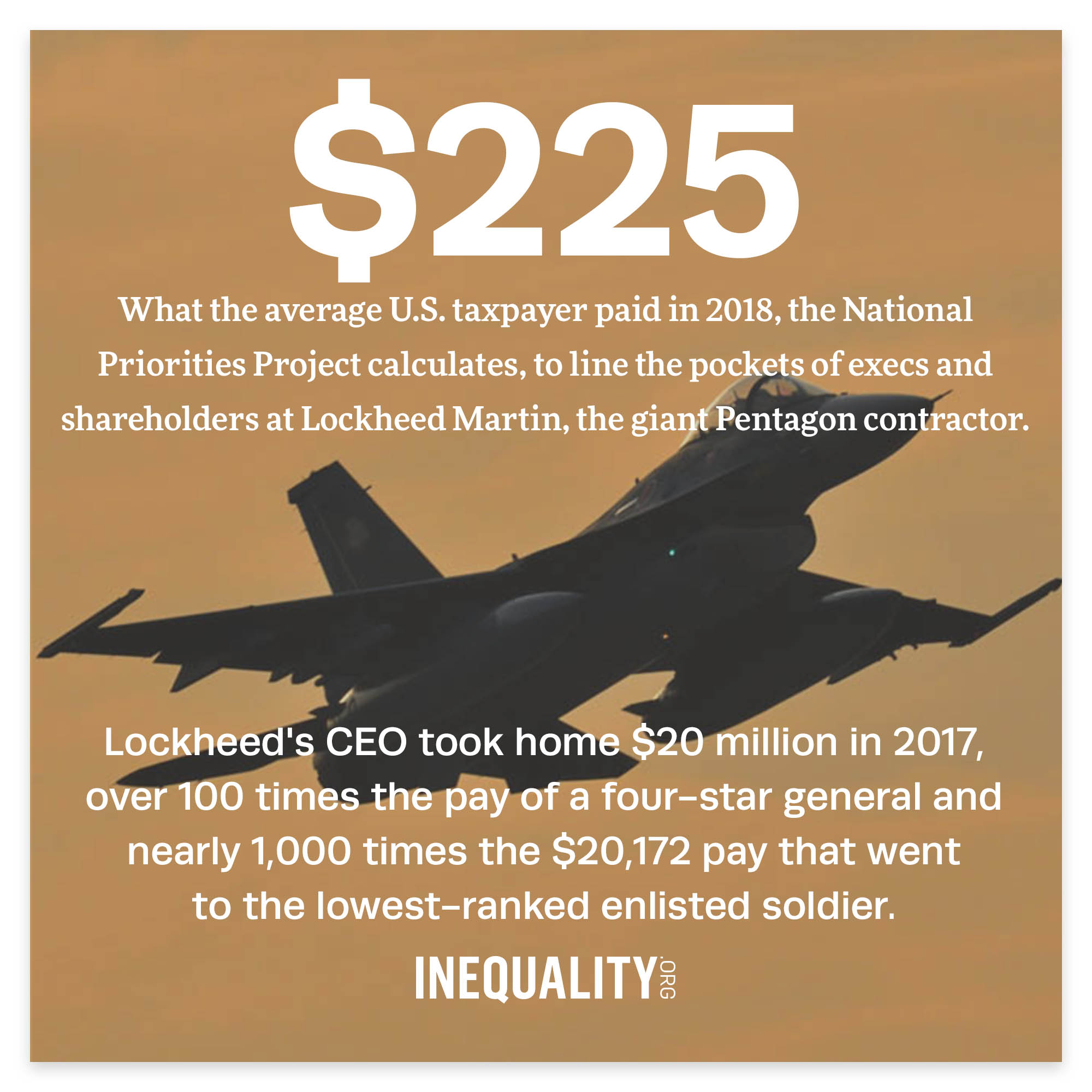

Lindsay Koshgarian, For Military Contractors, Tax Day Is Pay Day. Why does Lockheed Martin’s CEO get to take home millions in compensation? Because corporations have hijacked the military.

Negin Owliaei, It’s Time for $15 and a Union. A minimum wage hike would boost earnings for 40 million workers.

Josh Hoxie, Patriotic Millionaires Have Simple Message: Tax the Rich. Activists, academics, and elected officials gathered in Washington last week to explain why and how we should raise taxes on the wealthy.

Elsewhere on the web

Lindsay Koshgarian and Ashik Siddique, Tax Day 2019: Where Your 2018 Tax Dollar Was Spent. National Priorities Project. Want to know what your taxes pay for? Check out these resources from our colleagues.

Nell Abernathy, Darrick Hamilton, and Julie Margetta Morgan, New Rules for the 21st Century: Corporate Power, Public Power, and the Future of the American Economy, Roosevelt Institute. A call for reworking market rules so they no longer concentrate wealth, income, and power.

Dylan Matthews, In Norway, you can look up your neighbor’s income on the internet. That’s a great idea. Vox. The case for transparent tax returns.

Allan Essig, Making a Case to Tax the Rich, JustTaxes. The argument that the privileged few create jobs comes from the same ideological space that figures anyone who works hard enough can become rich.

Katherine Boyle, In IPO-mad San Francisco, a crisis of wealth, Washington Post. A super-concentration of wealth is pushing talented people out of the city they call home.

Richard Florida, How the 1 Percent Is Pulling America’s Cities and Regions Apart, CityLab. America’s growing geographic divide derives from economic inequality.

Ann Jones, A Veblen Moment, Naked Capitalism. An introduction to the economist who explored the pathologies of the original Gilded Age rich.

Richard Partington, Millennials being squeezed out of middle class, says OECD, Guardian. The latest research on our shrinking middle class. |

|

|

|

| UPCOMING WORK |

|

| Ten Solutions to Bridge the Racial Wealth Divide |

The U.S. racial wealth divide today stretches wider than the gap nearly four decades ago, and trends point to an even wider gap ahead. A new report from the Institute for Policy Studies, the Kirwan Institute for the Study of Race and Ethnicity, and the National Community Reinvestment Coalition takes stock of this stark reality and offers ten bold solutions.

Implementing the policies this report recommends, notes co-author Darrick Hamilton, will be “essential to balancing the historical injustices that created the racial wealth divide in a manner that is universal but race conscious.” The solutions the report outlines strike at the heart of the structures that keep our racial wealth divide in place.

|

|

|

|

|

A FINAL FIGURE

|

|

|

|

|

|

|

|