| THIS WEEK |

Have the rich finally lost their political immunity? We’ve been watching with great interest this year as 2020 White House hopefuls have called time and again for policies that could pain our nation’s deepest pockets. Might be a good idea, we thought, to pin the field down on specifics. So we joined with The Nation magazine and sent all this year’s presidential candidates a detailed questionnaire on inequality.

This survey highlights policy battlefronts that range from CEO pay to intergenerational transfers of wealth. And what did we learn from the responses? Those who seek our nation’s highest office — at least on the Democratic Party side — no longer see safe harbor in the warm embrace of the ultra rich. You can read our analysis in The Nation.

Chuck Collins, for the Institute for Policy Studies Inequality.org team |

|

| |

|

| INEQUALITY BY THE NUMBERS |

|

|

|

|

| |

|

| FACES ON THE FRONTLINES |

|

| Bus Drivers Battle Privatization of Public Transit |

| Equal pay for equal work. Bus drivers employed by the multinational contractor Transdev in Virginia have been striking for that basic demand for a month, pushing forward a conversation in the Washington, D.C. area about the increasing privatization of public transit. Workers have been picketing at the origin garage for their bus route since the beginning of the strike, but they took their fight directly to the Metro board on Thursday. We have more on their fight this week. |

|

| |

|

| WORDS OF WISDOM |

|

|

|

|

| |

|

PETULANT PLUTOCRAT

OF THE WEEK |

|

| Helping Super Yachtsmen Pull Up Their Bootstraps |

| No one lobbied harder for Donald Trump’s corporate tax cut in late 2017 than FedEx CEO Frederick Smith, and no company may have benefited more from that cut than Smith’s FedEx. In fiscal 2017, FedEx paid corporate taxes at a 34-percent rate. In 2018, that rate fell to zero, saving the company $1.6 billion. The New York Times helpfully detailed all this last week, and Smith immediately erupted. The 75-year-old called the Times account an “outrageous distortion of the truth” and challenged the paper’s publisher and business editor to a public debate. Interestingly, the Washington Post notes, Smith “did not point to any specific errors” in the Times account. Times PR chief Danielle Rhoades Ha has, for her part, dismissed Smith’s debate challenge as “clearly a stunt.” Under Smith, FedEx has devoted $3.6 billion to stock buybacks and higher dividends since the 2017 tax cut. CEO Smith himself pocketed $16.6 million last year. Earlier this year, FedEx announced plans to eliminate employee bonuses for 2019. |

|

| |

|

| GREED AT A GLANCE |

|

|

|

|

| |

|

| TOO MUCH |

|

| Braking Corporate America’s Inequality Engine |

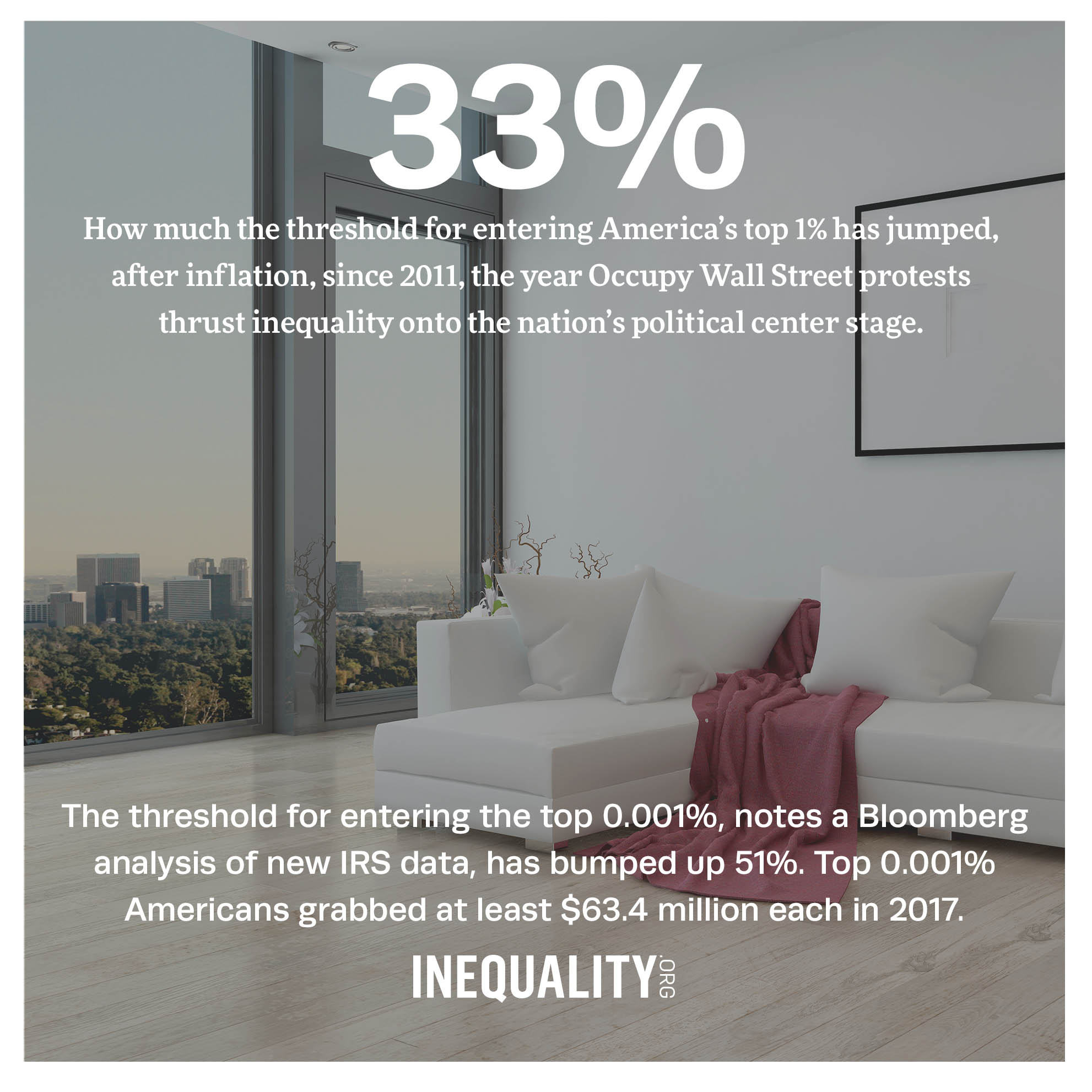

| Half the nation’s taxpayers, new IRS data show, took home under $41,740 in 2017. The nation’s top 0.01 percent, meanwhile, reported over $12,899,070 each in income. These awesomely affluent souls grabbed over 5.1 percent of the nation’s income, an income share up 72 percent over the top 0.01 percent’s share in 2002. Can you visualize all this? Probably not. Too many percentages. So let’s take a different approach to the newly released IRS income stats — by imagining the United States as an enterprise that employs 10,000 people. Inequality.org co-editor Sam Pizzigati, author of The Case for a Maximum Wage, has more. |

|

|

|

| |

|

| MUST READS |

This week on Inequality.org

Bama Athreya, Twenty Years After Seattle, Is There a New Race to the Bottom? Technology will continue to transform industries, but it's actually weak labor protections eroding the quality of work.

Elsewhere on the Web

Abby Kingsley, The United States of Inequality: A Timeline, Capital & Main. Historic mileposts on the descent to the New Gilded Age.

Iain Macwhirter, Society needs to take back control from the billionaires, The Herald. The super rich have become simply unsustainable, morally and economically.

Robert Goulder, The Other Wealth Tax, Forbes. Why a corporate wealth tax makes sense, too.

Dominic Rushe, Boo-hoo billionaires: Why America's super-wealthy are afraid for 2020, MSN. Our billionaires have no answers.

Aditya Chakrabortty, The task of politics today is to scare the capitalists as much as communism did, Guardian. Understanding why inequality eased in the middle of the 20th century. |

|

| |

|

| A FINAL FIGURE |

|

|

|

|

| |

|

|