|

THIS WEEK

|

Did you see my colleague Sarah Anderson in the news last week? Sarah lit up social media with a video produced with Senator Bernie Sanders that’s so far been viewed two million times! She also published a widely cited op-ed in the New York Times.

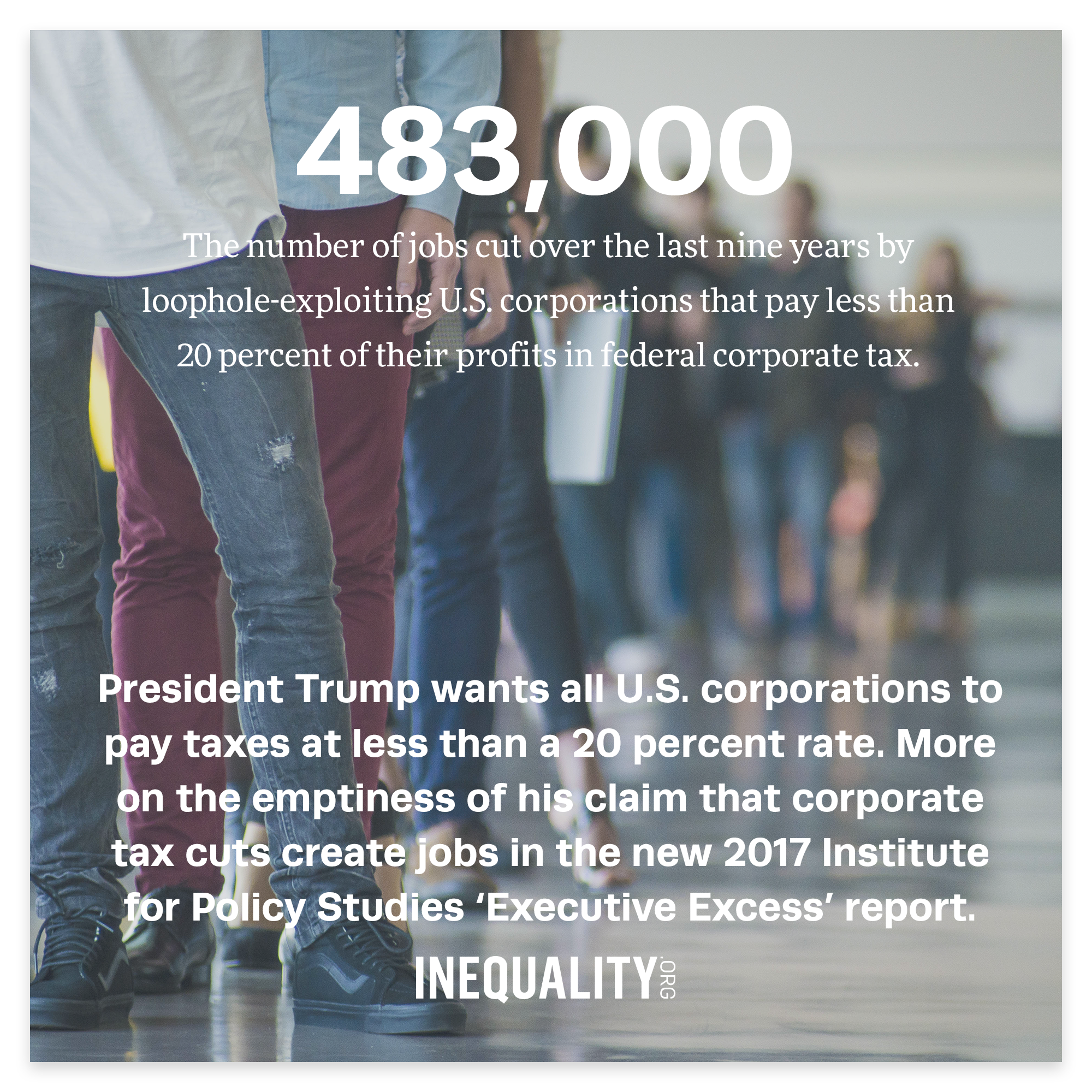

What was Sarah talking and writing about? The explosive findings from the latest annual edition of our Institute for Policy Studies Executive Excess series. The just-published 2017 edition reveals that profitable, tax-dodging corporations do not create jobs with the tax savings they reap. They lavish even higher pay on their top execs instead.

Why does all this really matter right now? President Trump and his pals are claiming that their plans for lower corporate taxes will make good jobs plentiful again. The new Executive Excess powerfully punctures that claim, and you can read more about it in outlets ranging from the Washington Post and CNBC to the Nation and the Guardian. Or just search Twitter for #payupcorps, one of last week’s top trending hashtags.

We’re ready for the fight against tax cuts for the wealthy, and we hope you’ll get involved too!

Chuck Collins, for the Institute for Policy Studies Inequality.org team |

|

|

|

|

INEQUALITY BY THE NUMBERS

|

|

|

|

|

|

|

|

FACES ON THE FRONTLINES

|

|

| The Coming Tax Fight — and Why We Need You! |

| With Donald Trump’s August 30 tax cut speech in Springfield, Missouri, the great tax fight of 2017 has now begun. The Trump tax cut plan, the President blustered in Missouri, will raise wages and benefit America’s working people. His speech, says Frank Clemente, co-founder and director of Americans for Tax Fairness, amounted to an “an extraordinary effort to obfuscate, fabricate, and create an alternative reality.” The Americans for Tax Fairness coalition, founded in 2012, now represents over 425 national and state organizations. They’re all gearing up for the upcoming tax battle, and Clemente, in an interview with Inequality.org, explains why this battle may be this year’s most pivotal political moment. |

|

|

|

|

|

|

WORDS OF WISDOM

|

|

|

|

|

|

|

PETULANT PLUTOCRAT

OF THE WEEK

|

|

| Do Any Rich Truly Deserve the ‘Moron’ Label? |

Gary Cohn, the former Goldman Sachs exec who now directs the National Economic Council for Donald Trump, has a take-no-prisoners image that matches the silver skulls on his black-beaded bracelet. These days Cohn is bullying his way through tax “reform,” pushing for a repeal of the estate tax, the only federal levy on grand concentrations of private wealth. In one recent Capitol Hill meeting, the New York Times reports, Cohn argued that the nation can easily live without the estate tax because even minimally competent wealthy taxpayers can avoid it. Snickered Cohn: “Only morons pay the estate tax.” But wealthy Americans who pay the estate tax, explains tax attorney Bob Lord in a new Inequality.org analysis, have plenty of good reasons. “Moronic” may much better describe the rich who move heaven and earth to avoid paying even the tiniest of tax bills. |

|

|

|

|

MUST READS

|

On Inequality.org this week, we cover everything from the upcoming tax fight in Congress to the perils of growing monopoly in the beer industry. How’s that for a great happy-hour read?

The past week’s biggest story, of course, has been the horrific hurricane on the Gulf Coast. Phil Mattera takes to Inequality.org to ask if taxpayer dollars should now be used to bail out the flooded-out petrochemical industry. Ben Leet wraps up our new Inequality.org offerings exploring the enormous gap between America’s top and bottom 1 percents.

Elsewhere on the web, Allan Lichtenstein reminds us this Labor Day that unions will determine the progressive future of the United States. America’s workers, meanwhile, are getting squeezed tighter every year, a function of concentrating grand fortune at the top, as laid out in a new release from researchers at How Much.

Can the U.S. Constitution co-exist with extreme inequality? Can our democracy? Zephyr Teachout reviews a new book that takes up questions like these, and a team of political scientists ponders, in the Social Science Resource Network, how inequality could leave our democracy disabled.

One less obvious extreme inequality externality: how our economic divides impact the way we perceive each other. We may wear our incomes, new research suggests, on our faces.

Living at the top end of our divides does come with a few handy perks, like the ability to shut down people who challenge what you believe. Google chief Eric Schmidt has just exercised a bit of this power by having think tank staff fired after an online post critical of Google’s monopolistic behavior. Matt Stoller, one of the staffers fired, shares his take.

Want to get rich like Google’s Schmidt? Nick Confessore has a feature-length piece on just how to do that in Donald Trump’s America. Trump himself seems more focused these days on helping the already rich become even richer. Veteran activist Bob Borosage pierces through Trump’s “populist” outpourings on taxes, and Alexandra Thornton examines the tax cuts for the wealthy hidden in the drive for tax “reform.” |

|

|

|

|

GREED AT A GLANCE

|

|

|

|

|

|

|

|

TOO MUCH

|

|

| A Shameful Inductee for the Labor Hall of Fame |

| Just in time for Labor Day 2017, the U.S. Department of Labor has enshrined the latest member of the Hall of Fame the Department created back in 1988. And who gets this honor, a tribute that has gone to real heroes like Cesar Chavez, the legendary farmworker organizer, and Tony Mazzocchi, the moving force behind federal worker safety protections? Ronald Reagan. No joke. An honor created to salute men and women who struggle to help all Americans share in the nation’s wealth has gone to a President who “became the most powerful union buster in the world.” Inequality.org co-editor Sam Pizzigati has the sorry details. |

|

|

|

|

|

|

A FINAL FIGURE

|

|

|

|

|

|

|

|