|

THIS WEEK

|

Rep. Kristi Noem, a Republican from South Dakota, has been a key player in the orchestrated effort to repeal the federal estate tax. Noem has claimed repeatedly that estate taxes deeply undermined her “average” farm family. But it turns out, as I note in a groundbreaking new piece just published by USA Today, that Noem may be stretching the truth — beyond recognition — on her family’s estate tax encounter. The reality: Repealing the estate tax remains all about helping the mega rich, not farmers.

America’s plutocrats are having a startlingly good year, and now they want to cap it off with a tax bill that repeals the estate tax. With one of their own in the White House, they’ve racked up a series of successes that have our government catering to their every whim, at the expense of everyone else. Sure seems that our super rich should have nothing to complain about, right? But that most certainly has not been the case.

We’ve been tracking America’s most petulant plutocrats all year long, tantrum by tantrum, and we’ve identified this year’s ten most petulant, a list that features deep-pockets ranging from the drug industry’s baddest of apples to a top profiteer off the tragedies in Puerto Rico. Now comes your turn: Help us name 2017’s most petulant plutocrat of all! Cast your vote in our online poll, and we’ll crown, in next week’s issue, one of these sore winners as the whiniest of the ultra-wealthy.

Chuck Collins, for the Institute for Policy Studies Inequality.org team |

|

|

|

|

INEQUALITY BY THE NUMBERS

|

|

|

|

|

|

|

|

FACES ON THE FRONTLINES

|

|

| A Movement for the Toughest Among Us |

| Fifty years ago, shortly before his assassination, Dr. Martin Luther King Jr. announced his plans to launch the Poor People’s Campaign — a multiracial coalition to address economic injustice in America. Last week, faith leaders gathered in Washington, D.C. to revive the movement and take on the evils of systemic racism, poverty, militarism, and ecological destruction. One of the event’s speakers, Mashyla Buckmaster, is joining the campaign because she understands those evils all too well. At the launch, she asked the crowd why America has “no problem with pregnant mothers being homeless in the dead of winter” — as she knows from personal experience — while CEOs hours away from her home in Grays Harbor County, Washington, take home millions in compensation. She shares her story this week on Inequality.org. |

|

|

|

|

|

|

WORDS OF WISDOM

|

|

|

|

|

|

|

PETULANT PLUTOCRAT

OF THE WEEK

|

|

| A CEO Knows Just What Poor People Need |

Former high-tech CEO Rod Blum likes working hard. Blum, now a member of Congress from Iowa, labored mightily earlier this fall to help pass the House GOP tax plan, legislation that gives America’s rich and the corporations they run trillions in tax breaks. More dollars for the rich, Blum vows, will grow the national economy. In 2018, Blum pronounced last week, he’ll be working to take dollars away from food stamps and other safety-net programs. Fewer dollars for the poor, says Blum, will grow the national economy. Cutting the safety net, he insists, will get people back into the job market. Says Blum: “Sometimes we need to force people to go to work.” Analysts are ridiculing Blum’s claim that cutting safety-net initiatives will hike America’s economic output. The disabled, the elderly, and children make up two-thirds of food-stamp beneficiaries, notes the Center on Budget and Policy Priorities, and about 90 percent of working-age parents receiving food stamps already find employment within a year of receiving benefits.

|

|

|

|

|

GREED AT A GLANCE

|

|

|

|

|

|

|

|

TOO MUCH

|

|

| How to Ruin a Perfectly Good CEO Pay Reform |

| Does the GOP tax plan now hurtling through Congress have, in the final analysis, any redeeming social value? Does anything at all remain of the “populist” — in the traditional sense of “anti-elite” — pledges that candidate Donald Trump made on the 2016 campaign trail? The President’s most ardent admirers can point to at least one provision in the tax legislation that, at first glance, looks like a legitimate hit on the overpaid CEOs that candidate Trump railed against during his campaign. But what does a second glance show? Inequality.org co-editor Sam Pizzigati takes a look. |

|

|

|

|

|

|

MUST READS

|

This week on Inequality.org:

Sarah Anderson, GOP Tax Plan Is Igniting a Movement for a Moral Economy. Republicans may score a short-term victory, but their plan is sparking a movement against inequality.

Josh Hoxie, Everyone Hates This Tax Bill. The more they learn, the more they hate it.

Taylor Downs, Increasing Access or Concentrating Wealth? Technology can be a leveling force in our ridiculously unequal world. Software developers should ensure their industry makes good on that promise.

Elsewhere on the web:

Sarah Anderson, 10 Reasons to Revive the 1968 Poor People’s Campaign, The Nation. The first: Since 1968, the number of Americans below the poverty line has jumped 60 percent. The second: The top 1 percent share of national income has nearly doubled since 1968.

From Jane Austen to haunting memoirs: books to open your eyes to inequality, The Guardian. An excellent starter list of books that have changed the lives of some of the world’s top thinkers about inequality.

Adam Looney, The next tax shelter for wealthy Americans: C-corporations, Brookings. The Senate tax bill includes no rules to limit the ability of high-income professionals to have their labor income treated as lightly taxed corporate profits.

Emma Bowman, What Living On $100,000 A Year Looks Like, NPR. Not easy street.

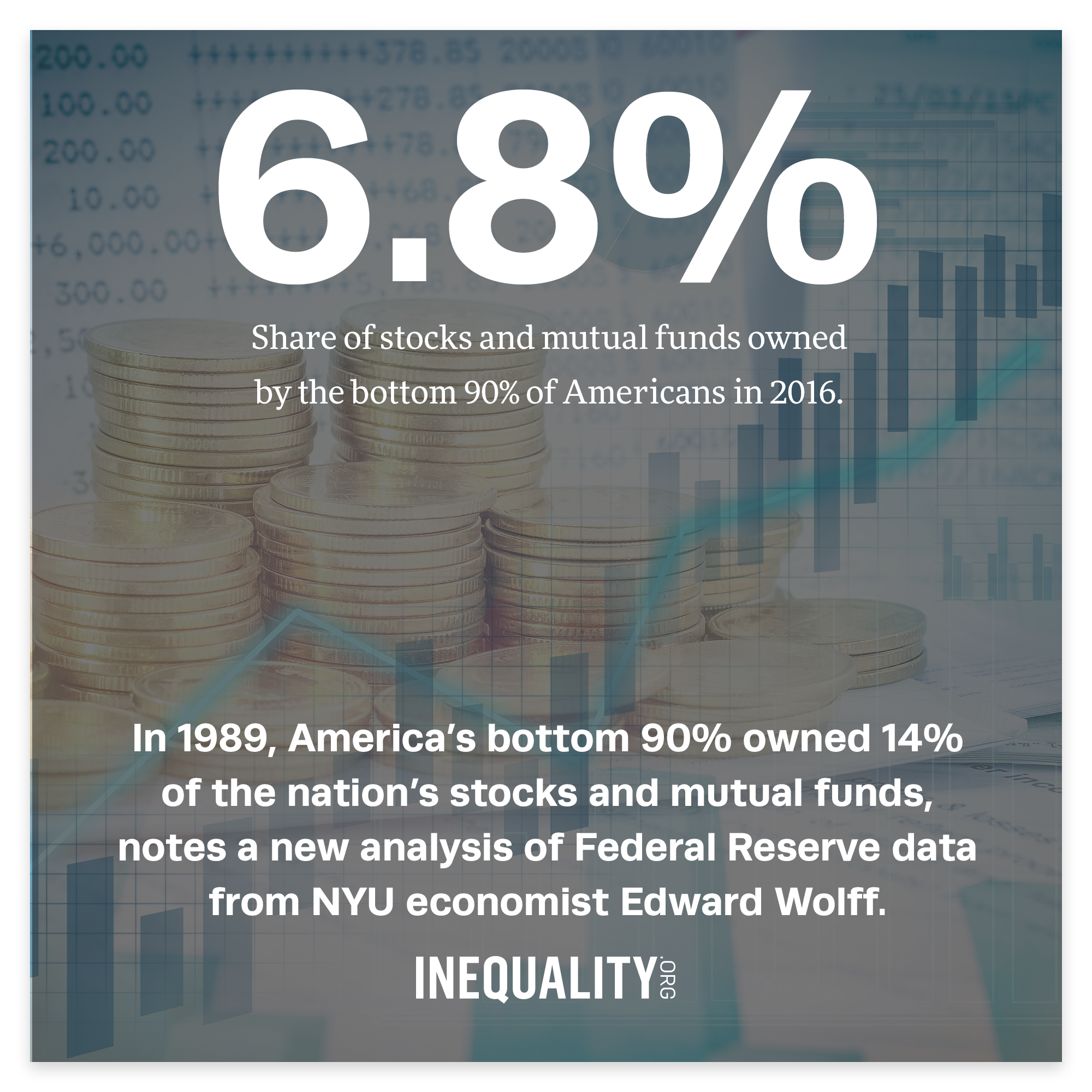

Matt Bruenig, Say It Together: Top Incomes Are Being Driven By Capital, People’s Policy Project. Income from the ownership of assets is now driving the gains of the top 1 percent.

Heather Timmons, The three ultra-rich families battling for control of the Republican party, Quartz. The Mercers, the Kochs, and the Adelsons.

Edward Kleinbard, Senators picked Americans’ pockets via degraded tax policy process, The Hill. Tax experts are already finding both unintended opportunities and inappropriate tax penalties in the hundreds of pages of hastily drafted Senate tax legislation.

Maia Szalavitz, The surprising factors driving murder rates: income inequality and respect, The Guardian. There's a strong connection between inequality and the homicide rate.

| |

|

|

|